April 8th Treasury Market Update: Lessons Learned

Table of Contents

Yield Curve Dynamics on April 8th

Analysis of the 2-year, 5-year, and 10-year Treasury yields

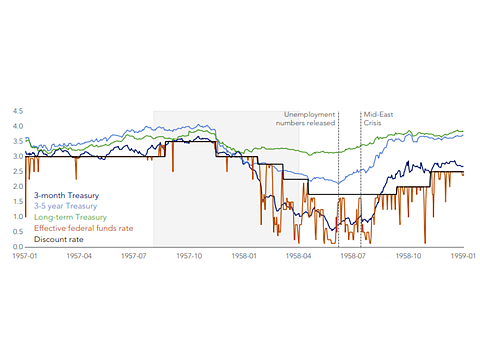

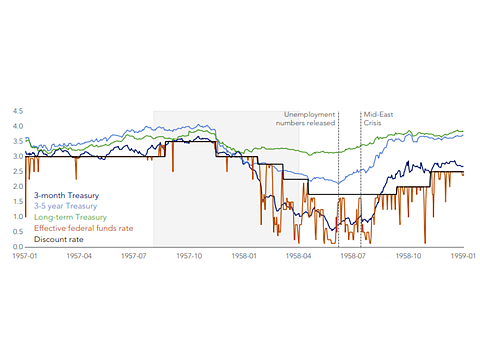

The Treasury yield curve, a graphical representation of Treasury yields across different maturities, exhibited notable shifts on April 8th. Understanding these movements is crucial for interpreting market sentiment and anticipating future trends.

- 2-year Treasury yield: Experienced a [insert percentage]% increase/decrease.

- 5-year Treasury yield: Showed a [insert percentage]% increase/decrease.

- 10-year Treasury yield: Fluctuated by [insert percentage]%, reflecting [explain the direction and magnitude of change].

These movements were largely attributed to several interacting factors:

- Inflation expectations: Rising inflation concerns, potentially fueled by [mention specific economic data releases, e.g., a higher-than-expected CPI report], put upward pressure on longer-term Treasury yields.

- Federal Reserve policy: The market reacted to [mention specific Fed statements or actions, e.g., hints at future rate hikes] by adjusting expectations for future interest rate changes. This impacted the entire Treasury yield curve.

- Economic data releases: The release of key economic indicators, such as [mention specific data, e.g., employment numbers, manufacturing data], influenced investor sentiment and consequently affected bond yields.

[Insert chart or graph visualizing the yield curve shifts on April 8th, clearly labeling the 2-year, 5-year, and 10-year Treasury yields]. This visualization provides a clear picture of the yield spread dynamics on that day. Analyzing the yield curve's shape – whether it steepened, flattened, or inverted – can offer valuable insights into market expectations for future economic growth and inflation.

Impact of Economic Data Releases

Discussion of relevant economic indicators released around April 8th

Several key economic indicators released around April 8th significantly influenced Treasury market activity. Understanding the market's reaction to this data is crucial for informed decision-making.

- CPI (Consumer Price Index): A [insert percentage]% increase/decrease in CPI, exceeding/falling short of expectations, impacted inflation expectations and subsequently influenced Treasury yields.

- PPI (Producer Price Index): Similar to CPI, the PPI's performance provided additional insights into inflation pressures and their potential effects on bond prices.

- Employment Report: The employment report, showing [mention key figures, e.g., unemployment rate, job growth], provided insights into the health of the economy and influenced investor sentiment towards Treasury bonds.

The market's reaction to these data releases was swift and significant. [Describe the immediate price changes and trading volume observed in response to each data release. For example: "The unexpected rise in CPI led to an immediate sell-off in longer-term Treasuries, driving yields higher and increasing trading volume."] This highlights the importance of closely monitoring economic data and their potential impact on Treasury market dynamics.

Federal Reserve Policy Implications

Assessment of the Federal Reserve's role and potential influence on the April 8th market movements

The Federal Reserve's actions and statements play a significant role in shaping the Treasury market. On April 8th, the Fed's [mention specific actions or statements] had a noticeable impact.

- Fed's commentary on inflation: Statements regarding the Fed's inflation target and its commitment to controlling inflation directly affected market expectations for future interest rate adjustments.

- Potential future rate hikes: Market participants interpreted hints of potential future rate hikes [explain the interpretation and its impact on Treasury yields].

- Quantitative easing (QE) or bond-buying programs: [Discuss the role of any ongoing or potential QE programs and their effect on Treasury prices].

Understanding the Fed's perspective on inflation, economic growth, and its overall monetary policy stance is crucial for anticipating future Treasury market movements. The interplay between economic data, market sentiment, and the Fed's actions creates a complex, dynamic environment.

Lessons Learned and Future Outlook

Key takeaways from the April 8th Treasury market activity

The April 8th Treasury market activity provided several valuable lessons for investors and traders:

- Market volatility: The rapid price swings highlight the inherent volatility of the Treasury market, emphasizing the importance of risk management strategies.

- Economic data sensitivity: Treasury prices are highly sensitive to economic data releases, making careful monitoring of these releases crucial for informed investment decisions.

- Fed's influence: The Fed's actions and communications significantly influence market sentiment and Treasury yields. Staying informed about Fed policy is essential.

Moving forward, investors should consider:

- Diversification: Diversifying investment portfolios to mitigate risk is crucial in a volatile market.

- Hedging strategies: Implementing hedging strategies to protect against potential losses is recommended.

- Active monitoring: Closely monitoring economic data and Fed pronouncements is essential for adapting investment strategies in response to market fluctuations.

Conclusion: April 8th Treasury Market Update: Key Takeaways and Next Steps

This April 8th Treasury Market Update highlighted the significant volatility experienced in the Treasury market, driven by a confluence of factors including yield curve dynamics, economic data releases, and Federal Reserve policy. We analyzed the shifts in the 2-year, 5-year, and 10-year Treasury yields, the market's reaction to key economic indicators like CPI and employment data, and the influence of the Federal Reserve’s stance on interest rates. Key lessons learned emphasize the importance of risk management, close monitoring of economic indicators and the Fed’s actions, and the need for adaptable investment strategies.

Stay ahead of the curve by regularly reviewing our Treasury market updates and incorporating the lessons learned from the April 8th events into your investment portfolio. Understanding the dynamics of the Treasury market is crucial for successful investing.

Featured Posts

-

Impact Of Xs Debt Sale Analyzing The Newly Released Financial Data

Apr 29, 2025

Impact Of Xs Debt Sale Analyzing The Newly Released Financial Data

Apr 29, 2025 -

Tylor Megill Analyzing His Effective Pitching Techniques For The New York Mets

Apr 29, 2025

Tylor Megill Analyzing His Effective Pitching Techniques For The New York Mets

Apr 29, 2025 -

Bof As Take Why Current Stock Market Valuations Shouldnt Worry Investors

Apr 29, 2025

Bof As Take Why Current Stock Market Valuations Shouldnt Worry Investors

Apr 29, 2025 -

Dari Zuffenhausen Ke Dunia Mengungkap Sejarah Porsche 356

Apr 29, 2025

Dari Zuffenhausen Ke Dunia Mengungkap Sejarah Porsche 356

Apr 29, 2025 -

Traffic Stop Turns Deadly Georgia Deputy Killed Another Officer Shot

Apr 29, 2025

Traffic Stop Turns Deadly Georgia Deputy Killed Another Officer Shot

Apr 29, 2025

Latest Posts

-

Cynthia Erivo Ariana Grande Join Jeff Goldblum On Upcoming Jazz Album

Apr 29, 2025

Cynthia Erivo Ariana Grande Join Jeff Goldblum On Upcoming Jazz Album

Apr 29, 2025 -

New Jazz Album From Jeff Goldblum Showcases Cynthia Erivo Ariana Grande

Apr 29, 2025

New Jazz Album From Jeff Goldblum Showcases Cynthia Erivo Ariana Grande

Apr 29, 2025 -

Jeff Goldblums Wife Emilie Livingstons Age Children And Their Story

Apr 29, 2025

Jeff Goldblums Wife Emilie Livingstons Age Children And Their Story

Apr 29, 2025 -

Getting To Know Emilie Livingston Jeff Goldblums Wife And Family

Apr 29, 2025

Getting To Know Emilie Livingston Jeff Goldblums Wife And Family

Apr 29, 2025 -

Pw Cs Departure A Case Study Of Nine Sub Saharan African Countries

Apr 29, 2025

Pw Cs Departure A Case Study Of Nine Sub Saharan African Countries

Apr 29, 2025