BofA's View: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Bear Market Signal

BofA's analysis suggests that the seemingly high stock market valuations are not inherently alarming. Their perspective is nuanced, incorporating several crucial factors often overlooked in simplistic valuations assessments.

The Role of Interest Rates and Inflation

BofA acknowledges the impact of rising interest rates and inflation on stock valuations. However, their analysis suggests these factors are already largely priced into the market.

- Higher interest rates generally increase borrowing costs for companies, potentially slowing down investment and reducing profitability. This can lead to lower stock prices. However, BofA's projections indicate that interest rate hikes are likely to slow down in the coming year.

- Inflation erodes the purchasing power of future earnings, making future cash flows less valuable today. This impacts valuation models. BofA's forecasts suggest inflation will gradually decline, though remain above historical averages.

- BofA's recent reports indicate a projected decline in interest rates to around 4% by the end of 2024, coupled with inflation moderating to approximately 3%. This data underpins their belief that the current valuation levels are justifiable given the predicted economic environment.

Strong Corporate Earnings and Future Growth Projections

BofA's assessment points to robust corporate earnings as a significant factor supporting current valuations. The firm highlights a sustained period of strong profitability across several key sectors.

- Strong performance in the technology and healthcare sectors, along with resilient growth in consumer staples, continue to drive earnings.

- BofA forecasts continued earnings growth, albeit at a more moderate pace compared to previous years. Their projections suggest a 7-9% annual growth rate for the next three years, a figure that supports current market capitalization.

- These positive earnings projections, coupled with their forecasts for interest rate and inflation moderation, justify, according to BofA, the current valuations. Their research emphasizes specific companies exhibiting this strong earnings growth.

Long-Term Investment Horizon and Market Cycles

BofA stresses the importance of maintaining a long-term investment strategy, arguing against short-term market timing based solely on valuation metrics.

- Historical data demonstrates the cyclical nature of the stock market, showing that market corrections are a normal part of long-term growth.

- Trying to time the market perfectly is exceptionally difficult and often detrimental to long-term returns. BofA's research reinforces this point, showcasing the superior returns achieved through consistent long-term investing.

- Market corrections, while potentially unsettling, can present attractive opportunities for investors to purchase quality assets at discounted prices. BofA advises long-term investors to focus on their overall portfolio strategy and consider adding to positions during dips, rather than panicking and selling.

Addressing Specific Investor Concerns Regarding Current Valuations

While acknowledging the validity of some investor anxieties, BofA provides counterarguments to address specific concerns about current valuations.

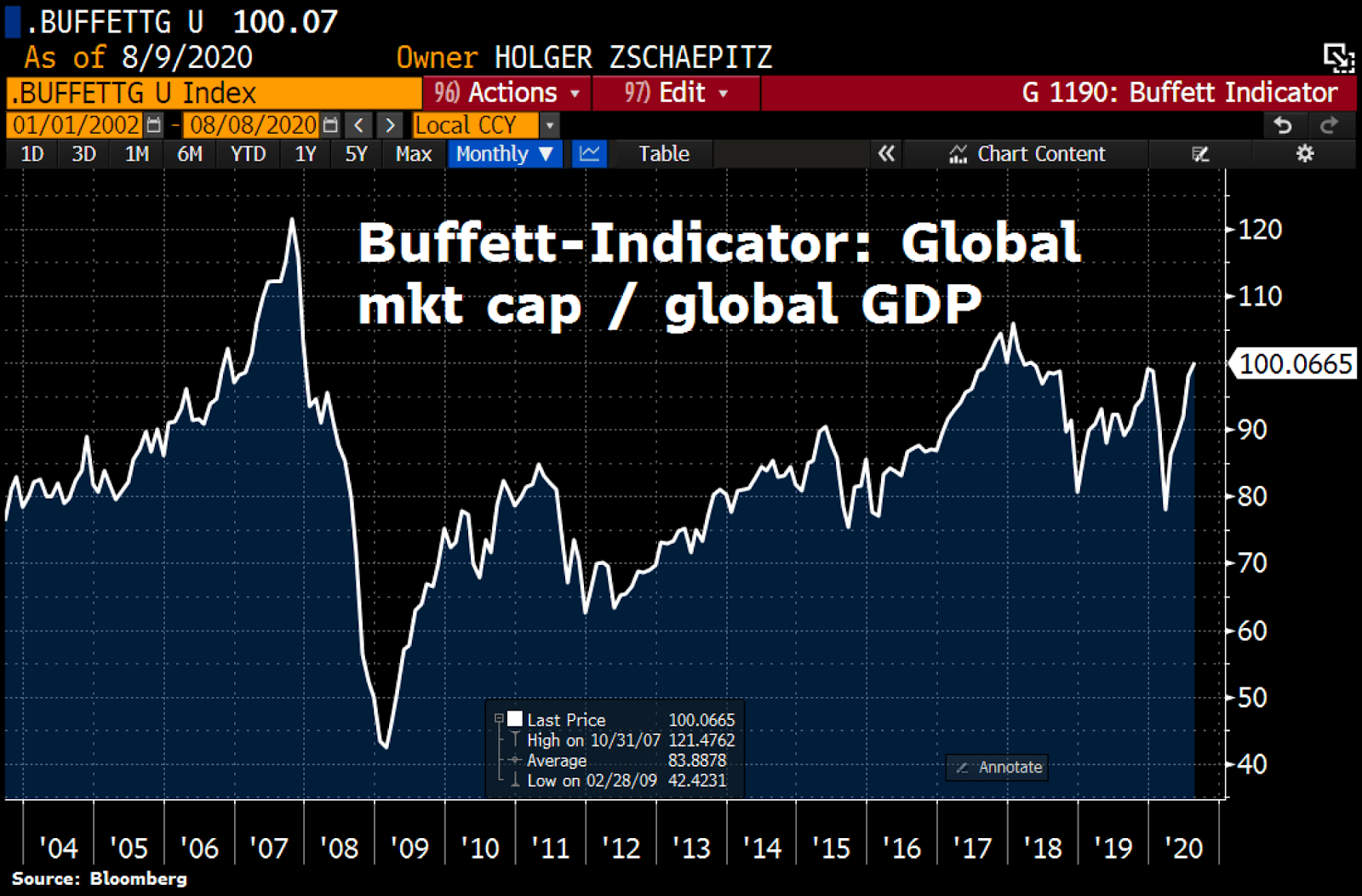

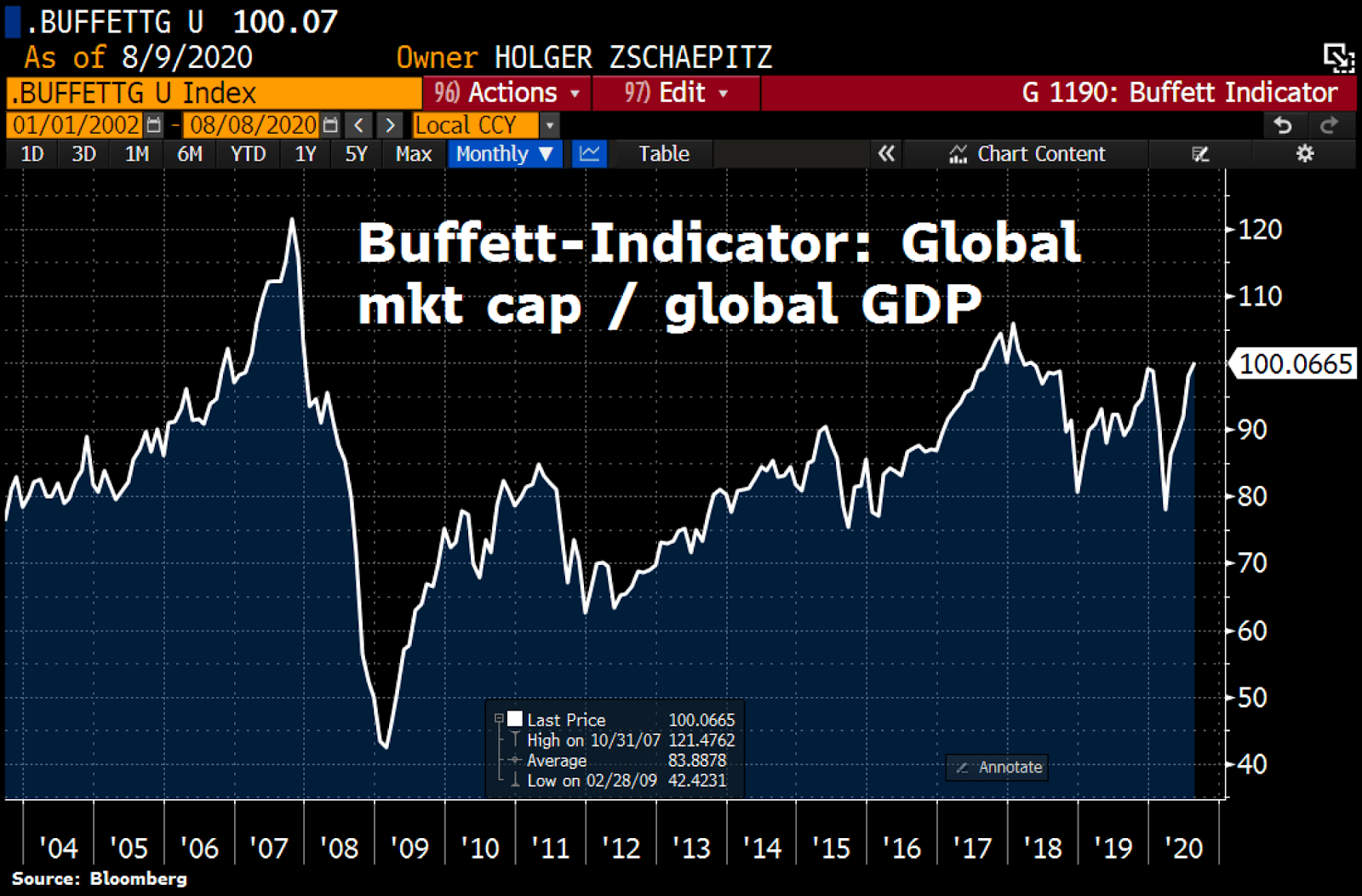

The Price-to-Earnings Ratio (P/E) Debate

High P/E ratios are a common source of concern for investors. BofA highlights that while a high P/E ratio can signal overvaluation, it's not the sole indicator of a market's health.

- The P/E ratio needs to be considered in context, with industry benchmarks and long-term trends playing a crucial role.

- BofA's analysis emphasizes using multiple valuation metrics, not relying solely on P/E. This approach offers a more comprehensive picture of a company's or the market's worth.

- They point to other metrics, such as Price-to-Sales and Price-to-Book ratios, which, when considered alongside P/E, suggest a less extreme valuation picture.

Concerns about Potential Market Corrections

The possibility of a market correction is a valid concern. BofA acknowledges this risk, but suggests the potential impact may be less severe than some investors fear.

- BofA's assessment suggests a significant correction is not their base-case scenario, given their outlook on corporate earnings and macroeconomic indicators.

- Even in the event of a correction, BofA believes it’s unlikely to wipe out the long-term gains of a diversified portfolio.

- Diversification across different asset classes and a disciplined investment strategy are essential tools for mitigating potential risks associated with market corrections.

Conclusion

BofA's analysis suggests that current high stock market valuations, while seemingly elevated, shouldn't necessarily trigger widespread investor alarm. Their perspective rests on the interplay of several factors: the manageable impact of interest rates and inflation, strong and projected corporate earnings, and the crucial role of a long-term investment horizon. By addressing specific concerns surrounding P/E ratios and potential market corrections, BofA offers a reasoned counterpoint to prevailing anxieties. To gain a deeper understanding of their detailed analysis and projections, we encourage you to consult BofA's full report [link to BofA report here]. Remember, while stock market valuations may seem high, BofA's view suggests they shouldn't deter investors with a long-term perspective and a well-defined investment strategy.

Featured Posts

-

Trump And Zelenskys Surprise Meeting Before Popes Funeral

Apr 28, 2025

Trump And Zelenskys Surprise Meeting Before Popes Funeral

Apr 28, 2025 -

Cybercriminal Nets Millions From Executive Office365 Account Breaches

Apr 28, 2025

Cybercriminal Nets Millions From Executive Office365 Account Breaches

Apr 28, 2025 -

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025 -

From Railroad To Overwater Highway A Florida Keys Road Trip

Apr 28, 2025

From Railroad To Overwater Highway A Florida Keys Road Trip

Apr 28, 2025 -

Millions In Losses Office365 Hack Targets Executive Accounts

Apr 28, 2025

Millions In Losses Office365 Hack Targets Executive Accounts

Apr 28, 2025

Latest Posts

-

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025 -

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025 -

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025 -

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025 -

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025