Billions In Bitcoin And Ethereum Options Expire: Market Volatility Ahead

Table of Contents

Understanding the Significance of Options Expiry

Options contracts are derivatives that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset (in this case, Bitcoin or Ethereum) at a specific price (strike price) on or before a certain date (expiration date). The sheer volume of options expiring on [Date of expiry] – representing billions of dollars in open interest – makes this event particularly significant for the cryptocurrency market.

-

Open Interest: Open interest refers to the total number of outstanding options contracts that haven't been exercised or expired. High open interest indicates a significant amount of potential buying or selling pressure that could be unleashed upon expiry, leading to amplified price volatility.

-

Call vs. Put Distribution: The ratio of call options (bets on price increases) to put options (bets on price decreases) provides valuable insight into market sentiment. A heavy concentration of calls suggests bullish expectations, while a preponderance of puts indicates bearish sentiment. This imbalance can significantly influence price direction after expiry.

-

Gamma Squeeze: A gamma squeeze occurs when a large number of options contracts near their strike price trigger a feedback loop. Market makers, to hedge their positions, are forced to buy or sell the underlying asset, further exacerbating price movements in the same direction, potentially leading to sharp and rapid price changes. This effect is amplified during periods of high open interest.

Factors Contributing to Market Volatility

Several factors beyond the options expiry itself contribute to the anticipated market volatility.

-

Macroeconomic Factors: Global macroeconomic conditions, including inflation rates, interest rate hikes by central banks, and overall economic uncertainty, significantly influence investor sentiment and risk appetite, impacting the price of cryptocurrencies.

-

Regulatory News: Regulatory announcements and actions regarding cryptocurrencies, both positive and negative, can significantly sway market sentiment and trigger price fluctuations. Uncertainty surrounding regulatory frameworks contributes to volatility.

-

Significant News Events:

- Bullet Point 1: [Mention any significant Bitcoin or Ethereum-related news events leading up to the expiry, such as major partnerships, technological upgrades, or regulatory developments. Be specific and link to credible sources.]

- Bullet Point 2: The activities of large institutional investors ("whales") and their trading strategies can heavily influence short-term price movements. Their buying or selling decisions can create significant ripples in the market.

- Bullet Point 3: Social media sentiment and the spread of FUD (Fear, Uncertainty, and Doubt) can dramatically affect market psychology, potentially leading to panic selling or buying frenzies.

Potential Price Movements and Trading Strategies

Predicting the exact price movements following the options expiry is impossible. However, several scenarios are plausible.

-

Scenario Analysis: [Discuss potential scenarios, e.g., a sharp price increase if bullish sentiment prevails and calls outnumber puts, or a significant drop if bearish sentiment dominates. Base this on analysis of historical data on previous options expiry events and current market conditions.]

-

Historical Data: Analyzing historical data from previous options expiry events can provide valuable insights into potential price patterns. However, it's crucial to remember that past performance is not indicative of future results.

-

Trading Strategies:

- Bullet Point 1: Employing robust risk management techniques, such as setting stop-loss orders to limit potential losses, is crucial during periods of high volatility.

- Bullet Point 2: Consider hedging strategies to mitigate potential losses or scalping strategies (short-term trades) to profit from short-term price fluctuations. However, these strategies require significant experience and understanding of market dynamics.

- Bullet Point 3: Stay updated with real-time market data and analysis from reliable sources such as reputable crypto news websites and trading platforms.

Protecting Your Crypto Investments During Volatility

Preserving your investments during times of market uncertainty requires a proactive approach.

-

Diversification: Diversifying your crypto portfolio across different assets reduces your overall risk. Don't put all your eggs in one basket.

-

Risk Mitigation: Strategies like dollar-cost averaging (investing a fixed amount at regular intervals) and setting stop-loss orders help mitigate risk.

-

Stablecoins: Utilizing stablecoins, which maintain a stable value pegged to a fiat currency like the US dollar, can help preserve capital during volatile periods.

-

Due Diligence: Thorough research and due diligence are paramount before making any investment decisions. Avoid impulsive actions based on hype or FUD.

-

Invest Responsibly: Never invest more money than you can afford to lose. Crypto investments are inherently risky.

Conclusion

The impending expiry of billions of dollars in Bitcoin and Ethereum options presents a significant event for the cryptocurrency market, potentially triggering substantial volatility. Understanding the mechanics of options expiry, along with the influence of macroeconomic factors, regulatory news, and market sentiment, is crucial for navigating this period. By employing effective risk management strategies, diversifying your portfolio, and staying informed, you can better protect your investments and potentially capitalize on opportunities.

Call to Action: Stay informed about the impending Bitcoin and Ethereum options expiry. Monitor market movements closely and utilize appropriate risk management strategies to navigate this period of anticipated volatility. Learn more about Bitcoin options trading and Ethereum options trading to make informed investment decisions. Don't miss out on crucial updates regarding this significant event in the cryptocurrency market. Stay vigilant and prepare for potential market swings around the Bitcoin and Ethereum options expiry.

Featured Posts

-

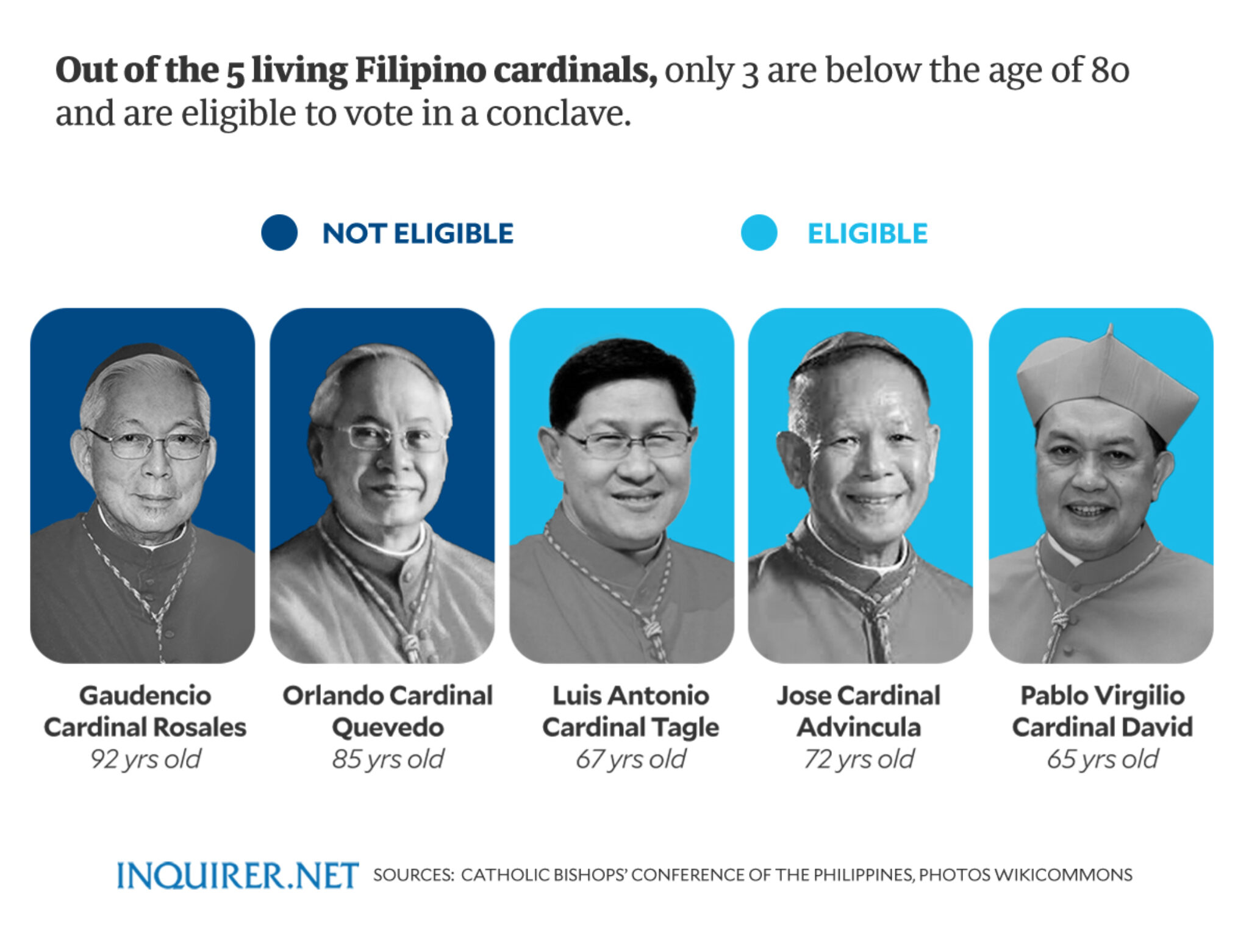

Conclave 2023 The Process Of Selecting A New Pope

May 08, 2025

Conclave 2023 The Process Of Selecting A New Pope

May 08, 2025 -

Bitcoin Trading On Binance Buying Volume Exceeds Selling For First Time In Half A Year

May 08, 2025

Bitcoin Trading On Binance Buying Volume Exceeds Selling For First Time In Half A Year

May 08, 2025 -

Did Saturday Night Live Make Counting Crows Famous

May 08, 2025

Did Saturday Night Live Make Counting Crows Famous

May 08, 2025 -

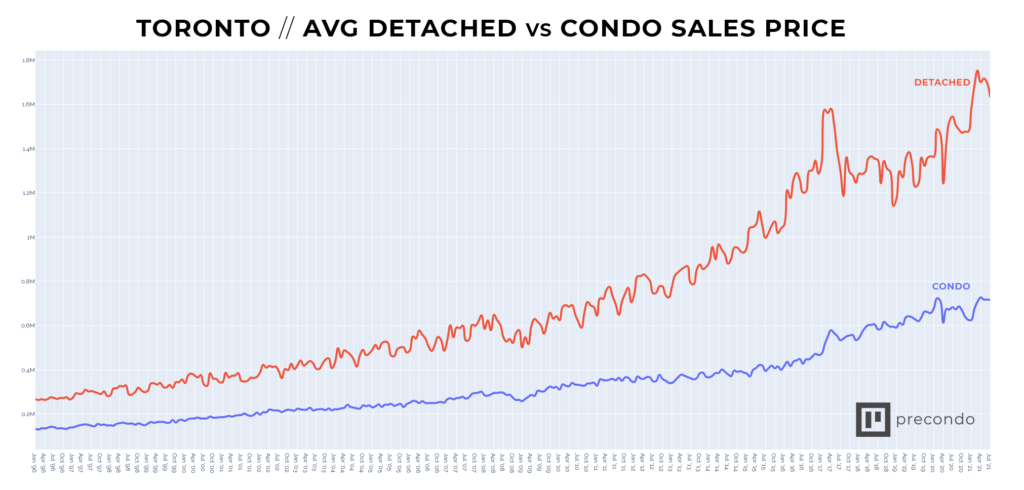

Toronto Home Sales And Prices A 23 And 4 Decline Respectively

May 08, 2025

Toronto Home Sales And Prices A 23 And 4 Decline Respectively

May 08, 2025 -

From Skimpy To Strong Examining The Evolution Of Rogues X Men Costume

May 08, 2025

From Skimpy To Strong Examining The Evolution Of Rogues X Men Costume

May 08, 2025

Latest Posts

-

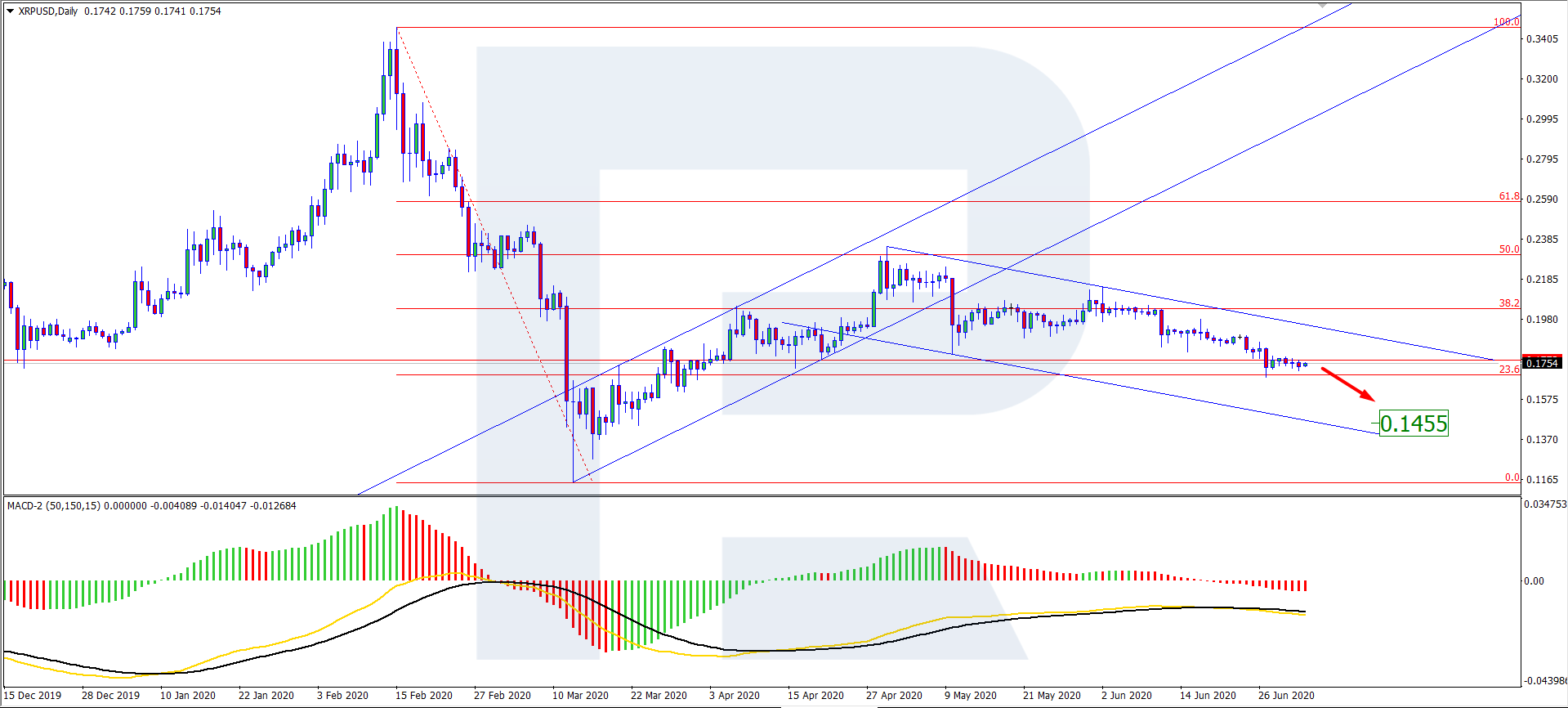

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025 -

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025 -

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025 -

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025 -

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025