BlackRock ETF: Billionaire Investments Fuel 110% Growth Prediction For 2025

Table of Contents

BlackRock ETFs (Exchange-Traded Funds) are investment funds traded on stock exchanges, offering investors diversified exposure to various asset classes like stocks, bonds, and commodities. Their accessibility, low expense ratios, and ease of trading make them a popular choice for both seasoned investors and beginners. BlackRock, a global leader in investment management, offers a vast array of ETFs, catering to a wide spectrum of investment goals and risk tolerances.

This article aims to explore the reasons behind the predicted 110% growth for specific BlackRock ETFs, focusing on the investment strategies employed by prominent billionaires and the broader market forces at play.

Billionaire Investment Strategies Driving BlackRock ETF Growth

Several high-profile billionaire investors are reportedly accumulating significant positions in certain BlackRock ETFs, contributing to the optimistic growth projections.

Identifying the Key Billionaire Investors

While specific investment details are often kept private, analyzing publicly available information can shed light on the involvement of certain prominent investors. It's crucial to remember that this information is based on publicly available data and may not reflect the entirety of their investment strategies.

- Example 1 (Hypothetical): Let's say billionaire investor X has a known history of successful investments in sustainable energy. Their investment in a BlackRock ETF focused on renewable energy technologies might indicate a strong belief in the sector's future.

- Example 2 (Hypothetical): Billionaire investor Y, renowned for their tech investments, might be heavily invested in a BlackRock ETF tracking the Nasdaq 100, reflecting their bullish outlook on the technology sector.

These investors' previous successes and established investment philosophies play a significant role in shaping market sentiment. Their large-scale investments can influence other investors, creating a positive feedback loop and driving up demand for the targeted BlackRock ETFs.

Analyzing Investment Trends

The billionaires' investment choices reveal several key trends:

- Sustainable Investing: Many billionaires are increasingly focusing on ETFs that align with Environmental, Social, and Governance (ESG) criteria. This reflects a growing global awareness of climate change and social responsibility.

- Technological Advancements: The rapid growth of technology continues to attract significant investment, with ETFs focused on sectors like artificial intelligence, cloud computing, and cybersecurity proving popular.

- Emerging Markets: Some billionaires are betting on the long-term growth potential of emerging markets, investing in BlackRock ETFs that offer exposure to developing economies.

These trends, reflected in the specific sectors and asset classes within the ETFs, are significant contributors to the predicted 110% growth. The convergence of these trends suggests a confluence of factors propelling the growth of these specific ETFs.

Market Factors Contributing to the BlackRock ETF Growth Projection

Beyond billionaire involvement, several macroeconomic and industry-specific factors are expected to boost the performance of these BlackRock ETFs.

Macroeconomic Factors

- Inflation & Interest Rates: While inflation can be detrimental, controlled inflation coupled with strategic interest rate adjustments can stimulate economic growth, benefiting certain sectors represented in the ETFs.

- Global Economic Growth: Continued global economic growth, albeit at a potentially slower pace than previous years, fuels demand for various goods and services, positively impacting the underlying companies held within the ETFs.

- Government Stimulus: Government policies and spending can significantly impact specific sectors, potentially boosting the performance of related ETFs.

These factors increase demand for these ETFs, particularly those in sectors poised to benefit from economic growth and strategic government initiatives.

Industry-Specific Growth Drivers

- Technological Advancements: Breakthroughs in artificial intelligence, biotechnology, and renewable energy are driving significant growth in these sectors, making related ETFs attractive investment options.

- Regulatory Changes: New regulations and supportive policies can stimulate growth in specific industries, positively impacting the performance of associated ETFs. This could include tax incentives for renewable energy or supportive policies for the tech sector.

- Consolidation and Mergers: Industry consolidation can lead to increased efficiency and profitability, benefitting the companies and, consequently, the ETFs that hold their shares.

Examples of companies within the ETFs driving this growth might include leaders in renewable energy, groundbreaking biotechnology firms, or rapidly expanding technology companies. The link between these industry trends and predicted ETF performance is clear: innovative companies drive sector growth, leading to higher ETF valuations.

Risks and Considerations for Investing in BlackRock ETFs

While the 110% growth prediction is compelling, it's crucial to acknowledge the inherent risks associated with any investment.

Market Volatility

- Potential for Underperformance: Market conditions can change rapidly, and the projected growth might not materialize as anticipated. Factors beyond anyone's control can significantly impact market performance.

- Economic Downturns: Economic recessions or geopolitical instability can lead to significant market corrections, impacting even the most promising investments.

- Unexpected Events: Unforeseen events like pandemics or natural disasters can negatively affect market performance.

Diversification is critical to mitigate risk. Don't put all your eggs in one basket. Spread your investment across various asset classes and ETFs to cushion against potential losses.

Due Diligence

Before investing in any BlackRock ETF, thorough research is paramount:

- Expense Ratios: Compare the expense ratios of different ETFs to find the most cost-effective options.

- Fund Holdings: Carefully review the ETF's holdings to understand the underlying assets and their associated risks.

- Historical Performance: Analyze the ETF's past performance, but remember that past performance doesn't guarantee future results.

Reliable information about BlackRock ETFs is available on the BlackRock website, financial news sources, and through reputable financial advisors.

Conclusion: Capitalizing on the BlackRock ETF Growth Potential

The 110% growth prediction for selected BlackRock ETFs stems from a confluence of factors: significant billionaire investments, compelling market trends, and favorable macroeconomic conditions. However, it's vital to acknowledge the inherent risks associated with any investment in the stock market.

Remember the importance of due diligence. Thoroughly research your chosen BlackRock ETFs, understanding their holdings, expense ratios, and associated risks. Don't miss out on the potential of these high-growth BlackRock ETFs. Conduct your own research and consider adding these promising investments to your portfolio today! Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Deandre Dzordan I Nikola Jokic Neobican Obicaj I Uloga Bobija Marjanovica

May 08, 2025

Deandre Dzordan I Nikola Jokic Neobican Obicaj I Uloga Bobija Marjanovica

May 08, 2025 -

Shreveport Police Crack Multi Vehicle Theft Ring Suspects Arrested

May 08, 2025

Shreveport Police Crack Multi Vehicle Theft Ring Suspects Arrested

May 08, 2025 -

Analyzing Nathan Fillions Memorable Saving Private Ryan Scene

May 08, 2025

Analyzing Nathan Fillions Memorable Saving Private Ryan Scene

May 08, 2025 -

I Just Watched The New Superman Footage Krypto Steals The Show But This Moment Is Bigger

May 08, 2025

I Just Watched The New Superman Footage Krypto Steals The Show But This Moment Is Bigger

May 08, 2025 -

Toronto Housing Market Report 23 Sales Decline 4 Price Reduction

May 08, 2025

Toronto Housing Market Report 23 Sales Decline 4 Price Reduction

May 08, 2025

Latest Posts

-

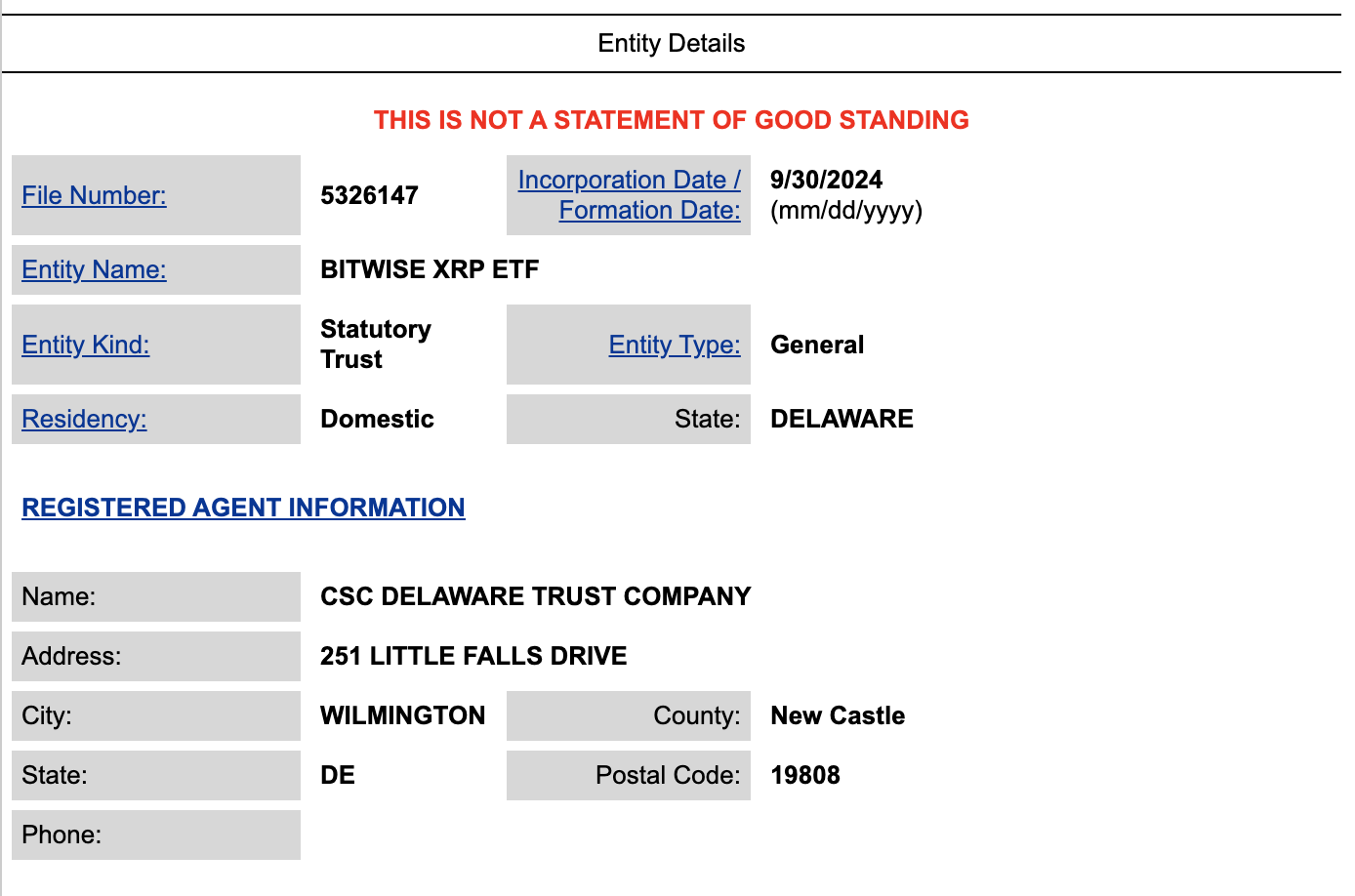

Grayscales Xrp Etf Filing Xrp Price Performance Compared To Bitcoin

May 08, 2025

Grayscales Xrp Etf Filing Xrp Price Performance Compared To Bitcoin

May 08, 2025 -

Xrp Etfs Potential For 800 Million In Week 1 Inflows Upon Approval

May 08, 2025

Xrp Etfs Potential For 800 Million In Week 1 Inflows Upon Approval

May 08, 2025 -

Saturday April 12th Lotto Winning Numbers Announced

May 08, 2025

Saturday April 12th Lotto Winning Numbers Announced

May 08, 2025 -

Daily Lotto Results Thursday 17th April 2025

May 08, 2025

Daily Lotto Results Thursday 17th April 2025

May 08, 2025 -

Xrp Surges Outpacing Bitcoin After Sec Acknowledges Grayscale Xrp Etf Application

May 08, 2025

Xrp Surges Outpacing Bitcoin After Sec Acknowledges Grayscale Xrp Etf Application

May 08, 2025