Understanding The Unpopularity Of 10-Year Mortgage Terms In Canada

Table of Contents

Higher Interest Rate Risk Associated with 10-Year Mortgages in Canada

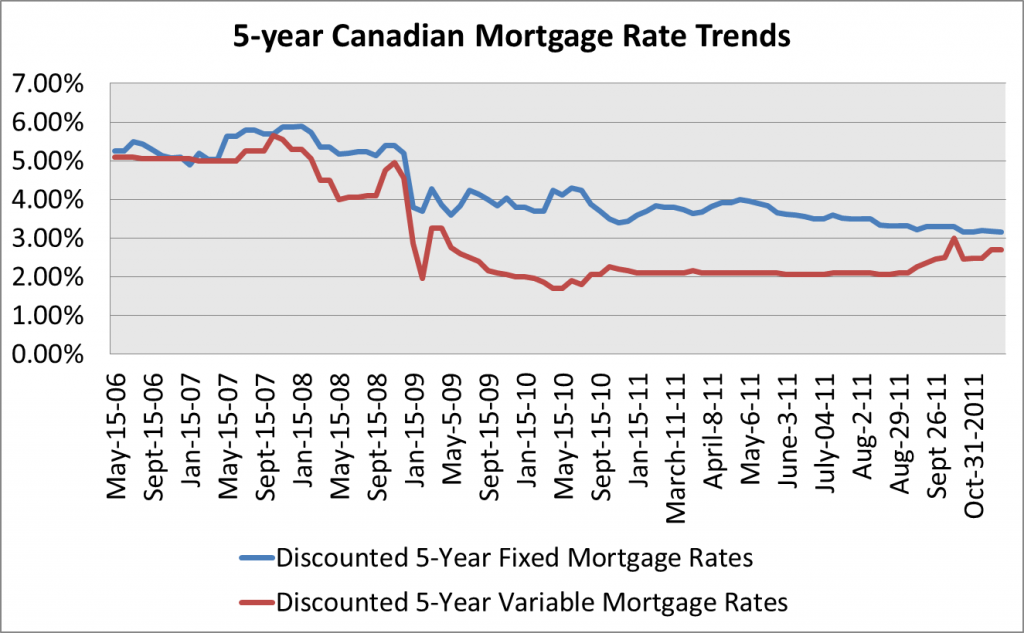

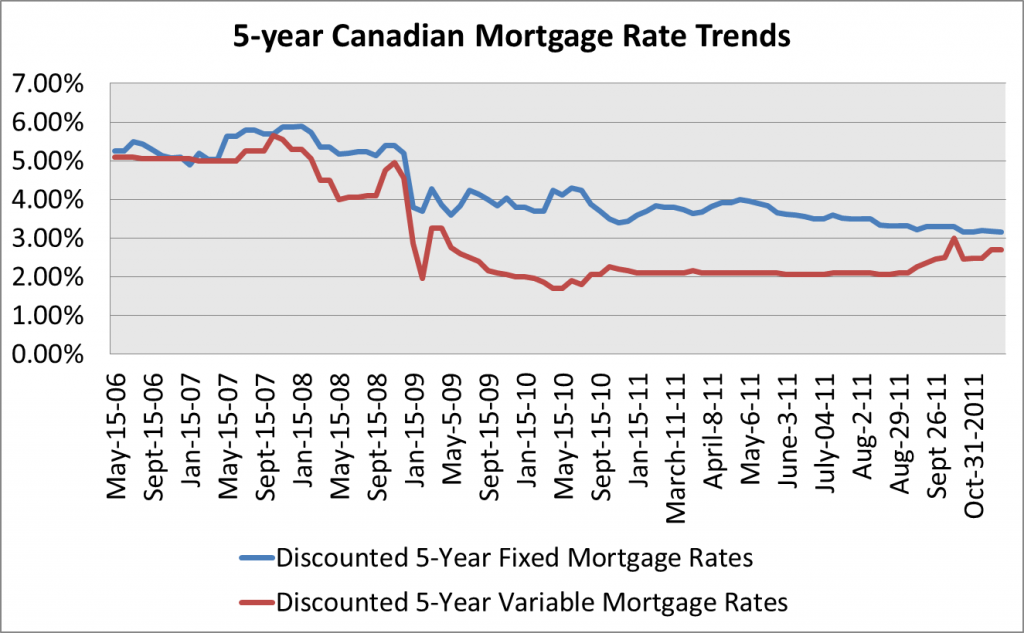

One of the primary deterrents for Canadians considering a 10-year mortgage is the significant interest rate risk involved. Interest rates are notoriously volatile, fluctuating based on various economic factors. Locking into a 10-year term means committing to a specific interest rate for an extended period. If rates rise significantly during that time, your monthly payments could become considerably higher than initially anticipated, placing a strain on your budget.

- Increased financial burden if rates rise significantly: A sudden jump in interest rates could lead to financial hardship, particularly if your income remains stagnant.

- Difficulty predicting long-term financial stability: Accurately forecasting your financial situation a decade into the future is challenging. Unexpected expenses or job changes can make high, fixed mortgage payments difficult to manage.

- Comparison with shorter-term mortgages and their flexibility: Shorter-term mortgages, like 5-year terms, allow for refinancing at the end of the term, giving you the opportunity to capitalize on lower interest rates if they become available.

- Impact of variable vs. fixed interest rates: While a fixed-rate 10-year mortgage offers predictability, a variable-rate mortgage carries even higher risk, as payments can fluctuate with the prime rate.

Limited Flexibility and Prepayment Penalties for 10-Year Mortgages

The rigidity of a 10-year mortgage term presents another significant challenge. Life is unpredictable, and circumstances can change dramatically over a decade. A job loss, relocation, or unexpected family expenses might necessitate breaking your mortgage early, which often comes with substantial penalties.

- Difficulty adapting to changing life circumstances: Unexpected life events can significantly impact your ability to meet long-term mortgage obligations.

- High penalties for early mortgage repayment: Breaking a 10-year mortgage early typically results in significant financial penalties, potentially negating any initial savings from a lower interest rate.

- Comparison with the flexibility of shorter-term mortgages: Shorter-term mortgages offer greater flexibility, allowing you to refinance or switch lenders when opportunities arise, adapting to changing financial situations.

Psychological Factors and Risk Aversion Related to Long-Term Commitments

Beyond the financial aspects, psychological factors play a significant role in the unpopularity of 10-year mortgage terms. Committing to such a substantial debt for a decade can be daunting, even for financially responsible individuals.

- Uncertainty about future income and expenses: Predicting your financial situation ten years out is inherently uncertain. This uncertainty can contribute to anxiety and reluctance to commit to such a long-term obligation.

- Preference for shorter-term financial planning: Many Canadians prefer shorter-term financial planning horizons, finding it more manageable and less stressful.

- The psychological impact of a large long-term debt: The sheer size of a long-term mortgage can be psychologically burdensome for some borrowers, leading to stress and anxiety.

The Prevalence and Accessibility of Alternative Mortgage Options in Canada

Fortunately, Canadians have access to a range of alternative mortgage options that offer comparable benefits with less risk.

- Popularity of 5-year fixed-rate mortgages: The 5-year fixed-rate mortgage remains the most popular choice in Canada, offering a balance between affordability and flexibility.

- Advantages of adjustable-rate mortgages (ARMs) and their suitability for some borrowers: ARMs offer lower initial interest rates but carry the risk of fluctuating payments. They can be suitable for borrowers comfortable with potential payment increases.

- The role of mortgage brokers in helping Canadians find suitable mortgage terms: Mortgage brokers play a crucial role in guiding Canadians through the complex mortgage landscape, helping them find the best term for their individual circumstances.

Conclusion: Making Informed Decisions about Canadian Mortgage Terms

The lower popularity of 10-year mortgage terms in Canada stems from a combination of factors: higher interest rate risk, limited flexibility, psychological factors related to long-term commitments, and the availability of attractive alternatives. Choosing a mortgage term requires careful consideration of your financial situation, risk tolerance, and long-term goals. Before committing to any mortgage term, consult with a financial advisor and a mortgage broker to explore your options and choose the right mortgage term for you. Explore alternatives to 10-year mortgages in Canada and learn more about different mortgage options available in Canada to make the best decision for your financial future.

Featured Posts

-

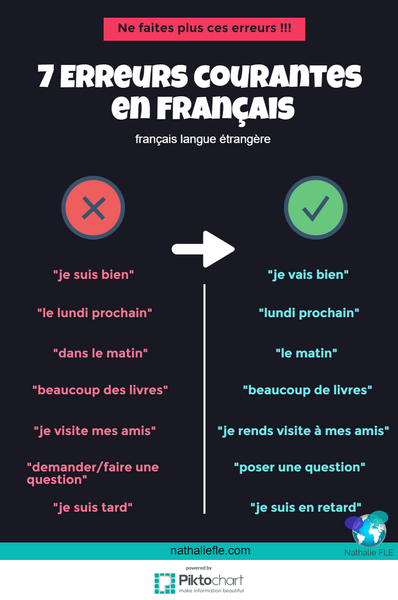

Comment Eviter Les Erreurs Couteuses

May 05, 2025

Comment Eviter Les Erreurs Couteuses

May 05, 2025 -

Sheins London Ipo A Victim Of Us Trade Tensions

May 05, 2025

Sheins London Ipo A Victim Of Us Trade Tensions

May 05, 2025 -

Stock Market Valuations Bof As Reassuring Take For Investors

May 05, 2025

Stock Market Valuations Bof As Reassuring Take For Investors

May 05, 2025 -

Sarajevo Book Fair Gibonnis Book Promotion

May 05, 2025

Sarajevo Book Fair Gibonnis Book Promotion

May 05, 2025 -

Trae Youngs Historic Night Hawks Triumph Over Sixers

May 05, 2025

Trae Youngs Historic Night Hawks Triumph Over Sixers

May 05, 2025

Latest Posts

-

Book Now 30 Off Lavish Spring Hotel Accommodation

May 31, 2025

Book Now 30 Off Lavish Spring Hotel Accommodation

May 31, 2025 -

Limited Time Offer 30 Off Lavish Spring Hotel Stays

May 31, 2025

Limited Time Offer 30 Off Lavish Spring Hotel Stays

May 31, 2025 -

The Reality Of Ai Why It Doesnt Learn And What That Means For Users

May 31, 2025

The Reality Of Ai Why It Doesnt Learn And What That Means For Users

May 31, 2025 -

Responsible Ai Addressing The Limitations Of Current Ai Learning

May 31, 2025

Responsible Ai Addressing The Limitations Of Current Ai Learning

May 31, 2025 -

Up To 30 Off Book Your Lavish Spring Hotel Stay Today

May 31, 2025

Up To 30 Off Book Your Lavish Spring Hotel Stay Today

May 31, 2025