Microsoft-Activision Deal: FTC's Appeal And What It Means

Table of Contents

The FTC's Arguments Against the Microsoft-Activision Deal

The FTC lawsuit against the Microsoft-Activision merger centers on antitrust concerns and the potential for competitive harm. The core argument revolves around Microsoft's potential to leverage its market power, particularly after acquiring Activision Blizzard, to stifle competition and harm consumers. This fear is largely driven by the immensely popular Call of Duty franchise.

-

Concerns about Call of Duty Exclusivity: The FTC's primary concern is that Microsoft could make Call of Duty exclusive to Xbox consoles and its Game Pass subscription service. This would significantly harm PlayStation players, who currently enjoy the game on their platform. This action would severely reduce competition and choice for gamers.

-

Market Dominance and Stifling Competition: The FTC alleges that Microsoft’s acquisition would consolidate market power in several sectors of the gaming industry. The merger could give Microsoft an unfair advantage in console gaming, PC gaming, and the burgeoning cloud gaming market. This dominance could lead to higher prices, reduced innovation, and a less diverse range of games for consumers.

-

Cloud Gaming Market Concerns: The FTC is particularly concerned about Microsoft’s potential to leverage its position in the cloud gaming market after the acquisition. This concern stems from the belief that Microsoft could use its increased market share to disadvantage competitors and limit consumer choice in this rapidly expanding sector of the gaming industry.

The Judge's Initial Ruling and the FTC's Appeal

A judge initially dismissed the FTC's lawsuit, ruling in favor of Microsoft. This initial victory for Microsoft seemed to pave the way for the deal's completion. However, the FTC swiftly filed an appeal, arguing that the judge’s decision overlooked crucial evidence and misapplied relevant antitrust laws. This appeal signifies a significant escalation in the legal battle.

-

The Judge's Reasoning: The judge’s dismissal was based on the argument that the FTC failed to prove that the merger would likely lead to substantial competitive harm. The judge seemingly believed that Microsoft's commitment to keep Call of Duty on PlayStation alleviated the antitrust concerns.

-

The FTC's Grounds for Appeal: The FTC's appeal focuses on several points. They argue that the judge incorrectly assessed the evidence regarding the potential for Microsoft to harm competition in the gaming industry. The appeal also challenges the legal interpretations used by the judge in dismissing the lawsuit, highlighting the potential for long-term harm to the competitive gaming landscape.

-

Timeline and Implications: The appeal process is expected to be lengthy and complex, potentially delaying or even preventing the completion of the Microsoft-Activision deal. The outcome could set important precedents for future mergers and acquisitions in the technology and entertainment industries.

The Impact on Game Developers and Publishers

The Microsoft-Activision merger has substantial implications for game developers and publishers, both large and small. The increased market consolidation could lead to a less competitive landscape.

-

Increased Licensing Fees and Reduced Competition: The combined power of Microsoft and Activision Blizzard could result in higher licensing fees for game developers, making it more challenging for smaller studios to compete. This may force many independent developers out of business.

-

Impact on Independent Game Studios: The acquisition creates a clear imbalance in the power dynamics within the gaming industry. Independent studios already facing challenges will find competition even more difficult in the event of the merger's success.

-

Long-Term Effects on Innovation: The potential for reduced competition could stifle innovation in the gaming space, with less diverse gaming experiences likely to result from this large-scale merger.

The Implications for Gamers and Consumers

The outcome of the Microsoft-Activision deal will directly impact gamers and consumers. While Microsoft has committed to keeping Call of Duty on PlayStation, concerns remain regarding other potential repercussions.

-

Potential Price Increases: The increased market power resulting from the merger could potentially lead to higher prices for games or subscription services like Xbox Game Pass. This cost increase would disproportionately impact budget-conscious gamers.

-

Game Availability Across Platforms: The accessibility of various games across different platforms, particularly PlayStation and Xbox, may be compromised by the merger depending on the outcome of the FTC's case and Microsoft's subsequent actions. This could force gamers to choose a specific console based on game availability.

-

Changes to the Overall Gaming Experience: The long-term effects of this merger on the gaming experience are still largely unknown. It may lead to changes in the type of games being developed, as well as the overall accessibility and pricing for consumers.

Conclusion

The FTC's appeal of the Microsoft-Activision deal represents a significant hurdle for the merger and highlights the complexities of antitrust law in the rapidly evolving gaming industry. The outcome will have far-reaching consequences for both gamers and the industry as a whole. The potential for decreased competition, higher prices, and reduced innovation are real concerns that warrant close attention. The Microsoft-Activision deal's impact will likely reshape the gaming industry for years to come.

Call to Action: Stay informed about the ongoing legal battles surrounding the Microsoft-Activision deal. Follow the latest developments and understand how this significant merger could shape the future of the gaming industry. Further research into the implications of the Microsoft-Activision deal will be crucial in understanding its impact.

Featured Posts

-

Chat Gpt Developer Open Ai Faces Ftc Investigation

Apr 28, 2025

Chat Gpt Developer Open Ai Faces Ftc Investigation

Apr 28, 2025 -

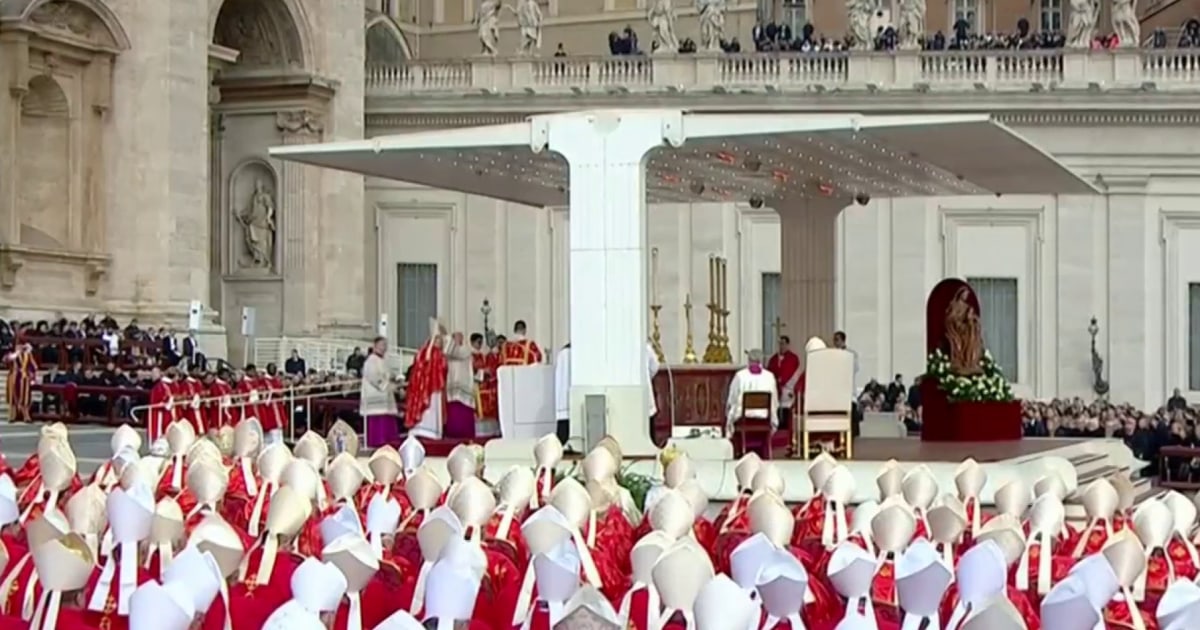

Heads Of State Honor Pope Francis At Solemn Funeral Service

Apr 28, 2025

Heads Of State Honor Pope Francis At Solemn Funeral Service

Apr 28, 2025 -

Market Downturn A Case Study Of Professional Selling And Individual Purchasing

Apr 28, 2025

Market Downturn A Case Study Of Professional Selling And Individual Purchasing

Apr 28, 2025 -

Nintendos Action Ryujinx Switch Emulator Development Ends

Apr 28, 2025

Nintendos Action Ryujinx Switch Emulator Development Ends

Apr 28, 2025 -

Contempt Of Parliament Yukon Politicians Confront Mine Manager

Apr 28, 2025

Contempt Of Parliament Yukon Politicians Confront Mine Manager

Apr 28, 2025

Latest Posts

-

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025 -

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025 -

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025 -

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025 -

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025