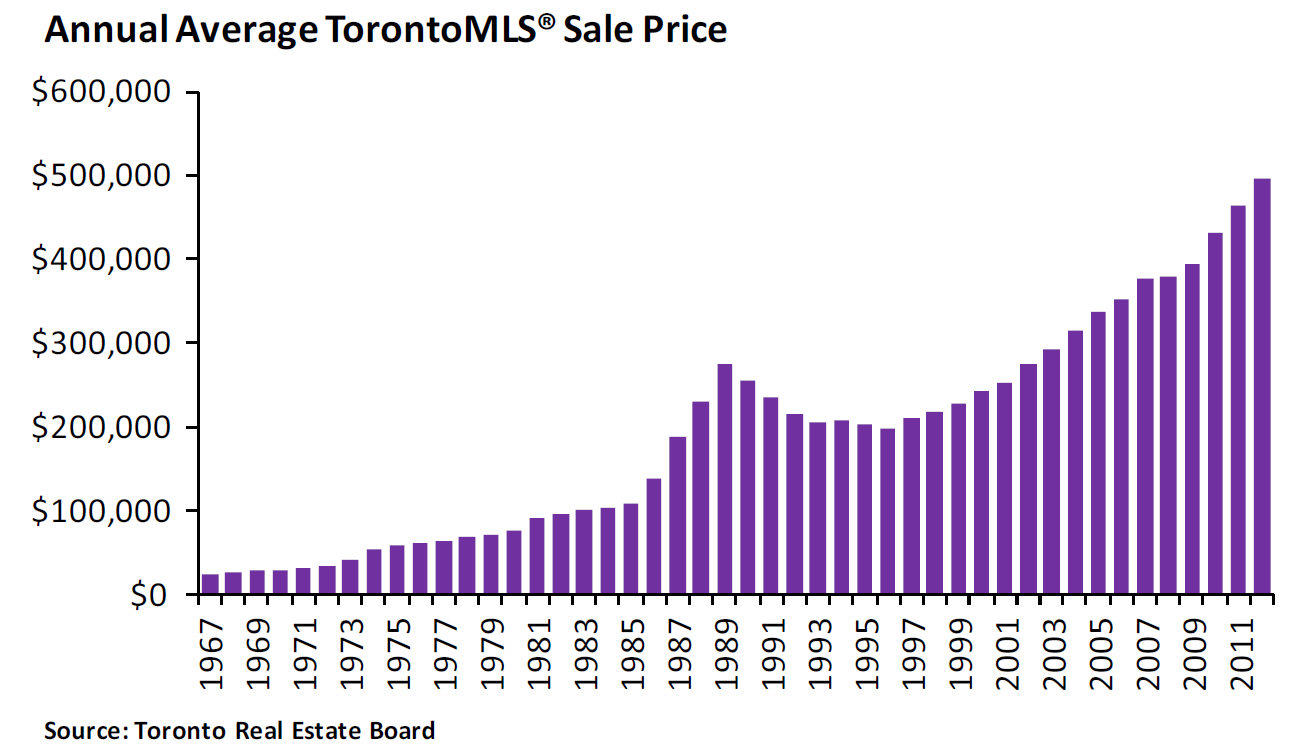

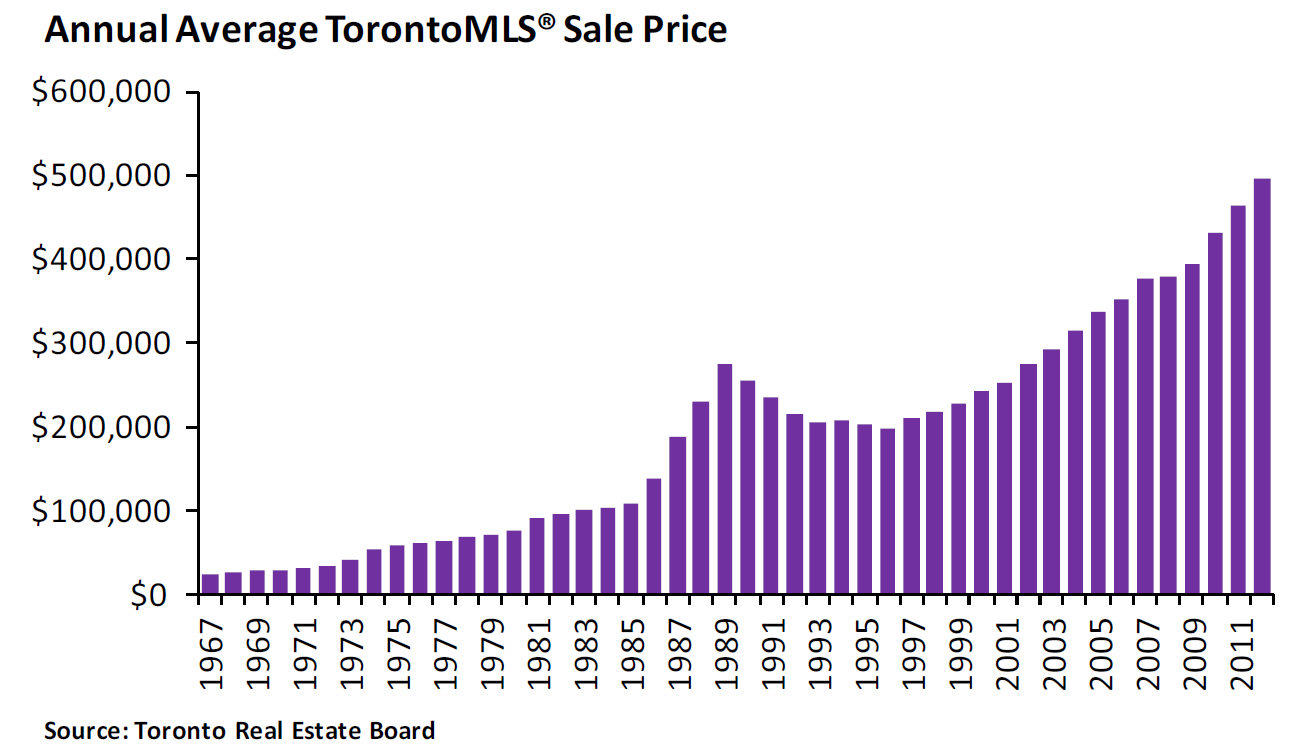

Analysis Of Toronto's Housing Market: 23% Sales Drop, 4% Price Decrease

Table of Contents

Causes of the Toronto Housing Market Decline

Several interconnected factors have contributed to the recent downturn in the Toronto housing market.

Increased Interest Rates

The Bank of Canada's aggressive interest rate hikes have dramatically impacted mortgage affordability. Higher interest rates translate to significantly larger monthly mortgage payments, reducing the purchasing power of buyers. For example, a 1% increase in interest rates can add thousands of dollars annually to a typical mortgage payment, effectively pricing many potential homebuyers out of the market.

- Impact on first-time homebuyers: First-time homebuyers, often relying on the maximum they can borrow, are particularly vulnerable. Higher rates drastically shrink their budget, making homeownership a much more distant prospect.

- Impact on investors: Increased borrowing costs reduce the profitability of real estate investments, leading to decreased investor activity.

- Impact on different mortgage types: Variable-rate mortgages are most immediately affected by interest rate changes, impacting borrowers significantly. Fixed-rate mortgages offer some protection but are still influenced by market conditions affecting future rates.

Economic Uncertainty

Beyond interest rates, broader economic uncertainty is playing a major role. Inflation erodes purchasing power, while recessionary fears and global economic instability fuel buyer hesitation. Concerns about job security and potential salary reductions further dampen consumer confidence, reducing demand in the Toronto real estate market.

- Impact of inflation on housing affordability: Rising inflation makes everything more expensive, including essential goods and services, leaving less disposable income for housing.

- Impact of job losses on buyer confidence: Fear of job loss directly impacts purchasing power and reduces confidence in making large financial commitments like purchasing a home.

- Global economic factors influencing the Toronto market: Global economic events, such as geopolitical instability or supply chain disruptions, influence the Canadian economy and, consequently, the Toronto housing market.

Increased Housing Inventory

The increased supply of homes for sale in Toronto has also contributed to the slowdown. A greater choice of properties shifts the balance of power from sellers to buyers. This increased inventory, coupled with reduced buyer demand, is directly impacting property prices Toronto.

- Types of properties seeing increased inventory: The increase in inventory is seen across various property types, including condos, townhouses, and detached homes, though the impact varies geographically.

- Geographic areas experiencing the most inventory growth: Certain areas of Toronto are experiencing a more significant increase in inventory than others, leading to more competitive pricing in those regions.

- Impact of increased inventory on price negotiations: Buyers now have more leverage to negotiate prices and secure better deals, especially in areas with higher inventory levels.

Impact of the Market Slowdown on Different Segments

The Toronto housing market slowdown affects different groups differently.

First-Time Homebuyers

First-time homebuyers face the most significant challenges in this market. Higher interest rates and reduced affordability severely limit their options.

- Strategies for first-time homebuyers in this market: Saving a larger down payment, exploring government support programs, and considering alternative housing options are crucial strategies.

- Potential government support programs: First-time homebuyers may qualify for government-backed programs that alleviate some of the financial pressure.

- Alternatives to homeownership: Renting or delaying homeownership until the market stabilizes are viable alternatives.

Investors

Real estate investors are also feeling the impact. Rental yields are decreasing, and investment returns are becoming less attractive.

- Strategies for investors navigating the market downturn: Investors may consider diversifying their portfolios, focusing on undervalued properties, or temporarily postponing investment decisions.

- Potential risks and opportunities for investors: While risks are elevated, the current downturn may present opportunities for astute investors to purchase properties at discounted prices.

- Impact of rental regulations: Existing rental regulations play a crucial role in shaping investment strategies and the overall rental market dynamics.

Existing Homeowners

Existing homeowners seeking to sell face challenges, including lower selling prices and extended selling times.

- Strategies for homeowners selling in a slower market: Competitive pricing, enhanced property presentation, and strategic marketing are vital for a successful sale.

- The importance of pricing strategies: Accurately pricing the property according to current market conditions is crucial to attracting buyers.

- Considerations for downsizing or relocation: Existing homeowners may need to adjust their expectations and explore alternative options if selling becomes difficult.

Future Outlook for the Toronto Housing Market

Predicting the future of the Toronto housing market is complex. Several factors will influence whether we see a market recovery or further slowdown.

- Predictions for interest rates: The Bank of Canada's future interest rate decisions will significantly influence mortgage affordability and buyer demand.

- Predictions for housing inventory: The level of new housing construction and the rate at which existing homes are sold will determine future inventory levels.

- Predictions for sales volume and price changes: Sales volume and price changes will depend on a combination of interest rate changes, economic conditions, and housing supply.

Conclusion: Navigating the Toronto Housing Market Slowdown

The 23% sales drop and 4% price decrease in the Toronto housing market reflect the impact of increased interest rates, economic uncertainty, and increased inventory. This slowdown significantly impacts first-time homebuyers, investors, and existing homeowners. The future outlook remains uncertain, but careful monitoring of interest rates, economic conditions, and housing supply is crucial. To navigate this dynamic market successfully, stay informed about Toronto housing market trends and consult with experienced real estate professionals for personalized advice tailored to your specific needs and circumstances. Contact a realtor today to discuss your options in the current Toronto real estate market.

Featured Posts

-

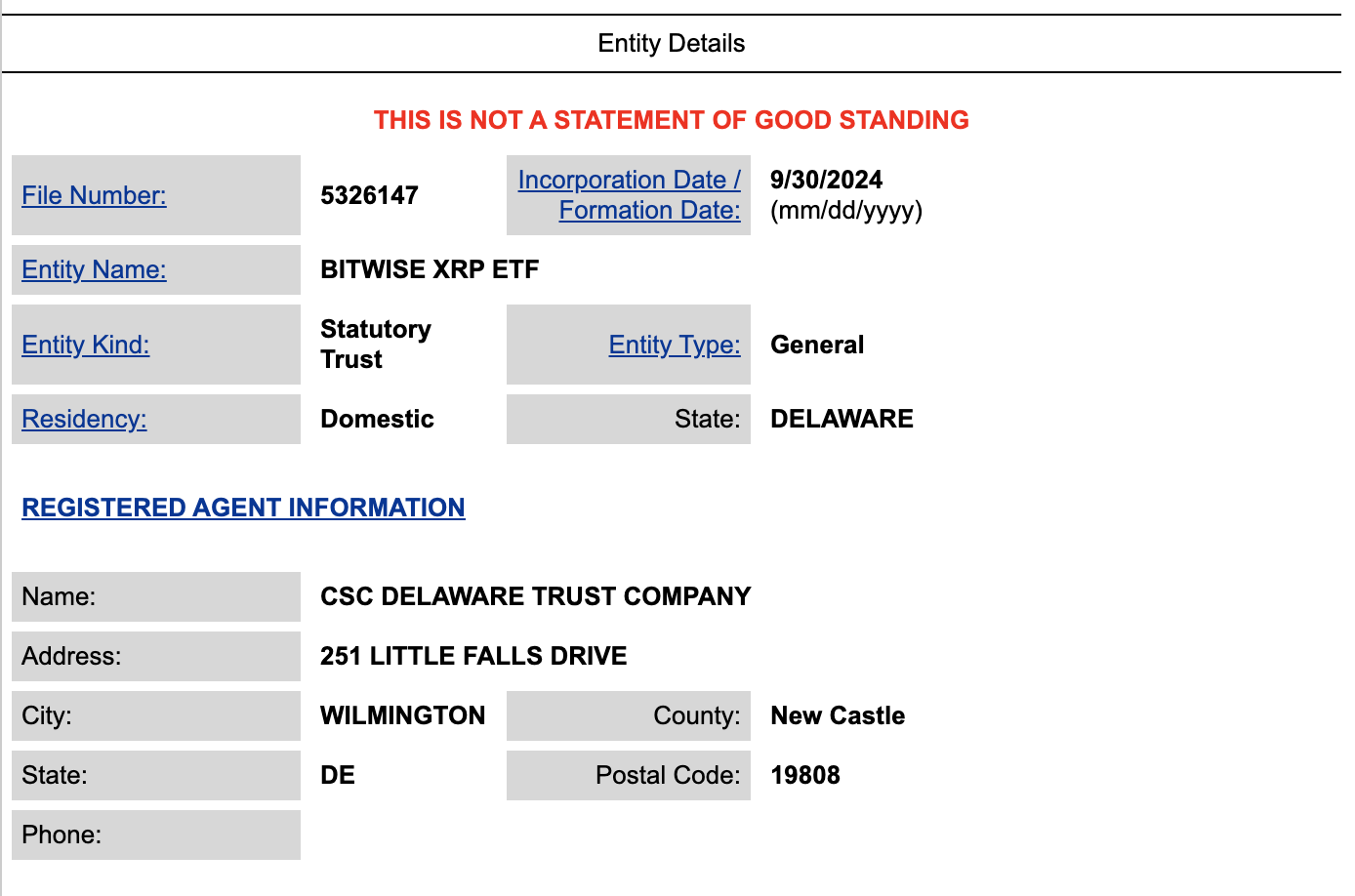

Grayscales Xrp Etf Filing Xrp Price Performance Compared To Bitcoin

May 08, 2025

Grayscales Xrp Etf Filing Xrp Price Performance Compared To Bitcoin

May 08, 2025 -

Analyzing Xrps Price Action Derivatives Market Implications

May 08, 2025

Analyzing Xrps Price Action Derivatives Market Implications

May 08, 2025 -

Xrp Etf Risks The Impact Of High Supply And Limited Institutional Adoption

May 08, 2025

Xrp Etf Risks The Impact Of High Supply And Limited Institutional Adoption

May 08, 2025 -

Bitcoin Madenciligi Azalan Karliligin Gercek Sebepleri

May 08, 2025

Bitcoin Madenciligi Azalan Karliligin Gercek Sebepleri

May 08, 2025 -

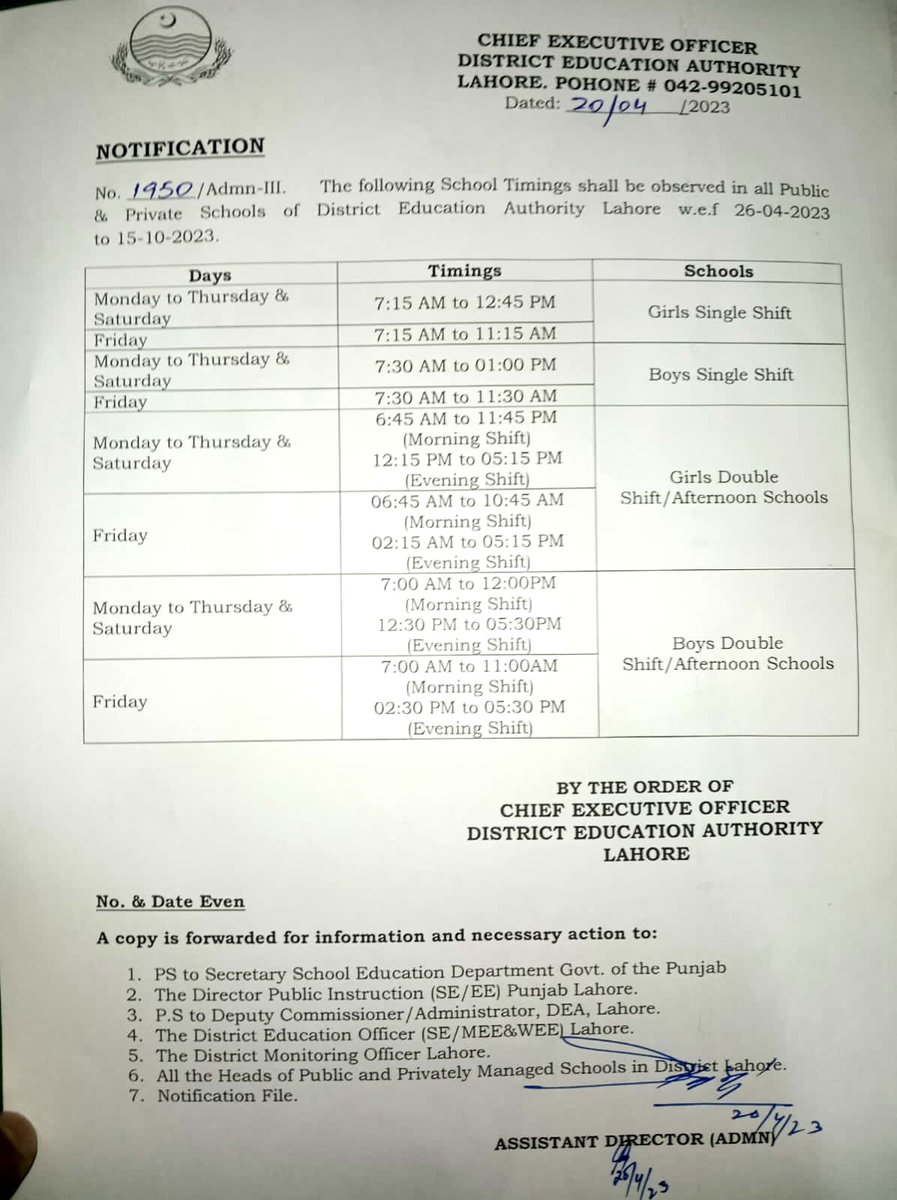

Lahwr Py Ays Ayl Ky Wjh Se Askwlwn Ke Awqat Kar Tbdyl Srkary Nwtyfkyshn

May 08, 2025

Lahwr Py Ays Ayl Ky Wjh Se Askwlwn Ke Awqat Kar Tbdyl Srkary Nwtyfkyshn

May 08, 2025

Latest Posts

-

Is Colin Cowherd Right About Jayson Tatum Examining The Evidence

May 08, 2025

Is Colin Cowherd Right About Jayson Tatum Examining The Evidence

May 08, 2025 -

The Colin Cowherd Jayson Tatum Debate A Comprehensive Analysis

May 08, 2025

The Colin Cowherd Jayson Tatum Debate A Comprehensive Analysis

May 08, 2025 -

Update On Jayson Tatums Wrist Boston Celtics Head Coach Weighs In

May 08, 2025

Update On Jayson Tatums Wrist Boston Celtics Head Coach Weighs In

May 08, 2025 -

Jayson Tatums Place In The Nba Analyzing Colin Cowherds Perspective

May 08, 2025

Jayson Tatums Place In The Nba Analyzing Colin Cowherds Perspective

May 08, 2025 -

Jayson Tatums Wrist Injury Boston Celtics Head Coach Gives Update

May 08, 2025

Jayson Tatums Wrist Injury Boston Celtics Head Coach Gives Update

May 08, 2025