Are $67 Million In Ethereum Liquidations A Sign Of Further Price Drops?

Table of Contents

Understanding Ethereum Liquidations

Ethereum liquidations occur when a trader's leveraged position on an exchange suffers losses exceeding their margin. Leveraged trading, which involves borrowing funds to amplify potential profits, significantly magnifies risk. When the market moves against a leveraged position, the exchange issues a margin call, demanding additional funds to cover potential losses. If the trader fails to meet this margin call, their position is liquidated – automatically sold to cover the debt.

- Definition of liquidation: In crypto trading, liquidation means the forced closure of a leveraged position due to insufficient collateral.

- Leveraged positions and risk: Using leverage increases potential returns but dramatically increases the risk of liquidation, especially during volatile market conditions.

- Triggers for mass liquidations: Significant market downturns, sudden and sharp price swings, or cascading liquidations (where one liquidation triggers others) can all lead to mass liquidations.

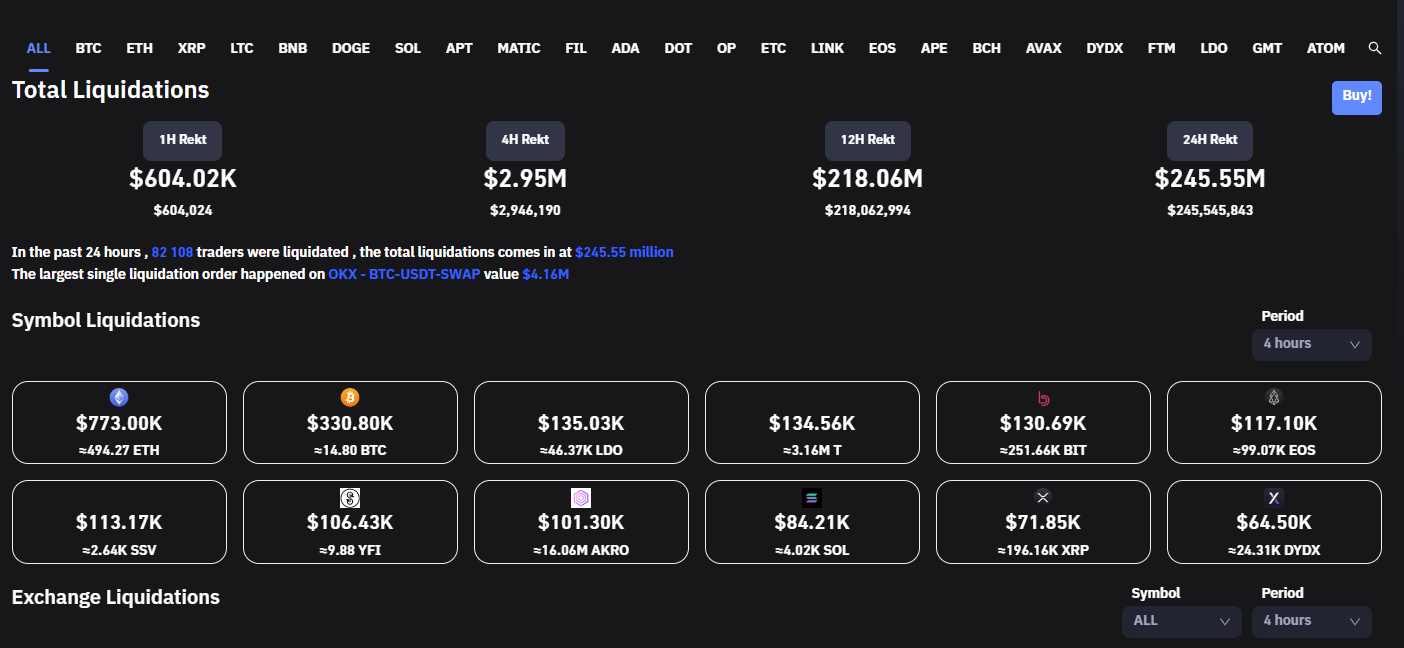

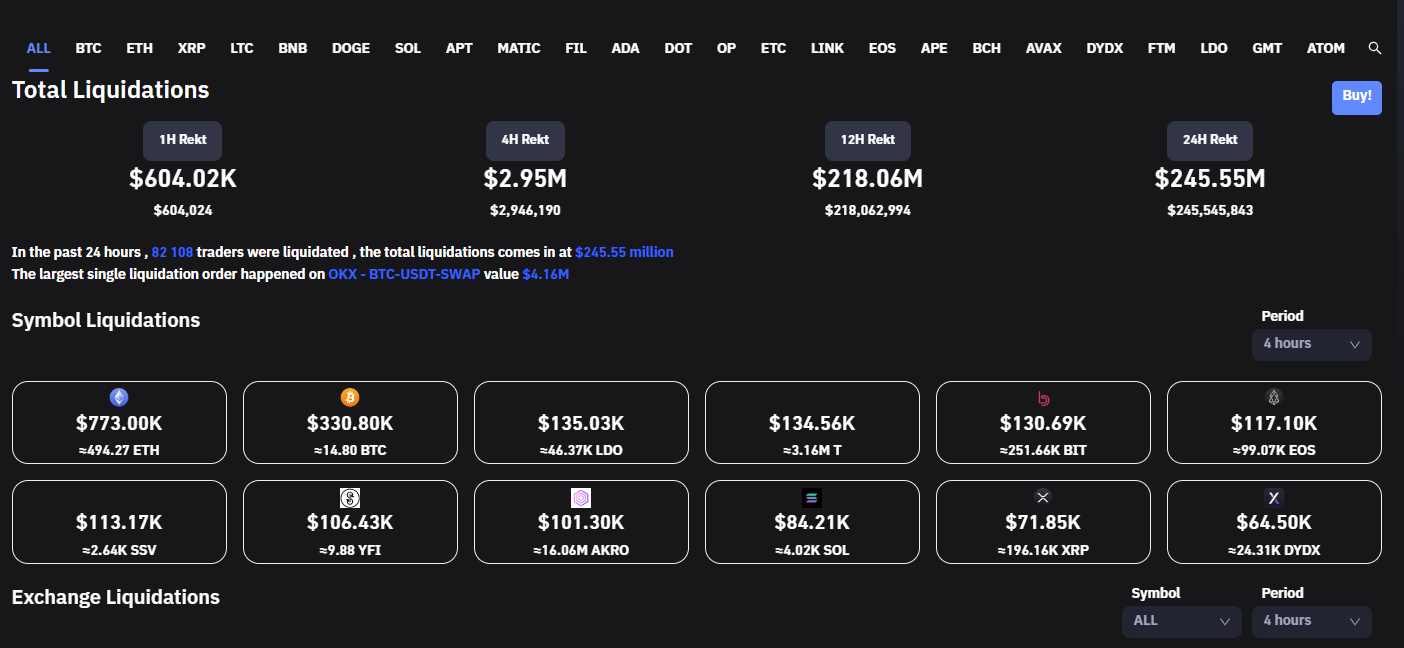

Analyzing the $67 Million Liquidation Event

The specific $67 million Ethereum liquidation event, occurring primarily on [Insert Date and Time if available], highlighted the market's fragility. While pinpointing the exact causes requires further investigation, contributing factors likely included [Mention specific contributing factors like market sentiment, news events, or specific altcoin movements]. The event primarily affected traders holding [Specify long or short positions].

- Date and time: [Insert Date and Time of the event, if available. Otherwise, remove this bullet point]

- Liquidation volume: Approximately $67 million worth of ETH was liquidated.

- Market conditions: Leading up to the event, the market experienced [Describe the market conditions: e.g., increasing volatility, negative sentiment, bearish trend].

- Affected platforms: [Mention the exchanges or platforms most heavily impacted by the liquidations, if known.]

Correlation Between Liquidations and Price Drops

Historically, large-scale Ethereum liquidations have often preceded or coincided with price drops. This correlation stems from the selling pressure created when leveraged positions are forcibly liquidated. However, it's crucial to understand that correlation doesn't equal causation. Other factors significantly influence ETH's price.

- Statistical analysis: While a definitive statistical analysis requires extensive data, anecdotal evidence suggests a strong correlation between significant liquidation events and subsequent price corrections.

- Psychological impact: Mass liquidations can negatively impact market sentiment, creating a self-fulfilling prophecy where fear drives further selling and price declines.

- Other market influences: Macroeconomic factors, regulatory changes, technological advancements, and general market sentiment all play a role in price movements independent of liquidations.

Factors to Consider Beyond Liquidations

While Ethereum liquidations provide valuable insight into market dynamics, focusing solely on them overlooks other critical influences on ETH's price.

- Macroeconomic conditions: Global economic trends, inflation rates, and interest rate adjustments can impact investor risk appetite and consequently, cryptocurrency prices.

- Regulatory developments: Changes in cryptocurrency regulations globally can significantly affect market sentiment and investment flows.

- Technological advancements: Ethereum network upgrades, the development of new decentralized applications (dApps), and scalability solutions can drive price increases or decreases depending on their impact on the network.

Strategies for Navigating Market Volatility

The volatility inherent in the cryptocurrency market underscores the importance of robust risk management strategies.

- Risk assessment in leveraged trading: Thoroughly assess your risk tolerance and avoid leveraging beyond your comfortable loss threshold.

- Diversification: Diversify your cryptocurrency portfolio to reduce exposure to the risks associated with any single asset, including ETH.

- Stay informed: Stay updated on market trends, news, and regulatory developments through reputable sources.

Conclusion

The $67 million in Ethereum liquidations serve as a reminder of the inherent risks in the cryptocurrency market, particularly for leveraged traders. While a correlation exists between large-scale liquidations and subsequent price drops, it's crucial to remember that other market factors play a significant role. Predicting precise price movements is inherently difficult. However, understanding Ethereum liquidations and their potential impact is crucial for navigating the volatile crypto market. Stay updated on the latest developments to make informed investment choices.

Featured Posts

-

Exploring Warfare 5 Movies That Capture Action And Heart

May 08, 2025

Exploring Warfare 5 Movies That Capture Action And Heart

May 08, 2025 -

Pressure Mounts For Economic Reform Amidst Taiwan Dollars Rise

May 08, 2025

Pressure Mounts For Economic Reform Amidst Taiwan Dollars Rise

May 08, 2025 -

Champions League Inter Milans Upset Victory Over Bayern Munich

May 08, 2025

Champions League Inter Milans Upset Victory Over Bayern Munich

May 08, 2025 -

Oklahoma City Thunder Portland Trail Blazers March 7th Game Information

May 08, 2025

Oklahoma City Thunder Portland Trail Blazers March 7th Game Information

May 08, 2025 -

Cybercriminals Office365 Scheme Nets Millions Fbi Alleges

May 08, 2025

Cybercriminals Office365 Scheme Nets Millions Fbi Alleges

May 08, 2025

Latest Posts

-

Xrp Price Prediction Is A Parabolic Rise On The Horizon

May 08, 2025

Xrp Price Prediction Is A Parabolic Rise On The Horizon

May 08, 2025 -

3 Key Factors Suggesting A Possible Parabolic Xrp Move

May 08, 2025

3 Key Factors Suggesting A Possible Parabolic Xrp Move

May 08, 2025 -

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025 -

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025 -

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025