Uber Stock Forecast: The Role Of Autonomous Vehicles

Table of Contents

The Potential Upsides of Autonomous Vehicles for Uber's Stock

The integration of autonomous vehicles presents a compelling case for significant long-term growth in Uber's stock value. The potential benefits are multifaceted and could revolutionize the ride-sharing landscape.

Reduced Operational Costs

Autonomous vehicles promise a dramatic reduction in operational expenses. The most immediate impact will be the decrease in labor costs – driver salaries, benefits, and associated overhead represent a considerable portion of Uber's current expenditure. Furthermore, self-driving cars can potentially improve fuel efficiency through optimized driving patterns, leading to lower fuel consumption. Finally, the reduced frequency of accidents associated with human error could translate to lower insurance premiums.

- Quantifiable Data: While precise figures vary based on location and operational specifics, studies suggest autonomous vehicles could reduce per-mile costs by 30-50%, significantly improving profitability margins.

- Increased Profitability: The combination of lower labor, fuel, and insurance costs could drastically increase Uber's profit margins per ride, leading to a healthier bottom line and potentially boosting investor confidence.

Increased Efficiency and Scalability

Autonomous vehicles can operate 24/7, unlike human drivers, maximizing vehicle utilization and generating significantly higher revenue per vehicle. Improved ride-matching algorithms and reduced wait times will further enhance efficiency. The lower operational overhead associated with AVs also opens doors to expansion into new markets and underserved areas, previously considered unprofitable due to high labor costs.

- Increased Ride Volume: 24/7 operation could increase ride volume by up to 50%, leading to exponential revenue growth.

- Geographic Expansion: Lower operational costs allow Uber to expand into rural or less densely populated areas, capturing a wider market share.

Enhanced Customer Experience

Beyond cost savings and efficiency, autonomous vehicles offer a potentially enhanced customer experience. The promise of increased safety and comfort through advanced driver-assistance systems (ADAS) is a major selling point. Furthermore, in-car entertainment options and personalized experiences could differentiate Uber from competitors. Improved reliability and consistent service levels will boost customer satisfaction and loyalty.

- Improved Rider Ratings: Data suggests that autonomous vehicle test programs have shown consistently higher rider satisfaction scores.

- Increased Customer Retention: A superior customer experience translates to increased customer loyalty and repeat business.

The Challenges and Risks Associated with Autonomous Vehicle Deployment

While the potential upsides are substantial, the path to widespread autonomous vehicle adoption is fraught with challenges that could negatively impact the Uber stock forecast.

Technological Hurdles and Development Costs

Perfecting autonomous driving technology is a complex and ongoing challenge. Adverse weather conditions, unexpected obstacles, and edge cases continue to pose significant hurdles. The substantial capital investment required for research, development, testing, and deployment is another major factor. Delays and unforeseen technical issues are inevitable, potentially impacting investor sentiment.

- Cost of Development: Billions of dollars are being invested in AV technology, representing a significant risk for Uber.

- Time to Market: Delays in achieving fully autonomous operation could postpone the realization of the projected benefits.

Regulatory and Legal Uncertainties

The regulatory landscape surrounding autonomous vehicles is rapidly evolving, creating uncertainty. Potential legal liabilities associated with accidents involving self-driving cars present a significant risk. The varying regulations across different jurisdictions create complexity for Uber's expansion plans.

- Regulatory Hurdles: Securing necessary permits and approvals for autonomous vehicle operation can be time-consuming and costly.

- Liability Issues: Determining liability in the event of an accident involving an autonomous vehicle remains a complex legal matter.

Public Perception and Acceptance

Public acceptance of autonomous vehicles is crucial for their successful deployment. Concerns about safety and reliability, coupled with potential job displacement for human drivers, represent significant challenges. Building public trust through education and addressing safety concerns is essential for the widespread adoption of the technology.

- Public Opinion: Surveys consistently show mixed public opinion regarding autonomous vehicles, with safety and job security being major concerns.

- Addressing Public Concerns: Uber needs robust public relations strategies to address anxieties and build confidence in its autonomous vehicle technology.

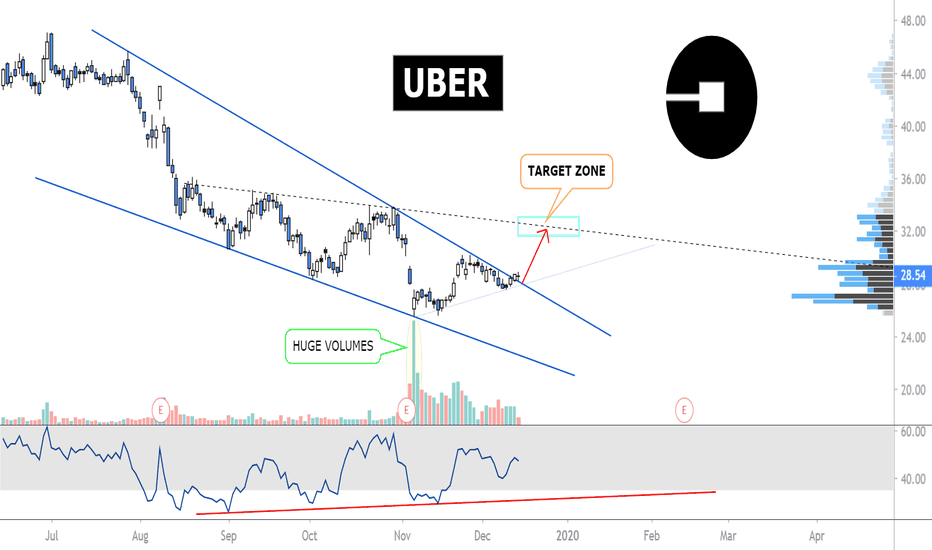

Analyzing the Uber Stock Forecast Considering Autonomous Vehicles

Considering both the potential upsides and the significant challenges, the impact of autonomous vehicles on Uber's financial performance is complex and nuanced. In the short term, the substantial investment costs and ongoing technological hurdles could put downward pressure on the stock price. However, in the long term, the potential for reduced operational costs, increased efficiency, and enhanced customer experience could lead to significant growth. External factors, such as competition from other ride-sharing companies and the overall economic climate, also play a crucial role.

- Influencing Factors: Uber's stock price will depend on a complex interplay between technological progress, regulatory approvals, public acceptance, and competitive pressures.

Conclusion: The Future of Uber Stock and Autonomous Vehicles

The integration of autonomous vehicles presents both significant opportunities and considerable challenges for Uber. While the potential for long-term growth through reduced costs, increased efficiency, and enhanced customer experience is undeniable, the hurdles related to technology, regulation, and public perception must be addressed. The Uber stock forecast, therefore, remains contingent upon the successful and timely deployment of this transformative technology. Continue to monitor Uber's progress in autonomous vehicle development, analyze evolving regulations, and assess public sentiment to make informed decisions regarding your investment strategy based on this Uber stock forecast and the impact of autonomous vehicles.

Featured Posts

-

Ma Hdth Lbarbwza Fy Marakana Khsart Mrwet Llasnan

May 08, 2025

Ma Hdth Lbarbwza Fy Marakana Khsart Mrwet Llasnan

May 08, 2025 -

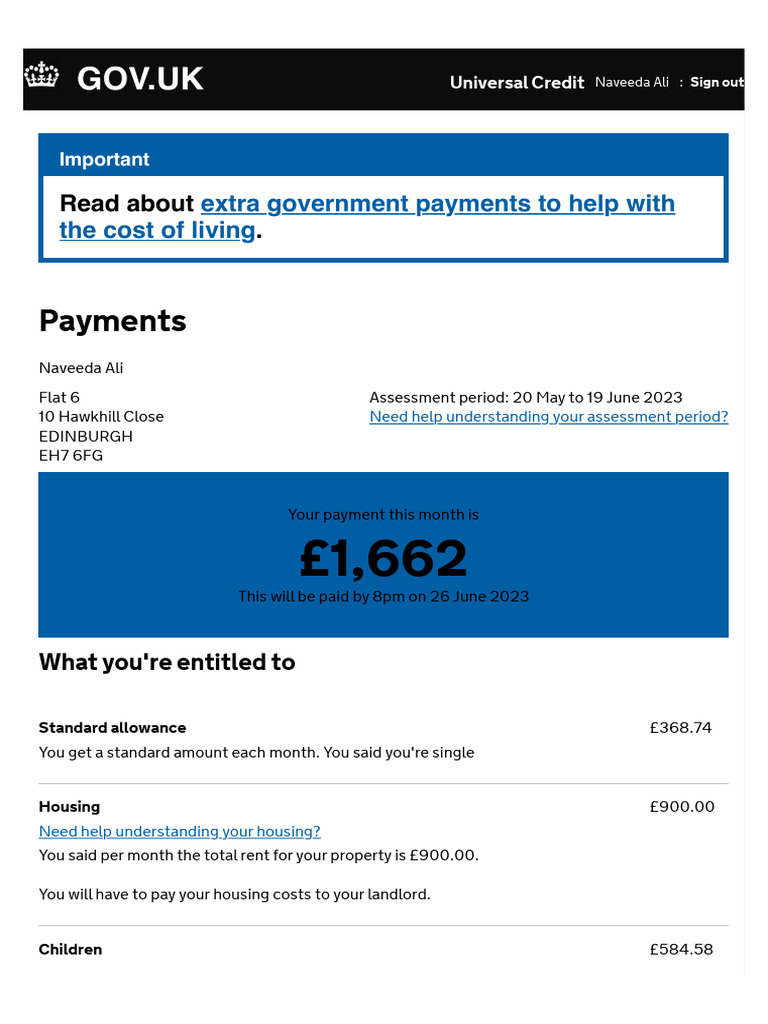

Missed Universal Credit Payments How To Claim A Refund

May 08, 2025

Missed Universal Credit Payments How To Claim A Refund

May 08, 2025 -

Is Xrps 400 Rally Sustainable A Look At Future Price Predictions

May 08, 2025

Is Xrps 400 Rally Sustainable A Look At Future Price Predictions

May 08, 2025 -

Significant Rise In Dwp Home Visits Concerns For Benefit System

May 08, 2025

Significant Rise In Dwp Home Visits Concerns For Benefit System

May 08, 2025 -

Psg Vence Al Lyon En Su Propio Estadio

May 08, 2025

Psg Vence Al Lyon En Su Propio Estadio

May 08, 2025

Latest Posts

-

Trade War Fallout Identifying Cryptocurrencies With Resilience

May 09, 2025

Trade War Fallout Identifying Cryptocurrencies With Resilience

May 09, 2025 -

Could This Cryptocurrency Thrive Despite The Trade War

May 09, 2025

Could This Cryptocurrency Thrive Despite The Trade War

May 09, 2025 -

Understanding The Bitcoin Rebound A Guide For Investors

May 09, 2025

Understanding The Bitcoin Rebound A Guide For Investors

May 09, 2025 -

Recent Bitcoin Rebound Signs Of A Market Recovery

May 09, 2025

Recent Bitcoin Rebound Signs Of A Market Recovery

May 09, 2025 -

Bitcoin Madenciliginin Gelecegi Son Mu

May 09, 2025

Bitcoin Madenciliginin Gelecegi Son Mu

May 09, 2025