Ethereum Price: Bullish Trend Strengthened By Large ETH Accumulation

Table of Contents

Evidence of Large-Scale ETH Accumulation

Several indicators point towards significant large-scale accumulation of ETH, suggesting a strong bullish sentiment driving the price increase.

On-Chain Data Analysis

Analyzing on-chain data provides compelling evidence of ETH accumulation. Metrics like exchange balances, whale wallet activity, and DeFi participation paint a clear picture.

- Exchange reserves decreased by 15% in the last 8 weeks: This signifies less ETH available for immediate selling, suggesting a bullish outlook among investors.

- Number of addresses holding over 1000 ETH increased by 12%: This demonstrates a growing concentration of ETH amongst large holders (whales), who often influence market price movements.

- DeFi protocols show a surge in locked ETH: The increasing amount of ETH locked in DeFi protocols indicates strong belief in the Ethereum ecosystem and its future growth, reducing the circulating supply.

You can explore this data further on platforms like Glassnode and CoinMetrics .

Institutional Investor Activity

Institutional interest is another crucial factor driving the Ethereum price upward. Growing participation from established financial players provides stability and confidence in the market.

- Grayscale Ethereum Trust holdings have increased steadily: The ongoing purchases by Grayscale, a major player in the digital asset investment space, demonstrates institutional confidence in ETH's long-term value.

- Several reports indicate increased interest from pension funds and hedge funds: Institutional adoption signifies a broader acceptance of Ethereum as a valuable asset, contributing to price appreciation.

- This institutional involvement suggests increased price stability and potential for future growth. The entry of large, established players often brings a more measured and less volatile approach to trading, potentially stabilizing price fluctuations.

Factors Contributing to the Bullish Ethereum Price Trend

The bullish Ethereum price trend isn't solely dependent on accumulation; several other crucial factors contribute to this positive momentum.

The Ethereum Merge's Lasting Impact

The successful transition to proof-of-stake (PoS) through the Ethereum Merge has significantly impacted ETH's value proposition and continues to influence the price.

- Reduced energy consumption: The shift to PoS drastically lowered Ethereum's environmental impact, attracting environmentally conscious investors.

- Increased transaction efficiency: PoS resulted in faster and cheaper transaction processing, making Ethereum more attractive for users and developers.

- Improved scalability: Ongoing development efforts are focused on enhancing Ethereum's scalability, allowing it to handle a greater number of transactions, thus boosting its appeal and value.

Growing Ethereum Ecosystem

The expanding ecosystem built around Ethereum is a major driver of its price. The increasing number of applications built on the network significantly increases demand for ETH.

- Booming DeFi ecosystem: Decentralized finance (DeFi) applications built on Ethereum continue to flourish, attracting significant user engagement and driving ETH demand.

- Thriving NFT market: Non-fungible tokens (NFTs) built on Ethereum remain highly popular, creating a continuous demand for ETH as the transaction currency.

- Innovative dApps: A vast array of decentralized applications (dApps) are being built on Ethereum, broadening its usability and driving further ETH demand.

Increased Developer Activity & Network Upgrades

The constant improvement and upgrades to the Ethereum network showcase the dedication of its developers, building confidence and attracting investment.

- EIP-1559: This upgrade improved transaction fees and reduced inflation, making ETH more attractive.

- Sharding: This upcoming upgrade is designed to significantly improve scalability and transaction throughput, further enhancing Ethereum's capabilities.

- Continuous development: The ongoing commitment to network improvements demonstrates a long-term vision for Ethereum's success, attracting developers and investors alike.

Potential Risks and Challenges

While the current trend for the Ethereum price is bullish, several potential risks and challenges could impact its future performance.

Market Volatility & External Factors

The cryptocurrency market is inherently volatile, and external factors can significantly influence the Ethereum price.

- Macroeconomic conditions: Global economic events and regulatory changes can impact the entire crypto market, including Ethereum.

- Regulatory uncertainty: Varying regulatory approaches across different jurisdictions could create uncertainty and potentially affect ETH's price.

- Overall cryptocurrency market sentiment: General market sentiment can significantly influence the price of all cryptocurrencies, including ETH.

Competition from Other Layer-1 Blockchains

Ethereum faces competition from other Layer-1 blockchains offering alternative solutions.

- Solana, Cardano, and Avalanche: These platforms offer differing advantages and attempt to compete with Ethereum's dominance.

- Competition for developers and users: The level of competition impacts Ethereum's market share and user adoption, influencing its price.

- Technological advancements: Innovation in competing networks could challenge Ethereum's technological edge.

Ethereum Price Outlook: A Bullish Future?

In summary, the strong evidence of ETH accumulation, coupled with the positive impact of the Merge, the thriving ecosystem, and ongoing network development, strongly suggests a bullish trend for the Ethereum price. However, market volatility, regulatory uncertainty, and competition from other Layer-1 blockchains remain potential challenges. The Ethereum price remains a key indicator in the overall cryptocurrency market.

Stay updated on the latest developments affecting the Ethereum price and continue your research into this exciting asset. Understanding the factors influencing its future movements is crucial for informed investment decisions.

Featured Posts

-

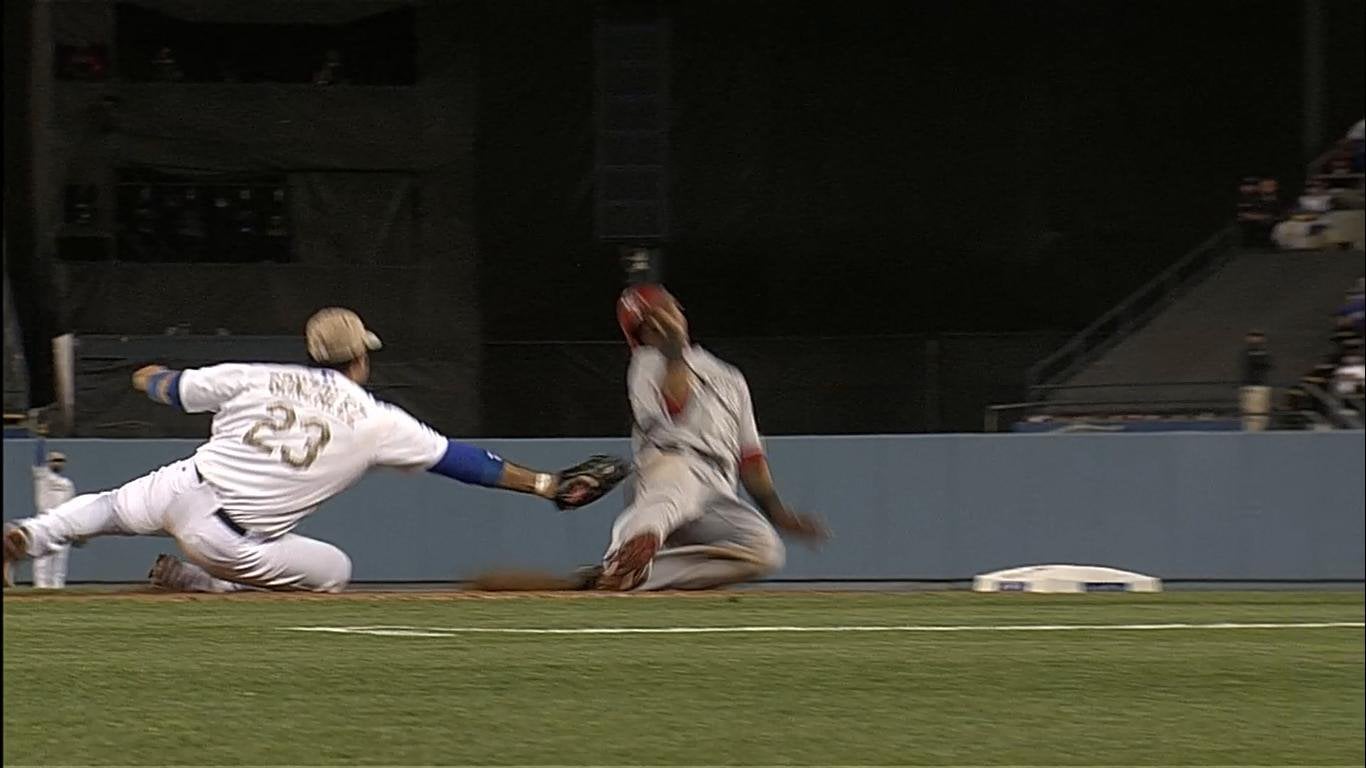

Angels Farm System Receives Scathing Review From Baseball Insiders

May 08, 2025

Angels Farm System Receives Scathing Review From Baseball Insiders

May 08, 2025 -

Xrp Ripple A High Risk High Reward Investment Opportunity

May 08, 2025

Xrp Ripple A High Risk High Reward Investment Opportunity

May 08, 2025 -

Barcelona Vs Inter Milan Six Goal Thriller In Champions League Semi Final

May 08, 2025

Barcelona Vs Inter Milan Six Goal Thriller In Champions League Semi Final

May 08, 2025 -

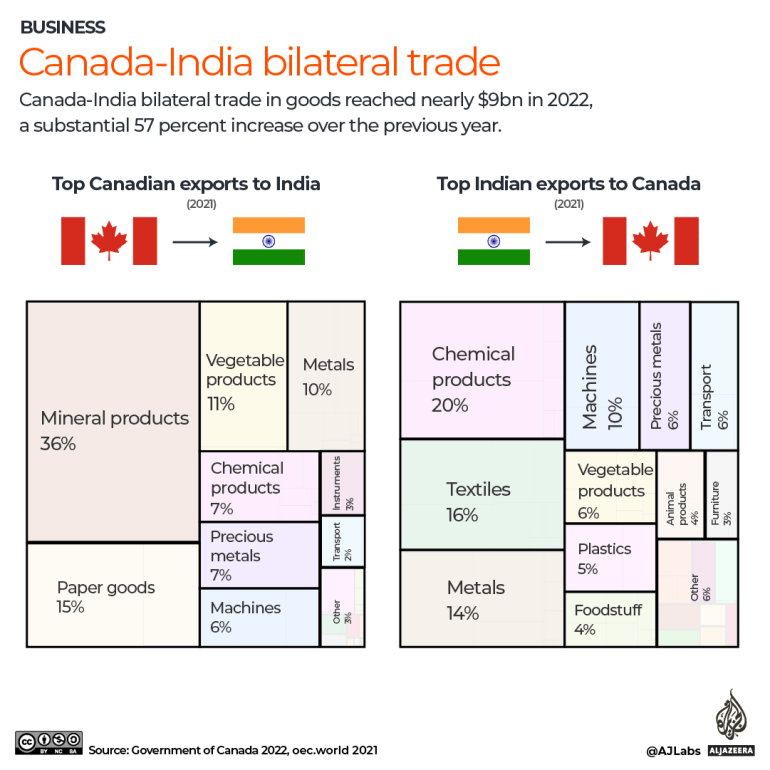

Washington And Canada A New Chapter In Trade Relations

May 08, 2025

Washington And Canada A New Chapter In Trade Relations

May 08, 2025 -

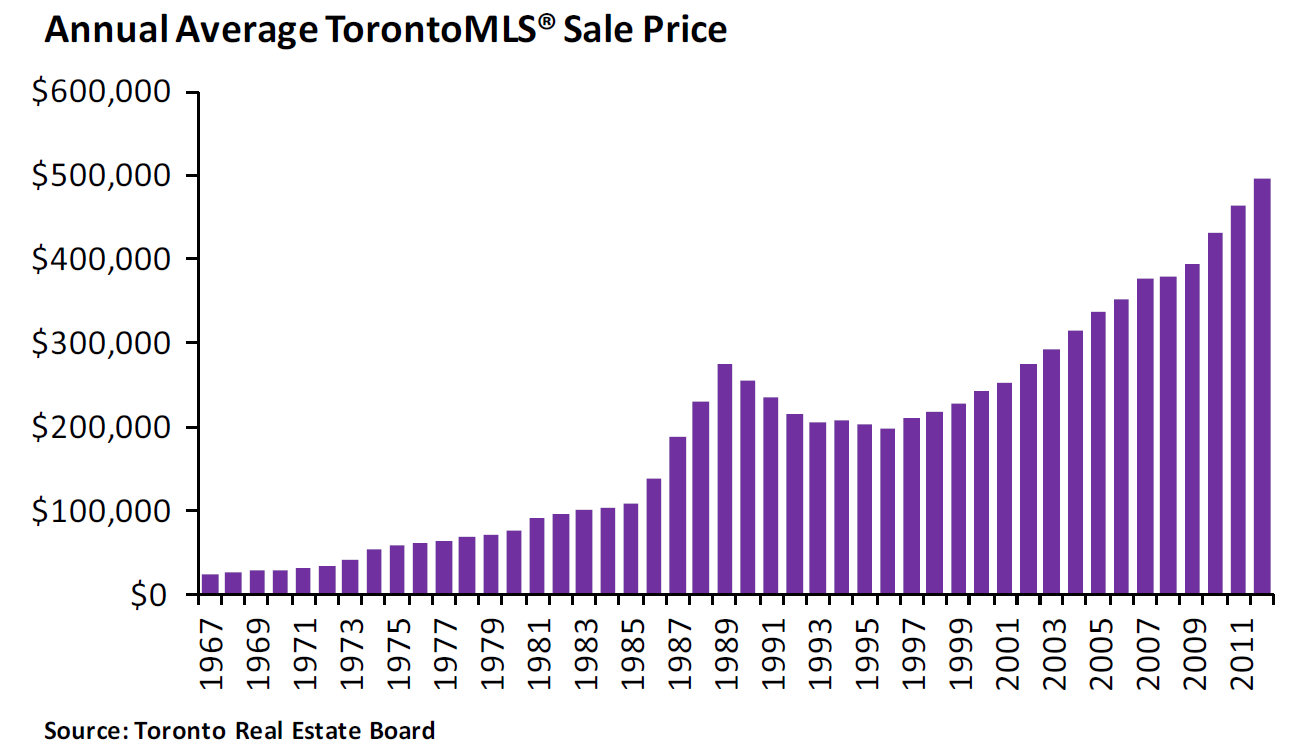

Analysis Of Torontos Housing Market 23 Sales Drop 4 Price Decrease

May 08, 2025

Analysis Of Torontos Housing Market 23 Sales Drop 4 Price Decrease

May 08, 2025

Latest Posts

-

Bitcoin Madenciligi Son Durak

May 08, 2025

Bitcoin Madenciligi Son Durak

May 08, 2025 -

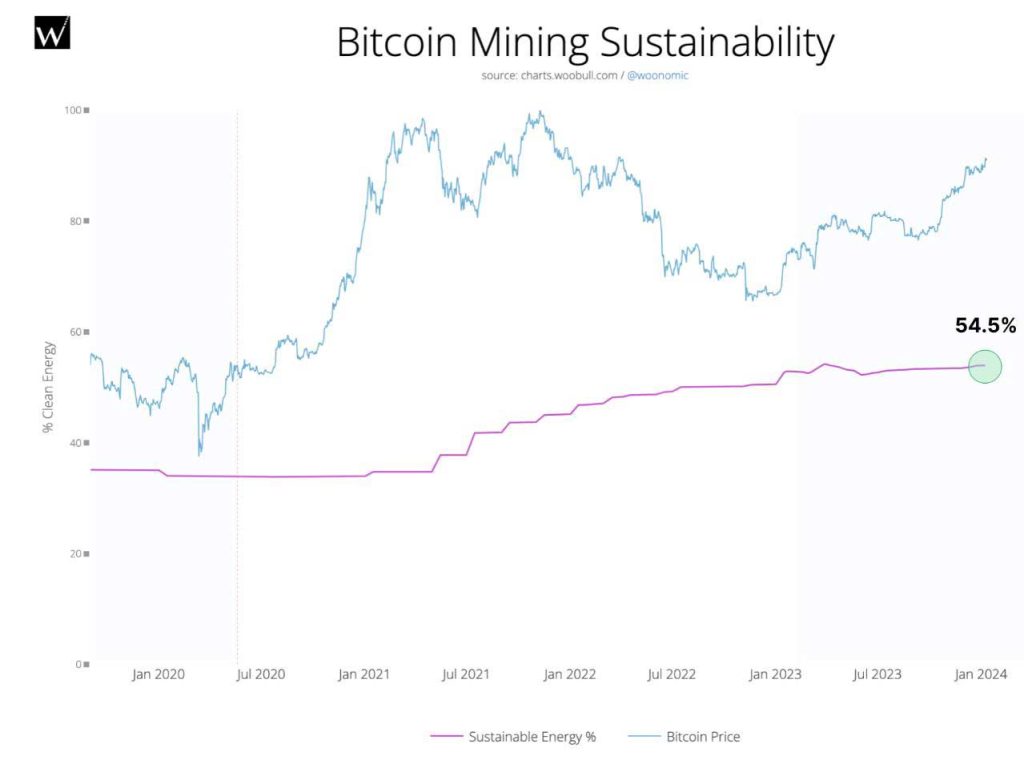

Bitcoin Mining Exploring The Reasons For The Recent Surge In Activity

May 08, 2025

Bitcoin Mining Exploring The Reasons For The Recent Surge In Activity

May 08, 2025 -

Bitcoin Madenciliginin Sonu Yaklasiyor Mu

May 08, 2025

Bitcoin Madenciliginin Sonu Yaklasiyor Mu

May 08, 2025 -

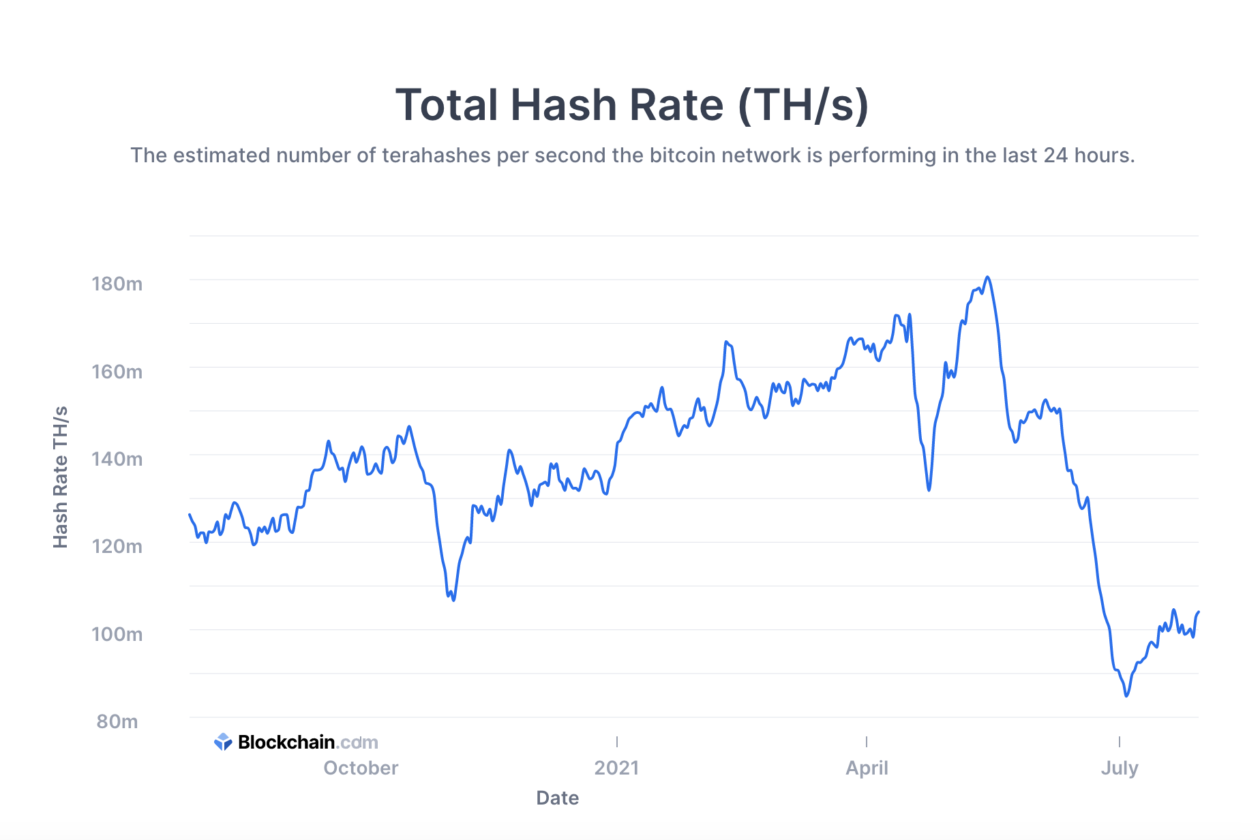

This Weeks Bitcoin Mining Increase A Deep Dive

May 08, 2025

This Weeks Bitcoin Mining Increase A Deep Dive

May 08, 2025 -

Understanding The Recent Spike In Bitcoin Mining Difficulty And Hashrate

May 08, 2025

Understanding The Recent Spike In Bitcoin Mining Difficulty And Hashrate

May 08, 2025