Market Volatility Expected As Billions In Bitcoin And Ethereum Options Expire

Table of Contents

Understanding Bitcoin and Ethereum Options Expirations

What are Options Contracts?

Options contracts are financial derivatives that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset (in this case, Bitcoin or Ethereum) at a predetermined price (strike price) on or before a specific date (expiration date).

- Call Option: Grants the right to buy the asset at the strike price. Investors buy calls when they anticipate a price increase.

- Put Option: Grants the right to sell the asset at the strike price. Investors buy puts when they anticipate a price decrease.

The strike price and expiration date are crucial elements defining the option's value. Options contracts provide leverage, allowing investors to potentially profit from large price swings with a smaller initial investment. However, this leverage also amplifies potential losses.

The Scale of the Upcoming Expirations

Billions of dollars in Bitcoin and Ethereum options are set to expire in [Insert Specific Dates Here]. These expirations occur across major exchanges, including [List Major Exchanges]. The sheer size of the open interest—the total number of outstanding options contracts—indicates significant potential for market movement. A high open interest suggests a large number of contracts needing to be settled, potentially leading to considerable buying or selling pressure, significantly impacting Bitcoin options open interest and Ethereum options open interest.

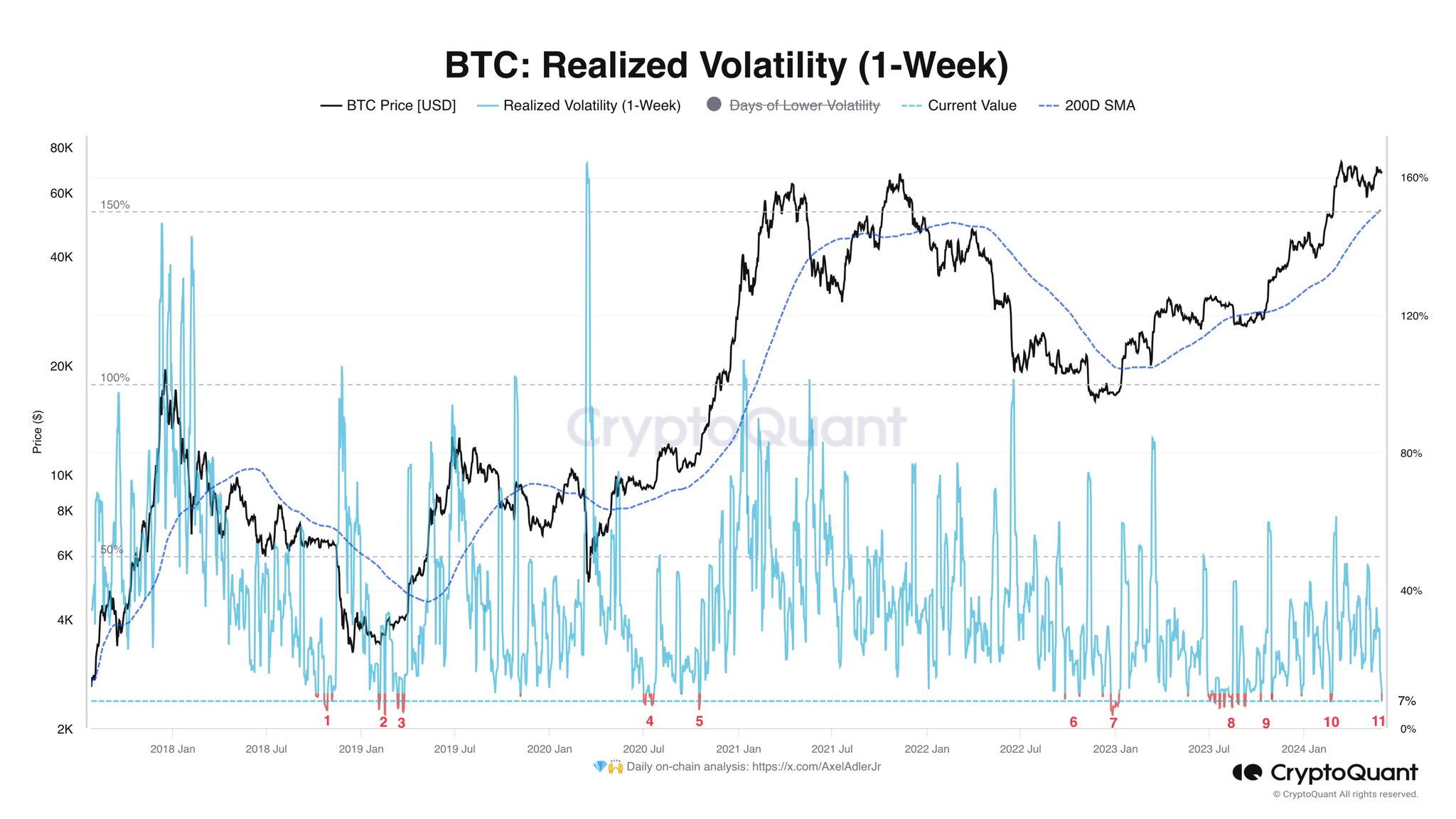

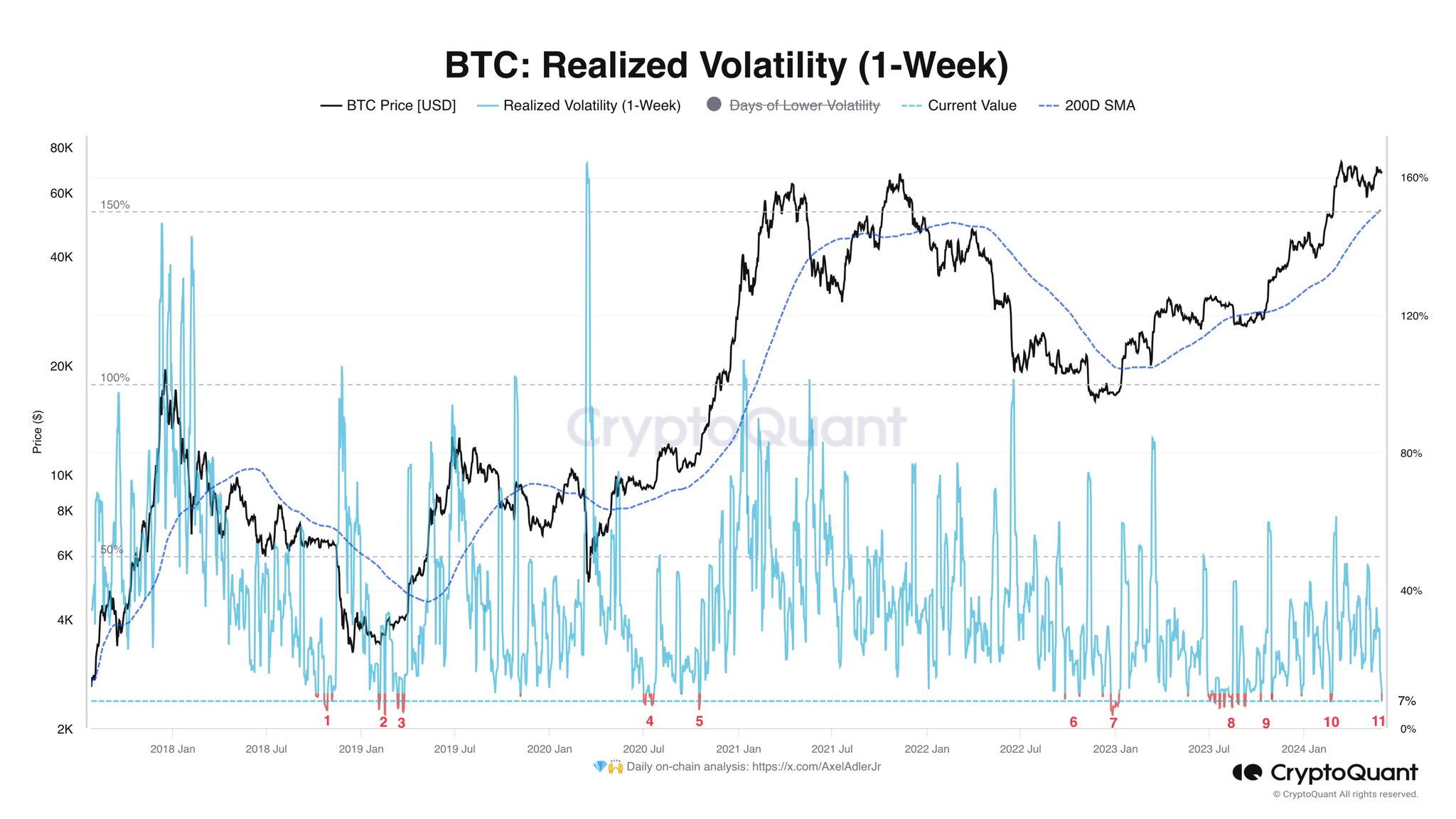

Historical Precedents

Analyzing past Bitcoin options expiration and Ethereum options expiration events reveals a correlation between expiry dates and price volatility. While not always directly causal, several previous expirations have resulted in notable price swings in both Bitcoin and Ethereum. [Insert specific examples of past expirations and their effects, citing sources]. Studying these historical precedents, including analysis of Bitcoin options open interest and Ethereum options open interest leading up to the expirations, can provide valuable insights, though past performance does not guarantee future results. Keywords: Bitcoin options open interest, Ethereum options open interest, crypto options trading, crypto derivatives.

Factors Contributing to Potential Volatility

Market Sentiment and Investor Behavior

Market sentiment leading up to the expiration is a crucial factor. A predominantly bullish sentiment could lead to increased buying pressure, while bearish sentiment might trigger significant selling. The actions of both institutional and retail investors will play a significant role. News events, macroeconomic factors (such as inflation rates or regulatory announcements), and overall market trends will further influence investor behavior and consequently, price movements.

The Role of Whales and Large Holders

Large holders of Bitcoin and Ethereum ("whales") possess the financial clout to significantly influence market prices. Their actions, whether they are buying, selling, or simply holding their assets, can create substantial price movements. These whales may strategically utilize options contracts to manage their risk or potentially manipulate the market for their profit, emphasizing the need for careful observation and analysis of large-scale transactions.

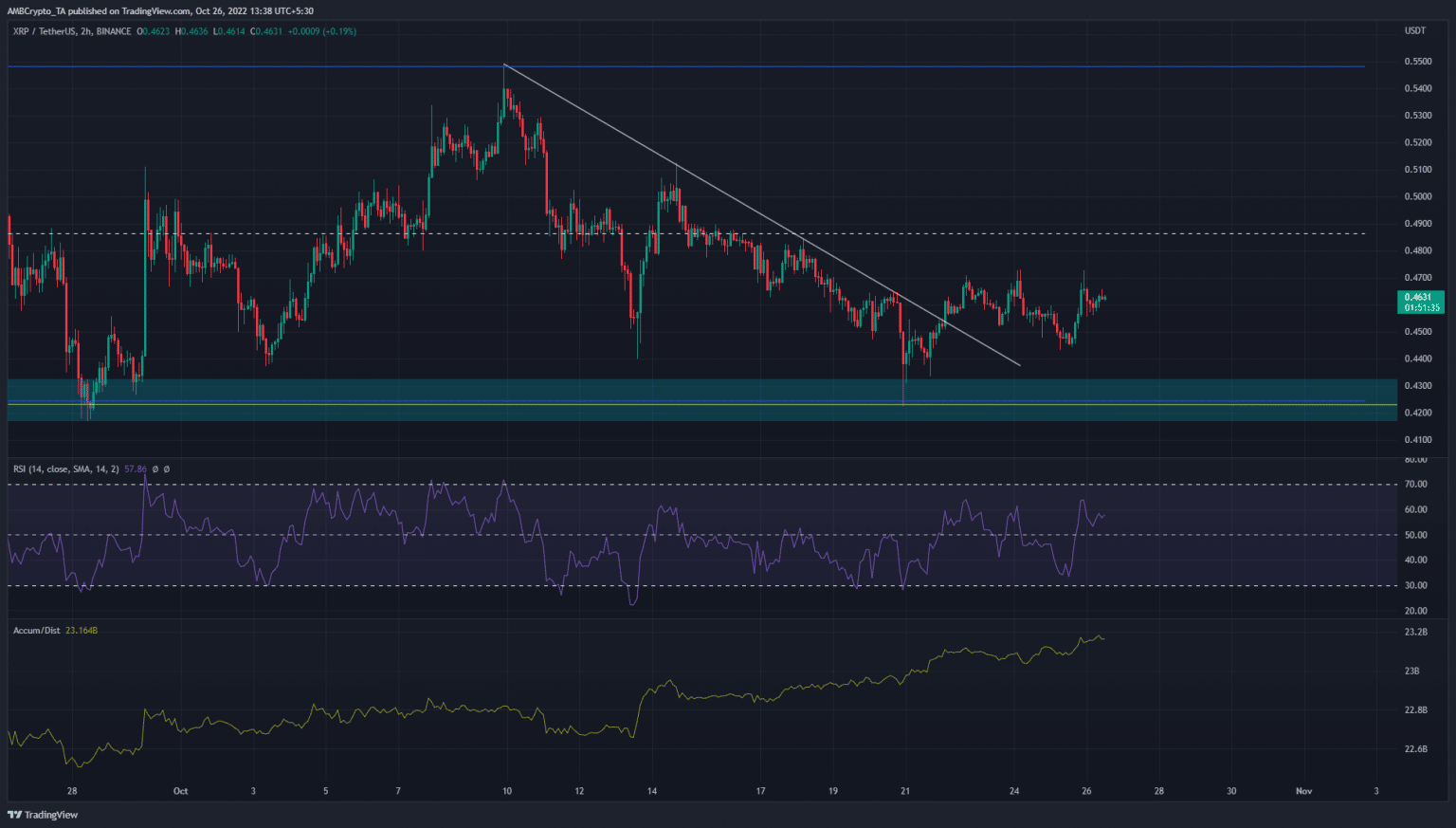

Technical Analysis and Chart Patterns

Technical analysis provides a valuable framework for predicting potential price movements during the options expiration. Analyzing support and resistance levels, chart patterns (such as head and shoulders or double tops/bottoms), and various technical indicators (like RSI or MACD) can offer clues regarding the potential direction of Bitcoin and Ethereum prices. Keywords: Bitcoin technical analysis, Ethereum technical analysis, support and resistance levels, chart patterns.

Strategies for Navigating the Volatility

Risk Management Techniques

Navigating the volatility requires a robust risk management strategy. This includes:

- Diversification: Spreading investments across different assets minimizes the impact of potential losses in Bitcoin or Ethereum.

- Position Sizing: Investing only a portion of your portfolio in cryptocurrencies reduces the risk of significant losses.

- Stop-Loss Orders: Setting stop-loss orders automatically sells your assets when they reach a predetermined price, limiting potential losses.

Opportunities for Traders

Increased volatility also presents opportunities for skilled traders. Strategies like arbitrage (exploiting price differences across exchanges) can be profitable in volatile markets. However, it's crucial to remember that successful trading requires in-depth analysis, careful risk assessment, and a strong understanding of market dynamics.

Staying Informed

Staying updated on market news and analysis is crucial. Follow reputable news sources, financial analysts, and key influencers in the crypto space. This information helps in making well-informed decisions and adapting your strategies to the evolving market conditions. Keywords: Bitcoin trading strategies, Ethereum trading strategies, crypto risk management.

Conclusion: Preparing for Bitcoin and Ethereum Options Expiration Volatility

The upcoming Bitcoin and Ethereum options expiration presents a significant event with the potential for substantial market volatility. Understanding the factors influencing price movements, employing sound risk management techniques, and staying informed are crucial for navigating this period. Both risks and opportunities exist, requiring careful analysis and informed decision-making. Stay informed about the upcoming Bitcoin and Ethereum options expiration and prepare for potential market volatility. Conduct your own research and consider consulting with a financial advisor before making any investment decisions. [Insert links to reputable exchanges or analytical websites].

Featured Posts

-

Toronto Housing Market Report 23 Sales Decline 4 Price Reduction

May 08, 2025

Toronto Housing Market Report 23 Sales Decline 4 Price Reduction

May 08, 2025 -

Major Vehicle Theft Case Solved Shreveport Police Arrest Suspects

May 08, 2025

Major Vehicle Theft Case Solved Shreveport Police Arrest Suspects

May 08, 2025 -

Andor Season 2 A Rogue One Star Reveals How It Will Rewrite Star Wars History

May 08, 2025

Andor Season 2 A Rogue One Star Reveals How It Will Rewrite Star Wars History

May 08, 2025 -

Barcelona And Inter Milans Champions League Semi Final A Classic Six Goal Encounter

May 08, 2025

Barcelona And Inter Milans Champions League Semi Final A Classic Six Goal Encounter

May 08, 2025 -

Should You Buy Xrp After Its 400 Increase A Comprehensive Guide

May 08, 2025

Should You Buy Xrp After Its 400 Increase A Comprehensive Guide

May 08, 2025

Latest Posts

-

Xrp Trading Volume Outpaces Solana Amidst Etf Speculation

May 08, 2025

Xrp Trading Volume Outpaces Solana Amidst Etf Speculation

May 08, 2025 -

Xrp Etf In Brazil Ripple News And Trumps Social Media Activity

May 08, 2025

Xrp Etf In Brazil Ripple News And Trumps Social Media Activity

May 08, 2025 -

Pro Shares Launches Xrp Etfs This Week Impact On Xrp Price

May 08, 2025

Pro Shares Launches Xrp Etfs This Week Impact On Xrp Price

May 08, 2025 -

Xrp Price Up 400 Predicting Future Growth Potential

May 08, 2025

Xrp Price Up 400 Predicting Future Growth Potential

May 08, 2025 -

Pro Shares Announces Xrp Etfs No Spot Market But Price Jumps

May 08, 2025

Pro Shares Announces Xrp Etfs No Spot Market But Price Jumps

May 08, 2025