Evaluating Uber (UBER) As An Investment Opportunity

Table of Contents

Uber's Business Model and Market Position

Uber's core business model revolves around connecting riders with drivers through its ride-sharing platform, expanding into food delivery (Uber Eats) and freight transportation. This diversification provides multiple revenue streams and reduces reliance on any single service. Uber's market share in ride-sharing varies geographically, facing competition primarily from Lyft in the US and various regional players globally. In food delivery, it competes with giants like DoorDash and Grubhub.

- Global Reach and Market Penetration: Uber operates in numerous countries worldwide, establishing a significant global presence and brand recognition. This broad reach provides a substantial foundation for growth.

- Dominance in Key Markets: While facing competition, Uber maintains a dominant market share in ride-sharing and food delivery in several key metropolitan areas. This market leadership translates into significant pricing power and network effects.

- Competitive Advantages: Uber's brand recognition, extensive driver and customer networks (network effects), and technological advancements give it a competitive edge. Its sophisticated app and user-friendly interface are key differentiators.

- Emerging Markets and Future Expansion: Uber continues to expand into new markets, capitalizing on the growing demand for ride-sharing and food delivery services in developing economies. This presents significant long-term growth potential. The Uber business model is constantly adapting to emerging trends and technologies.

Financial Performance and Growth Prospects

Analyzing Uber's financial performance requires a careful look at its revenue, profitability, and cash flow. While revenue growth has been impressive, driven by its diverse offerings, achieving sustained profitability remains a challenge. Uber's financial statements show fluctuating profitability, impacted by high operating costs, including driver compensation and marketing expenses.

- Revenue Growth Rates and Key Revenue Drivers: Uber's revenue growth is primarily fueled by its ride-sharing and Uber Eats segments, with contributions from freight transportation. The growth rate has varied year over year, reflecting market conditions and operational adjustments.

- Profitability Margins and Path to Profitability: Improving profitability margins is a key focus for Uber. This involves strategies such as optimizing operational efficiency, adjusting pricing strategies, and managing driver compensation costs. The path to consistent profitability remains a significant factor in assessing the UBER stock price.

- Cash Flow Generation and Capital Expenditures: Uber's cash flow generation is essential for reinvestment in its business, technological innovations, and potential acquisitions. Capital expenditures are significant, reflecting investments in its technology infrastructure and expansion into new markets.

- Analyst Estimates and Future Growth Potential: Analyst projections for Uber's future growth vary, reflecting differing perspectives on its ability to overcome challenges and capitalize on market opportunities. These projections should be considered alongside your own analysis of the UBER stock price.

Risks and Challenges Facing Uber

Investing in Uber (UBER) stock involves understanding significant potential risks and challenges. These range from regulatory hurdles and intense competition to economic downturns and labor relations. A comprehensive understanding of these challenges is vital when evaluating the investment opportunity.

- Regulatory Changes: The ride-sharing and delivery industries are subject to evolving regulations globally. Changes in licensing requirements, driver classifications, and safety regulations can significantly impact Uber's operations and profitability.

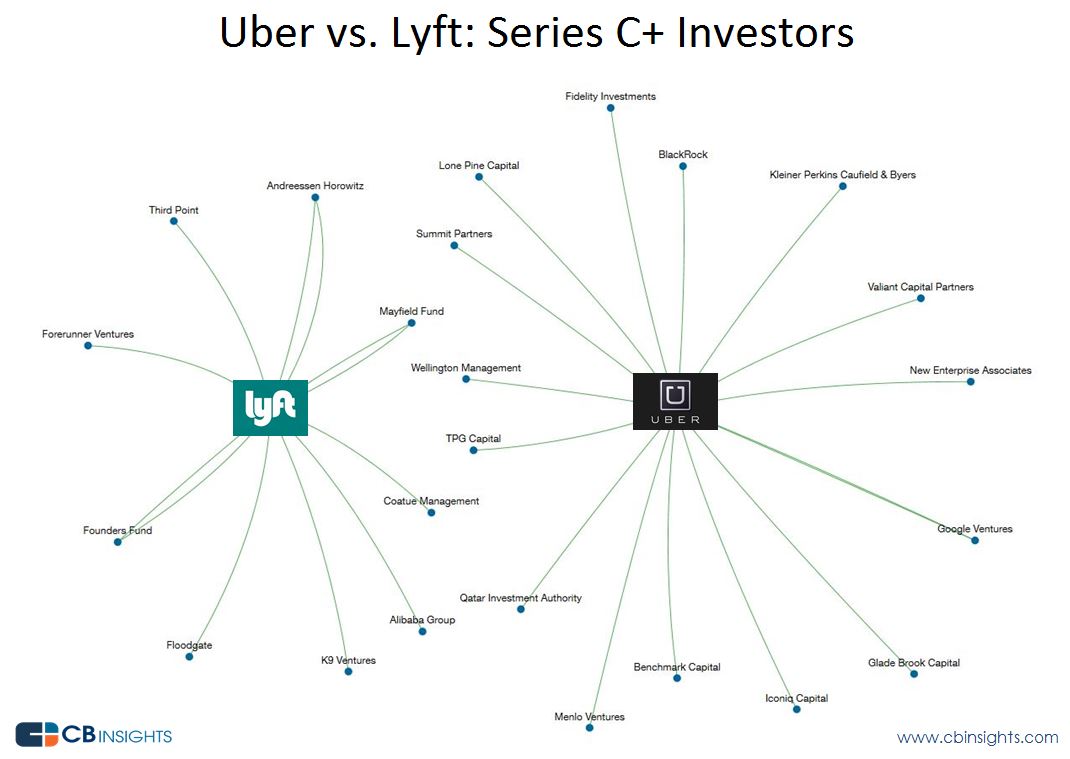

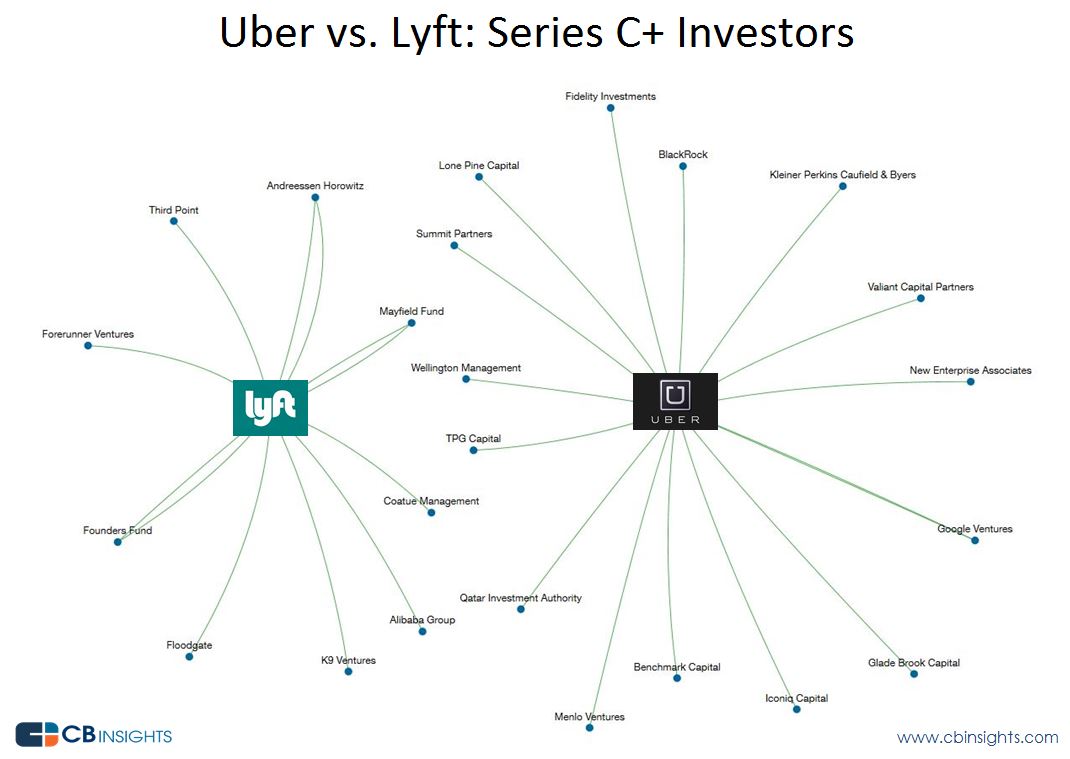

- Intense Competition and Price Wars: Uber faces fierce competition, leading to price wars that can squeeze profit margins. The competitive landscape is constantly shifting, with new entrants and technological innovations.

- Economic Downturns: Economic downturns can significantly reduce demand for ride-sharing and food delivery services, impacting Uber's revenue and profitability. This cyclical risk should be considered when assessing long-term investment potential.

- Driver Compensation and Labor Relations: Managing driver compensation and maintaining positive labor relations are crucial for Uber's operational stability. Driver-related issues can lead to protests, strikes, and negative publicity.

- Cybersecurity Threats and Data Privacy Concerns: Uber handles sensitive user and driver data, making it a potential target for cybersecurity threats. Data breaches can have significant financial and reputational consequences.

Valuation and Investment Considerations

Evaluating Uber's current stock valuation requires analyzing various metrics, such as the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and other relevant financial ratios. Comparing Uber's valuation to its peers and industry benchmarks provides valuable context. Remember that the UBER stock price is a reflection of market sentiment and future expectations.

- Current Stock Price and Market Capitalization: The current market capitalization and stock price reflect investor sentiment regarding Uber's future prospects. Understanding the factors driving the UBER stock price is critical for effective investment decisions.

- Key Valuation Metrics and Their Implications: Different valuation metrics provide insights into different aspects of Uber's performance and financial health. A holistic approach is needed for a complete picture.

- Comparison to Competitors' Valuations: Comparing Uber's valuation to that of its competitors provides valuable insights into its relative attractiveness as an investment. This comparative analysis helps assess the Uber stock price in relation to industry standards.

- Discounted Cash Flow Analysis (Optional): A discounted cash flow (DCF) analysis can provide an estimate of Uber's intrinsic value based on its projected future cash flows. This sophisticated method requires significant assumptions and should be used alongside other valuation metrics.

Conclusion

Investing in Uber (UBER) presents both exciting opportunities and significant challenges. Its diversified business model, global reach, and technological leadership offer substantial growth potential. However, intense competition, regulatory risks, and the need for sustained profitability are crucial considerations. While the analysis presented here provides a framework for understanding Uber as an investment opportunity, it's not a substitute for thorough due diligence. The UBER stock price is subject to market fluctuations and unforeseen events.

While investing in Uber (UBER) presents both opportunities and challenges, a thorough understanding of its business model, financial performance, and market position is crucial before making an investment decision. Conduct thorough due diligence and consult with a financial advisor before investing in UBER stock or any other stock.

Featured Posts

-

Dwp Reforms What Universal Credit Claimants Need To Know

May 08, 2025

Dwp Reforms What Universal Credit Claimants Need To Know

May 08, 2025 -

Dwp To Axe Two Benefits Final Payments Incoming

May 08, 2025

Dwp To Axe Two Benefits Final Payments Incoming

May 08, 2025 -

Billions In Bitcoin And Ethereum Options Expire Market Volatility Ahead

May 08, 2025

Billions In Bitcoin And Ethereum Options Expire Market Volatility Ahead

May 08, 2025 -

0 4

May 08, 2025

0 4

May 08, 2025 -

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025

Latest Posts

-

Trade War Fallout Identifying Cryptocurrencies With Resilience

May 09, 2025

Trade War Fallout Identifying Cryptocurrencies With Resilience

May 09, 2025 -

Could This Cryptocurrency Thrive Despite The Trade War

May 09, 2025

Could This Cryptocurrency Thrive Despite The Trade War

May 09, 2025 -

Understanding The Bitcoin Rebound A Guide For Investors

May 09, 2025

Understanding The Bitcoin Rebound A Guide For Investors

May 09, 2025 -

Recent Bitcoin Rebound Signs Of A Market Recovery

May 09, 2025

Recent Bitcoin Rebound Signs Of A Market Recovery

May 09, 2025 -

Bitcoin Madenciliginin Gelecegi Son Mu

May 09, 2025

Bitcoin Madenciliginin Gelecegi Son Mu

May 09, 2025