Toronto Housing Market Report: 23% Sales Decline, 4% Price Reduction

Table of Contents

Causes of the Toronto Housing Market Slowdown

Several interconnected factors have contributed to the recent slowdown in the Toronto housing market.

Rising Interest Rates

The Bank of Canada's aggressive interest rate hikes have significantly impacted mortgage affordability. Since March 2022, the benchmark interest rate has increased by several percentage points. This translates to substantially higher monthly mortgage payments for both new and existing homeowners.

- Increased monthly payments: Borrowers are now facing significantly larger monthly payments, reducing their purchasing power and affordability.

- Reduced borrowing power: Higher interest rates mean lenders approve smaller loan amounts, limiting the price range buyers can afford in the Toronto real estate market.

- Fewer buyers entering the market: The increased cost of borrowing has sidelined many potential buyers, leading to a drop in demand and a subsequent decrease in sales.

Economic Uncertainty

The broader economic climate plays a crucial role in influencing the housing market. Concerns about inflation, potential recession, and job market uncertainty are impacting consumer confidence, leading to decreased spending and a more cautious approach to major purchases like homes.

- Inflation: High inflation erodes purchasing power, impacting affordability and reducing consumer confidence in the Toronto housing market.

- Recessionary fears: Concerns about a potential economic downturn make buyers hesitant to commit to large financial obligations like mortgages.

- Job market uncertainty: Fear of job losses or reduced income makes potential homebuyers more cautious and less likely to enter the market.

Increased Inventory

The Toronto real estate market has seen a noticeable increase in the number of properties available for sale. This rise in inventory reduces the pressure on sellers and shifts the balance of power towards buyers.

- More choices for buyers: Increased inventory provides buyers with more options, allowing for greater selectivity and potentially better negotiation.

- Reduced pressure on sellers: With more properties available, sellers are less likely to receive multiple offers above the asking price.

- Leading to price adjustments: The increased competition among sellers naturally leads to price adjustments to attract buyers in the current Toronto real estate climate. The current inventory levels are significantly higher compared to the same period last year, indicating a notable shift in market dynamics.

Impact of the 4% Price Reduction

The recent 4% price reduction in the Toronto housing market has had distinct impacts on both buyers and sellers.

Implications for Home Sellers

The current market presents several challenges for home sellers in Toronto:

- Lower selling prices: Sellers are often forced to accept lower offers than anticipated due to reduced buyer demand.

- Increased time on market: Properties are staying on the market for longer periods, increasing carrying costs for sellers.

- Need for price adjustments: Many sellers need to make price adjustments to remain competitive and attract potential buyers.

Opportunities for Home Buyers

The 4% price reduction creates several advantageous circumstances for home buyers:

- More affordable prices: Buyers can now find homes at lower prices than in the previous peak market.

- Less competition: Reduced buyer demand translates to less competition for available properties.

- Better negotiation power: Buyers have a stronger negotiating position, potentially securing better deals.

Market Predictions and Future Outlook

Predicting the future of the Toronto housing market requires careful consideration of various factors.

Expert Opinions

Real estate analysts offer diverse predictions for the coming months and years: some predict a continued, albeit slower, price correction, while others anticipate a stabilization of the market once interest rate hikes plateau.

- Potential for further price corrections: Some analysts believe that prices might experience further minor adjustments before stabilizing.

- Anticipated changes in interest rates: The future trajectory of interest rates will significantly impact the market's performance.

- Predictions for sales volume: Sales volume is expected to remain relatively low until market confidence improves.

Long-Term Trends

Despite short-term fluctuations, the long-term outlook for the Toronto housing market remains relatively positive. Factors such as population growth and ongoing infrastructure development continue to fuel demand.

- Sustained demand despite short-term fluctuations: The fundamental drivers of demand, such as population growth and limited housing supply, are expected to remain.

- Potential for market recovery: Once economic uncertainty subsides and interest rates stabilize, the market is likely to recover.

Conclusion: Toronto Housing Market Report: Navigating the Current Landscape

This report highlights a significant shift in the Toronto housing market, characterized by a 23% sales decline and a 4% price reduction. Rising interest rates, economic uncertainty, and increased inventory have all contributed to this downturn. While the current market presents challenges for sellers, it offers significant opportunities for buyers. The long-term outlook remains positive, driven by ongoing population growth and infrastructure development. However, navigating this dynamic market requires informed decision-making. Stay updated on the latest trends in the Toronto housing market by subscribing to our newsletter! Or contact a real estate expert to discuss your options in the current Toronto real estate market.

Featured Posts

-

Sermaye Ve Guevenlik Odakli Spk Nin Kripto Para Platformlarina Yoenelik Yeni Duezenlemesi

May 08, 2025

Sermaye Ve Guevenlik Odakli Spk Nin Kripto Para Platformlarina Yoenelik Yeni Duezenlemesi

May 08, 2025 -

Iniciando Con Fuerza Los Dodgers Y Su Impresionante Racha Ganadora

May 08, 2025

Iniciando Con Fuerza Los Dodgers Y Su Impresionante Racha Ganadora

May 08, 2025 -

National Media Under Fire From Oklahoma City Thunder Players

May 08, 2025

National Media Under Fire From Oklahoma City Thunder Players

May 08, 2025 -

Nathan Fillion From Wwii Movie To The Rookie

May 08, 2025

Nathan Fillion From Wwii Movie To The Rookie

May 08, 2025 -

Assassins Creed Shadows Ps 5 Pros Ray Tracing Upgrade Analyzed

May 08, 2025

Assassins Creed Shadows Ps 5 Pros Ray Tracing Upgrade Analyzed

May 08, 2025

Latest Posts

-

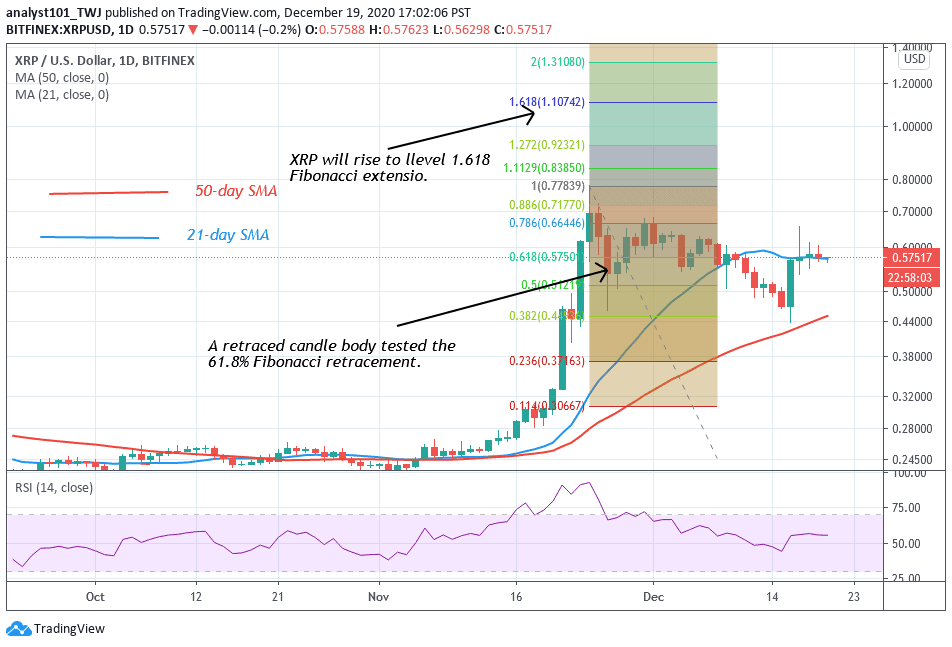

Analyzing The Challenges Why Xrp Etfs May Underperform Expectations

May 08, 2025

Analyzing The Challenges Why Xrp Etfs May Underperform Expectations

May 08, 2025 -

Ripple Xrp On The Rise A Look At Its Potential To Hit 3 40

May 08, 2025

Ripple Xrp On The Rise A Look At Its Potential To Hit 3 40

May 08, 2025 -

Ripples Xrp A Comprehensive Guide For Potential Investors

May 08, 2025

Ripples Xrp A Comprehensive Guide For Potential Investors

May 08, 2025 -

Xrp Etf Risks The Impact Of High Supply And Limited Institutional Adoption

May 08, 2025

Xrp Etf Risks The Impact Of High Supply And Limited Institutional Adoption

May 08, 2025 -

Can Xrp Hit 3 40 Analyzing Ripples Resistance Levels

May 08, 2025

Can Xrp Hit 3 40 Analyzing Ripples Resistance Levels

May 08, 2025