US Stock Market Rally Driven By Tech Giants, Tesla In The Lead

Table of Contents

Tesla's Stellar Performance and its Ripple Effect on the Market

Tesla's remarkable performance is a major catalyst for the current US stock market rally. Its influence extends far beyond its own stock price, impacting the broader electric vehicle (EV) sector and investor sentiment as a whole.

Record-Breaking Deliveries and Innovation

- Record-breaking deliveries: Tesla consistently exceeds delivery expectations, demonstrating strong demand for its electric vehicles. Recent quarters have shown significant increases compared to the same period last year, bolstering investor confidence. These figures are publicly available through Tesla's quarterly earnings reports and SEC filings.

- New product launches: Anticipation surrounding new product launches, such as the Cybertruck and potential advancements in autonomous driving technology, fuels further investor excitement and drives stock price appreciation. These innovations solidify Tesla's position as a leader in the EV market and attract significant media attention, further boosting its stock price.

- Market expansion: Tesla's continued global expansion into new markets increases its potential revenue streams and strengthens its long-term growth prospects, contributing positively to the overall market sentiment. Expanding into new regions diversifies Tesla's revenue streams and lessens dependence on any single market.

These factors combined create a powerful narrative of growth and innovation, directly contributing to the overall US stock market rally and positively impacting investor confidence in related technology stocks.

Tesla's Influence on the EV Sector and Related Stocks

Tesla's success isn't isolated; it's creating a positive ripple effect throughout the EV sector.

- Increased investment in EV infrastructure: Tesla's success is driving increased investment in charging infrastructure and related technologies, creating opportunities for other companies in the EV ecosystem. This attracts investment into the broader EV space.

- Positive spillover effect: Other electric vehicle companies benefit from the increased consumer awareness and acceptance of EVs driven by Tesla's market dominance. This increased consumer interest translates into higher demand for other EV manufacturers.

- Positive impact on related technology stocks: Companies supplying components or technologies to Tesla (battery producers, autonomous driving software developers, etc.) also experience growth, contributing to the broader market rally. Examples include companies specializing in lithium-ion battery technology or advanced sensor technology.

The Role of Other Tech Giants in the Market Rally

While Tesla is a significant driver, other tech giants also play a crucial role in the current US stock market rally. Their robust performance and positive outlook are essential components of this upward trend.

Strong Earnings Reports and Future Projections

- Exceeding expectations: Major tech companies like Apple, Microsoft, Google (Alphabet), and Amazon consistently report strong quarterly earnings, often exceeding analysts' expectations. These positive financial results demonstrate resilience and continued growth, boosting investor confidence. These earnings reports are regularly reported in major financial news outlets.

- Positive future projections: These companies also offer optimistic future projections, based on strong growth in their core businesses and expansion into new markets. This forward-looking optimism fuels further investment.

- Robust cash reserves: Many of these companies possess substantial cash reserves, providing them with financial stability and the ability to weather economic uncertainty, thereby instilling investor confidence.

Technological Advancements and Market Dominance

- AI and Cloud Computing: Groundbreaking advancements in artificial intelligence (AI), cloud computing, and other technologies are driving significant growth within these tech giants. These advancements are creating new revenue streams and expanding market opportunities.

- Market leadership: Their market dominance across various sectors ensures substantial revenue and profit margins, adding stability and predictability to their financial performance and inspiring investor confidence.

- Innovation pipeline: A strong innovation pipeline ensures these companies remain at the forefront of technological advancements, maintaining their competitive edge and driving future growth.

Macroeconomic Factors Contributing to the Rally

Beyond the performance of individual companies, macroeconomic factors also play a significant role in the current US stock market rally.

Easing Inflation Concerns

- Cooling inflation: Recent data suggests a cooling in inflation rates, easing concerns about persistent high inflation. This reduction in inflationary pressure reduces investor anxieties about potential interest rate hikes, leading to increased willingness to invest. This data is regularly published by the US Bureau of Labor Statistics.

- Federal Reserve policy: The Federal Reserve's monetary policy decisions, including interest rate adjustments, have a considerable impact on the stock market. A more accommodative monetary policy can contribute positively to market sentiment.

- Investor confidence: Easing inflation concerns translate directly into increased investor confidence, leading to greater investment in the stock market.

Positive Economic Indicators

- Job growth: Robust job growth and a low unemployment rate indicate a healthy economy, boosting consumer confidence and spending. This positive economic outlook is a key driver of the market rally. Job growth figures are reported monthly by the US Bureau of Labor Statistics.

- Consumer spending: Strong consumer spending demonstrates economic resilience and indicates continued demand for goods and services, thereby encouraging market optimism.

- Overall economic outlook: A generally positive outlook on the US economy further enhances investor confidence, contributing to the ongoing US stock market rally.

Conclusion

The current US stock market rally is a complex phenomenon driven by a confluence of factors. The remarkable performance of tech giants, particularly Tesla, is a significant driver, fueled by strong earnings, technological advancements, and a positive ripple effect across related sectors. Easing inflation concerns and positive macroeconomic indicators further contribute to this optimistic market trend. Tesla’s success, in particular, has a broader impact, influencing the entire EV sector and investor confidence in related technology stocks.

Call to Action: Understanding the dynamics behind this US Stock Market Rally is crucial for informed investment decisions. Stay updated on the latest market trends, including the performance of tech giants like Tesla and other major players, to make strategic investment choices. Learn more about investing in the US stock market and capitalizing on future opportunities presented by this ongoing rally.

Featured Posts

-

Yukon Mine Manager Faces Contempt After Refusal To Answer Questions

Apr 28, 2025

Yukon Mine Manager Faces Contempt After Refusal To Answer Questions

Apr 28, 2025 -

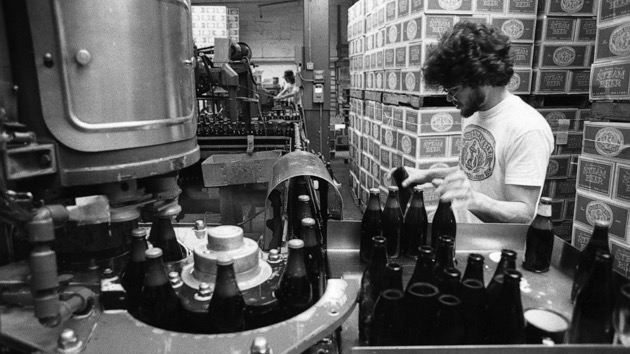

127 Years Of Brewing History Anchor Brewing Companys Closure

Apr 28, 2025

127 Years Of Brewing History Anchor Brewing Companys Closure

Apr 28, 2025 -

Individual Investors Response To Market Volatility A Deeper Look

Apr 28, 2025

Individual Investors Response To Market Volatility A Deeper Look

Apr 28, 2025 -

Actors Join Writers Strike Hollywood Faces Complete Production Halt

Apr 28, 2025

Actors Join Writers Strike Hollywood Faces Complete Production Halt

Apr 28, 2025 -

Senior Hamas Officials Hold Ceasefire Talks In Egypt Following Trump Statement

Apr 28, 2025

Senior Hamas Officials Hold Ceasefire Talks In Egypt Following Trump Statement

Apr 28, 2025

Latest Posts

-

Yankees Rally Past Opponent Name Rodon Dominates In Crucial Victory

Apr 28, 2025

Yankees Rally Past Opponent Name Rodon Dominates In Crucial Victory

Apr 28, 2025 -

Yankees Collapse Devin Williams Another Costly Outing Against Blue Jays

Apr 28, 2025

Yankees Collapse Devin Williams Another Costly Outing Against Blue Jays

Apr 28, 2025 -

Musks X Debt Sale A Deep Dive Into The New Financial Landscape

Apr 28, 2025

Musks X Debt Sale A Deep Dive Into The New Financial Landscape

Apr 28, 2025 -

Revealed How Musks X Debt Sale Reshapes The Companys Future

Apr 28, 2025

Revealed How Musks X Debt Sale Reshapes The Companys Future

Apr 28, 2025 -

The Changing Face Of X Financial Implications Of Musks Debt Deal

Apr 28, 2025

The Changing Face Of X Financial Implications Of Musks Debt Deal

Apr 28, 2025