Could XRP ETF Approval Trigger $800 Million In First-Week Investment?

Table of Contents

The Potential Impact of XRP ETF Approval

An ETF is an investment fund traded on stock exchanges, offering investors exposure to a specific asset class, in this case, XRP. The significance of XRP ETF approval lies in its ability to dramatically increase the accessibility and liquidity of XRP. Currently, investing in XRP directly requires navigating cryptocurrency exchanges, a process that can be complex and potentially risky for many investors. An ETF simplifies this process, making XRP accessible to a much broader range of investors.

- Increased Institutional Investment: The availability of an XRP ETF would attract significant institutional investment, as it provides a regulated and familiar investment vehicle for large financial institutions.

- Simplified Investment Process for Retail Investors: Retail investors can easily buy and sell XRP through their brokerage accounts, eliminating the need to interact directly with cryptocurrency exchanges.

- Higher Trading Volume and Price Volatility: Increased accessibility will likely lead to a substantial rise in trading volume, which, in turn, could cause increased price volatility.

- Potential for Price Surge due to Increased Demand: The influx of new investment spurred by an ETF is likely to drive up demand, potentially causing a significant price surge.

The current regulatory landscape surrounding XRP, particularly in the wake of the SEC's lawsuit against Ripple, plays a crucial role in the likelihood of ETF approval. A positive resolution to this legal battle would significantly increase the chances of an XRP ETF gaining regulatory approval.

Factors Contributing to the $800 Million Estimate

The $800 million figure is a projection based on several factors. Analyzing XRP's current market capitalization and considering the potential influx of new investment due to increased accessibility provides a foundation for this estimate. Current investor sentiment, which is largely positive concerning XRP's long-term potential, further supports this prediction.

- Existing XRP Holdings and Potential Sell-offs: The number of XRP already held by investors will influence the initial investment volume. Some investors might choose to sell their existing holdings upon the launch of an ETF.

- Analysis of Past ETF Launches and Their Market Impact: Examining the market impact of previous ETF launches, particularly in the cryptocurrency space, can offer valuable insights into potential XRP ETF performance.

- Consideration of Alternative Investment Options: The attractiveness of XRP compared to other cryptocurrencies and traditional investment vehicles will affect the level of investment.

- Impact of SEC ruling on Ripple: A positive outcome in the SEC vs. Ripple case would undoubtedly bolster investor confidence and potentially contribute to exceeding the $800 million estimate.

Expert opinions and market analysis from reputable sources are essential for evaluating the validity of the $800 million prediction. While some analysts are optimistic, others caution against such a significant influx of investment in the short term.

Potential Challenges and Risks

While the potential benefits of XRP ETF approval are significant, it's crucial to acknowledge the potential challenges and risks. Regulatory hurdles and delays in ETF approval remain a possibility, potentially hindering the rapid investment flow. The inherent volatility of the cryptocurrency market adds another layer of uncertainty.

- Potential for Price Corrections After Initial Surge: An initial price surge following ETF approval might be followed by a correction as market sentiment stabilizes.

- Risk of Investor Speculation and Market Manipulation: The increased trading volume could make XRP more susceptible to market manipulation and speculative trading.

- Uncertainty Surrounding Future Regulatory Decisions: Changes in regulatory frameworks could impact the performance of the XRP ETF.

- Competition from Other Cryptocurrencies: The competitive landscape of the cryptocurrency market means XRP might face competition from other assets.

Diversification and risk management are crucial when considering investments in cryptocurrencies, especially in the volatile period following an XRP ETF launch.

Analyzing the $800 Million Figure – Is it Realistic?

The $800 million estimate should be viewed as a potential outcome rather than a guarantee. Several scenarios are possible, depending on market conditions and investor behavior.

- Best-Case Scenario: A positive SEC ruling, strong investor sentiment, and increased institutional adoption could potentially exceed the $800 million estimate.

- Worst-Case Scenario: Regulatory delays, negative market sentiment, and significant sell-offs could result in a much lower investment inflow.

- Most Likely Scenario: A more realistic scenario might involve a substantial, yet potentially less dramatic, increase in investment, falling somewhere between the best and worst-case scenarios. The $800 million figure serves as a benchmark, but actual investment could vary significantly.

Conclusion

XRP ETF approval presents both significant opportunities and potential risks. While the $800 million first-week investment figure is ambitious, it reflects the potential impact of increased accessibility and liquidity. Thorough research and understanding of the associated risks are paramount before making any investment decisions. The XRP ETF approval remains a significant development to watch, with the potential to reshape the cryptocurrency landscape. Stay informed about the latest developments regarding XRP ETF approval and make informed decisions about your investments. Learn more about the potential implications of XRP ETF approval and how it might impact your portfolio. Don't miss the potential opportunities – research the future of XRP today!

Featured Posts

-

The Future Of Xrp Etf Applications Sec Case Resolution And Price Predictions

May 08, 2025

The Future Of Xrp Etf Applications Sec Case Resolution And Price Predictions

May 08, 2025 -

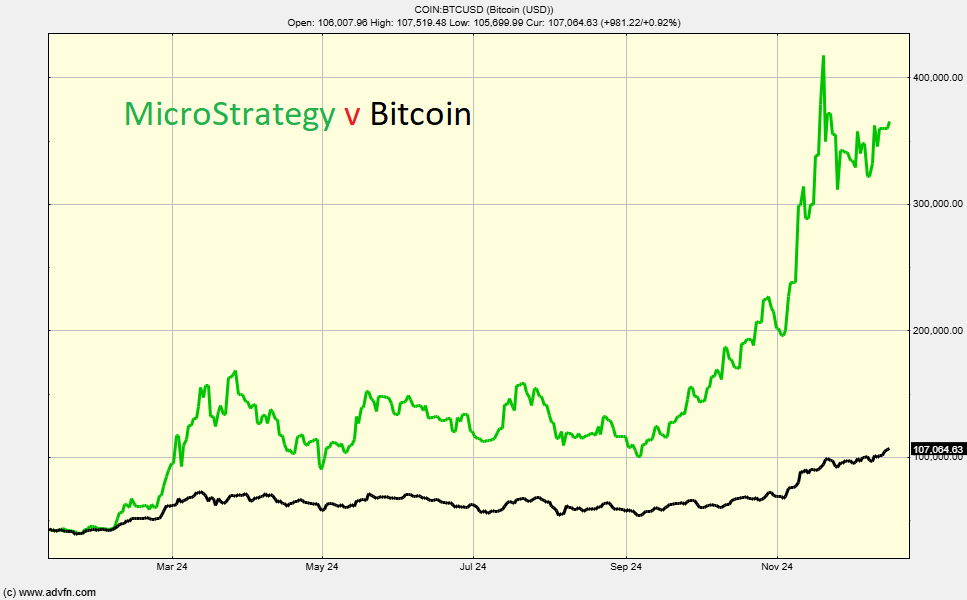

Micro Strategy Vs Bitcoin Predicting Investment Returns In 2025

May 08, 2025

Micro Strategy Vs Bitcoin Predicting Investment Returns In 2025

May 08, 2025 -

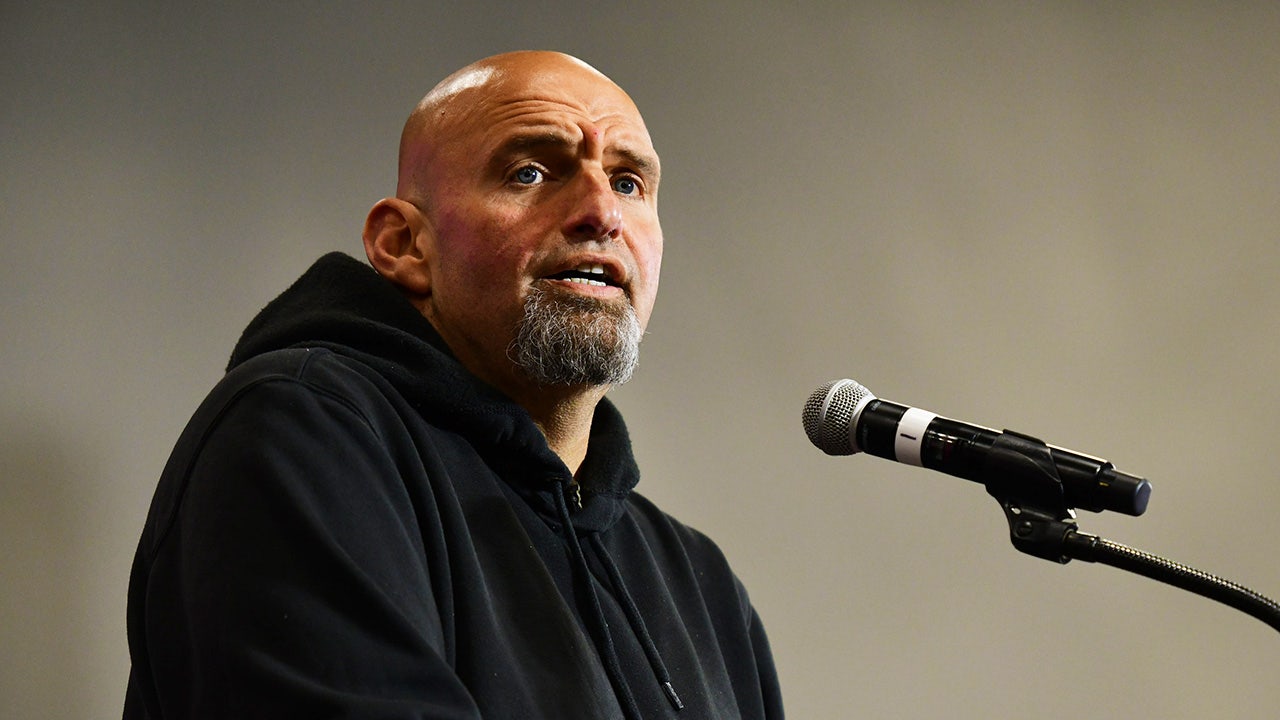

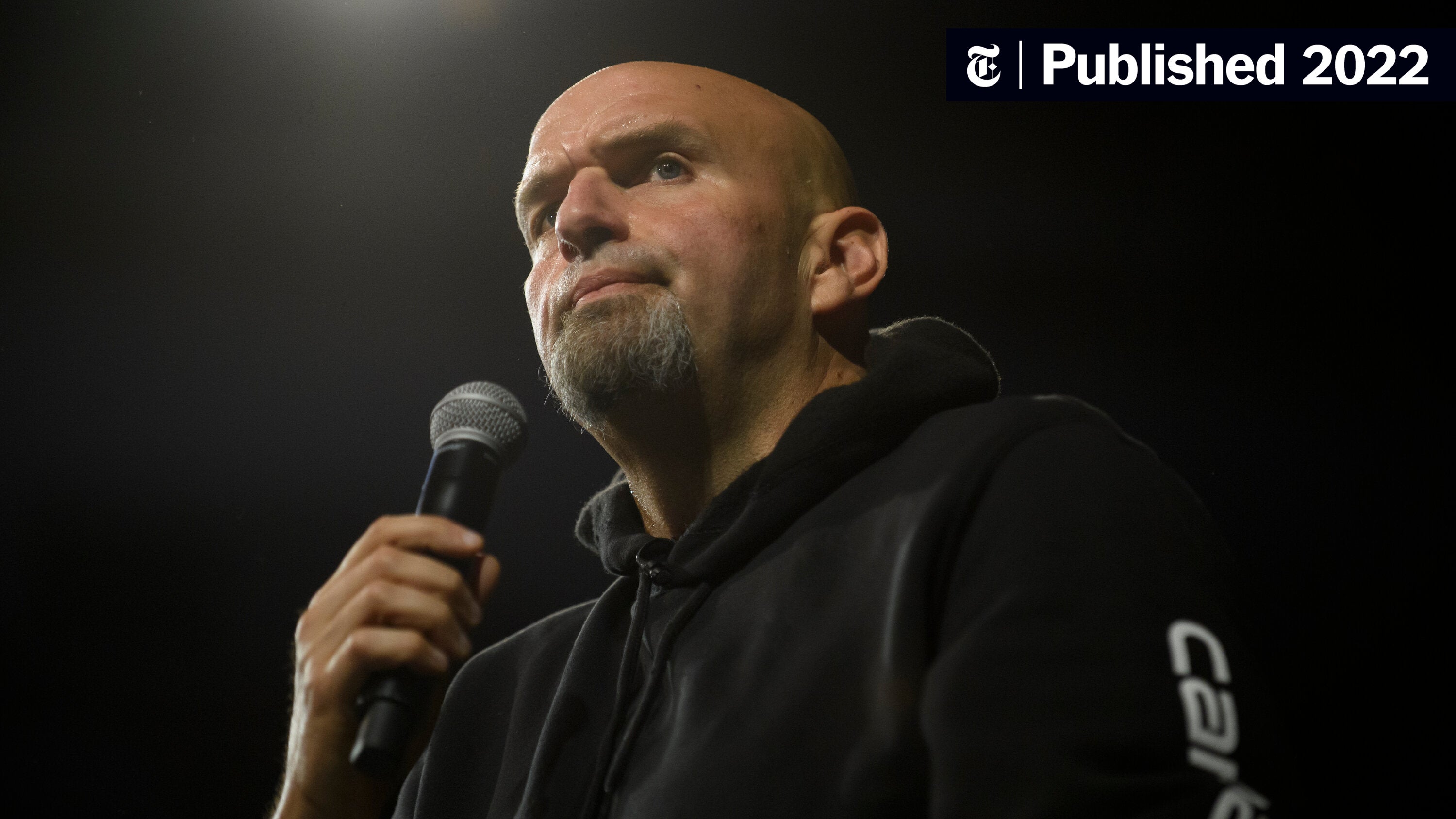

Fetterman Rejects Calls To Resign Remains Committed To Senate Service

May 08, 2025

Fetterman Rejects Calls To Resign Remains Committed To Senate Service

May 08, 2025 -

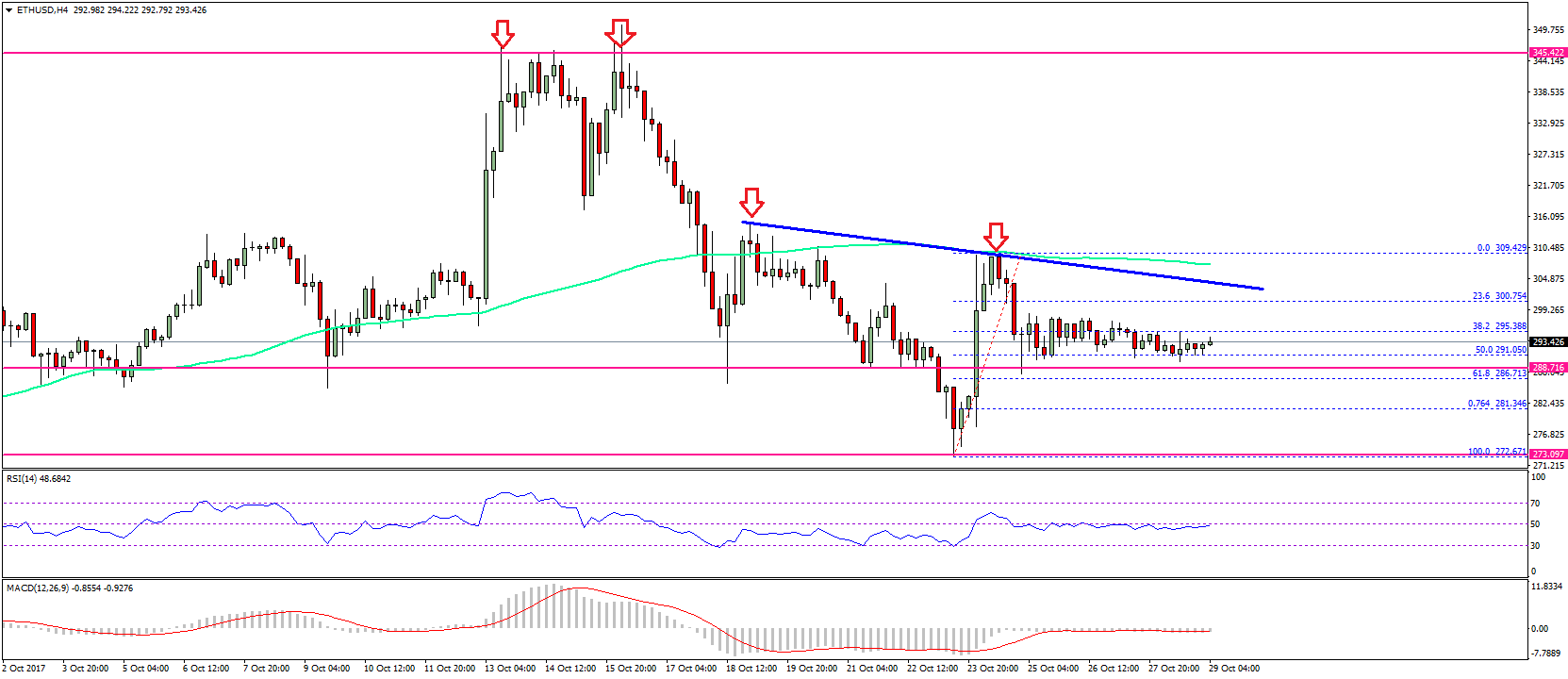

Ethereum Price Rebound Potential A Weekly Chart Indicator Analysis

May 08, 2025

Ethereum Price Rebound Potential A Weekly Chart Indicator Analysis

May 08, 2025 -

John Fetterman Responds To Ny Magazine Article Questioning His Health

May 08, 2025

John Fetterman Responds To Ny Magazine Article Questioning His Health

May 08, 2025

Latest Posts

-

Dwp Overhaul Universal Credit Changes And Potential Loss Of Benefits

May 08, 2025

Dwp Overhaul Universal Credit Changes And Potential Loss Of Benefits

May 08, 2025 -

Dwp Increases Home Visits For Benefit Claimants Impact And Concerns

May 08, 2025

Dwp Increases Home Visits For Benefit Claimants Impact And Concerns

May 08, 2025 -

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025 -

Saglik Bakanligi Personel Alimi 37 Bin Kisi Icin Son Basvuru Tarihleri Yaklasiyor

May 08, 2025

Saglik Bakanligi Personel Alimi 37 Bin Kisi Icin Son Basvuru Tarihleri Yaklasiyor

May 08, 2025 -

Acil Saglik Bakanligi 37 Bin Personel Aliyor Basvuru Sartlari Ve Nasil Basvurulur

May 08, 2025

Acil Saglik Bakanligi 37 Bin Personel Aliyor Basvuru Sartlari Ve Nasil Basvurulur

May 08, 2025