Navigate The Private Credit Boom: 5 Do's & Don'ts For Job Seekers

Table of Contents

Do's for Securing a Private Credit Job

1. Network Strategically

Building a strong network is paramount in the private credit industry. It's not just about who you know, but the quality of those relationships.

- Build relationships with professionals in private credit firms: Attend industry events, connect on LinkedIn, and seek informational interviews. Don't be afraid to reach out to people you admire; many professionals are happy to share their experiences.

- Attend industry conferences and events: SuperReturn, Private Debt Investor events, and smaller, niche conferences are excellent places to meet potential employers and learn about the latest trends in private credit. Actively participate in discussions and workshops.

- Leverage LinkedIn to connect with recruiters and hiring managers: Optimize your profile to highlight your relevant skills and experience. Engage with content related to private credit and participate in relevant groups.

- Join relevant professional organizations: The CFA Institute and the Alternative Credit Council are valuable resources for networking and professional development. These organizations often host events and provide access to industry leaders.

- Don't underestimate the power of informational interviews: These informal conversations can provide valuable insights into the industry and help you build relationships with potential mentors and future employers.

2. Highlight Relevant Skills

Your resume and cover letter must clearly demonstrate your qualifications for private credit jobs. Generic applications won't cut it in this competitive market.

- Emphasize financial modeling and analysis skills: Showcase your proficiency in Excel, financial modeling software, and data analysis techniques. Private credit roles require strong analytical abilities.

- Showcase experience in credit underwriting, portfolio management, or due diligence: Quantify your achievements whenever possible. For example, instead of saying "managed a portfolio," say "managed a $50 million portfolio, resulting in a 15% increase in ROI."

- Demonstrate strong understanding of financial statements and credit metrics: Highlight your understanding of leverage ratios, debt service coverage ratios, and other key metrics used in credit analysis.

- Tailor your resume and cover letter to each specific job description: Generic applications rarely succeed. Carefully review each job posting and highlight the skills and experience most relevant to the specific role.

- Quantify your achievements whenever possible to demonstrate impact: Use numbers and data to showcase your contributions in previous roles. This demonstrates your ability to deliver results.

3. Master the Interview Process

The interview process for private credit jobs is rigorous. Preparation is key to success.

- Research the firm's investment strategy and recent deals: Demonstrating knowledge of the firm's activities shows genuine interest and initiative.

- Prepare for behavioral questions, technical questions, and case studies: Practice your responses to common interview questions and prepare for in-depth discussions of your experience.

- Practice your responses to common interview questions: Prepare answers to questions like "Tell me about yourself," "Why private credit?", and "What are your salary expectations?".

- Ask insightful questions to demonstrate your interest and knowledge: Asking thoughtful questions demonstrates your engagement and understanding of the industry.

- Follow up with a thank-you note after each interview: This reinforces your interest and professionalism.

Don'ts for Private Credit Job Seekers

1. Ignore Networking Opportunities

Networking is crucial for securing a private credit job. Don't underestimate its power.

- Don't underestimate the importance of networking: Active networking is far more effective than simply applying online.

- Don't rely solely on online applications: While online applications are important, they should complement a proactive networking strategy.

- Don't be afraid to reach out to people in your network for advice and introductions: Many professionals are willing to help those starting their careers.

- Don't neglect your online presence: Maintain a professional and up-to-date LinkedIn profile that showcases your skills and experience.

2. Undersell Your Experience

Present yourself confidently and accurately.

- Don't downplay your accomplishments or skills: Highlight your strengths and contributions effectively.

- Don't be afraid to highlight your unique strengths and experiences: What sets you apart from other candidates?

- Don't present yourself as less qualified than you are: Be confident in your abilities.

- Don't overlook transferable skills from other industries: Many skills are transferable from other finance roles or even non-finance fields.

3. Neglect Due Diligence

Thorough research is essential.

- Don't apply for jobs without researching the company and the role: Understand the firm's investment strategy, culture, and values.

- Don't rush the application process: Take your time to prepare a compelling application.

- Don't underestimate the importance of understanding the private credit landscape: Stay informed about industry trends and news.

- Don't skip researching salary expectations and benefits: Know your worth and what to expect from potential employers.

Conclusion

The private credit job market offers tremendous opportunities for skilled professionals, but success requires a strategic approach. By following these do's and don'ts – focusing on strategic networking, highlighting relevant skills, and mastering the interview process – you can significantly increase your chances of landing your dream private credit job. Don't delay – start your journey to securing a rewarding career in the booming world of private credit jobs today!

Featured Posts

-

Individual Investors Response To Market Volatility A Deeper Look

Apr 28, 2025

Individual Investors Response To Market Volatility A Deeper Look

Apr 28, 2025 -

Senior Hamas Officials Hold Ceasefire Talks In Egypt Following Trump Statement

Apr 28, 2025

Senior Hamas Officials Hold Ceasefire Talks In Egypt Following Trump Statement

Apr 28, 2025 -

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Development

Apr 28, 2025

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Development

Apr 28, 2025 -

16 Million Fine For T Mobile Details Of Three Years Of Data Security Issues

Apr 28, 2025

16 Million Fine For T Mobile Details Of Three Years Of Data Security Issues

Apr 28, 2025 -

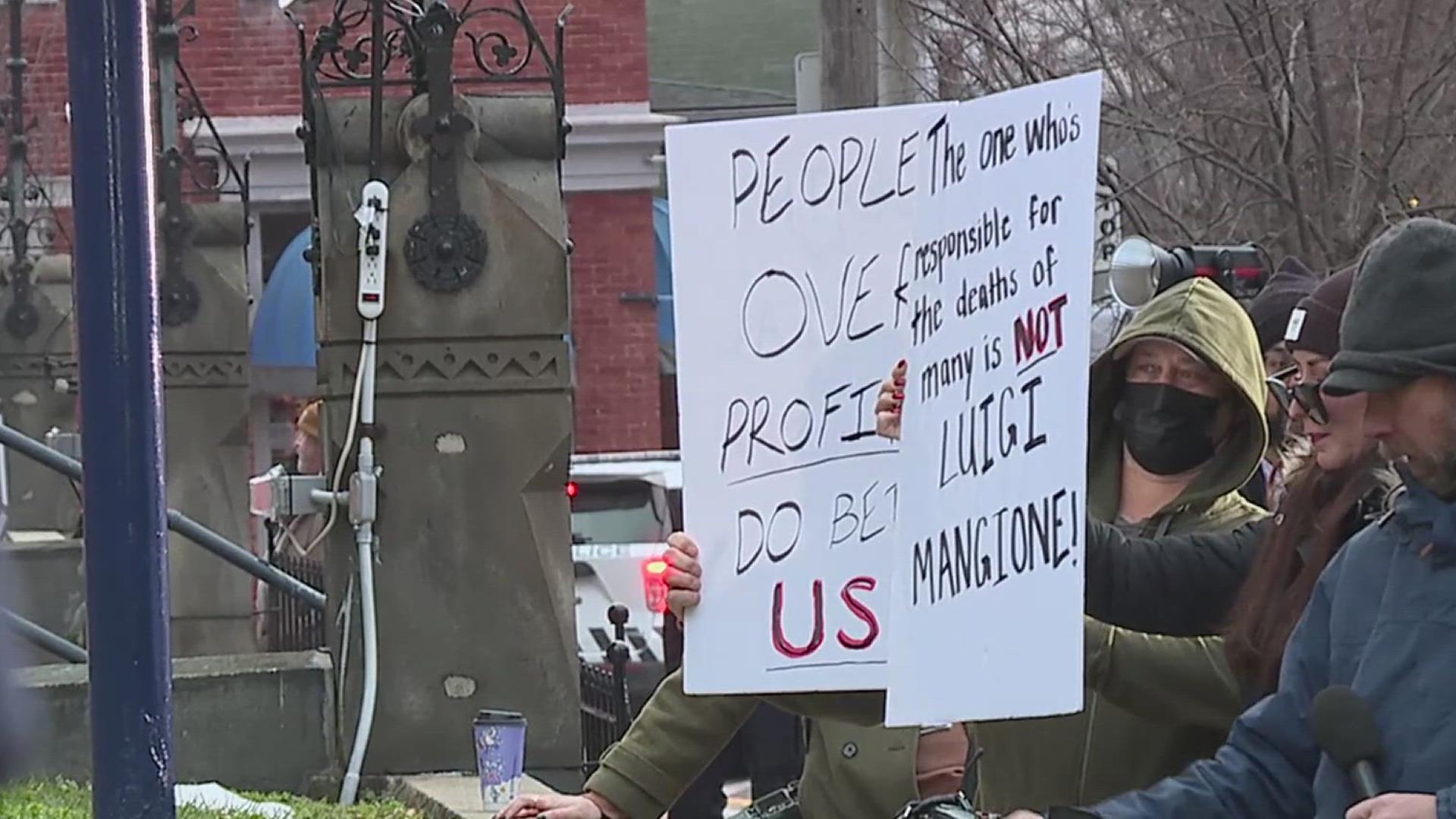

Luigi Mangione Supporters Their Hopes And Expectations

Apr 28, 2025

Luigi Mangione Supporters Their Hopes And Expectations

Apr 28, 2025

Latest Posts

-

Teslas Rise Lifts Us Stocks Tech Giants Power Market Growth

Apr 28, 2025

Teslas Rise Lifts Us Stocks Tech Giants Power Market Growth

Apr 28, 2025 -

Us Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025

Us Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025 -

Tesla And Tech Fuel Us Stock Market Surge

Apr 28, 2025

Tesla And Tech Fuel Us Stock Market Surge

Apr 28, 2025 -

Starbucks Union Votes Against Proposed Pay Raise

Apr 28, 2025

Starbucks Union Votes Against Proposed Pay Raise

Apr 28, 2025 -

Starbucks Union Spurns Companys Wage Increase Proposal

Apr 28, 2025

Starbucks Union Spurns Companys Wage Increase Proposal

Apr 28, 2025