Pope Francis And The Vatican's Persistent Financial Challenges

Table of Contents

The Historical Context of Vatican Finances

A Legacy of Opulence and Hidden Wealth

For centuries, the Vatican accumulated considerable wealth through donations from the faithful, shrewd investments, and extensive land ownership. However, a significant lack of transparency shrouded much of its financial dealings for decades. This historical opacity fostered an environment where financial mismanagement and even scandals could flourish, casting a long shadow on the current efforts at reform.

- Examples of historical Vatican investments and assets: The Vatican's holdings have included vast real estate portfolios in Rome and globally, significant art collections, and investments in various financial instruments, some of which have proven controversial.

- Secrecy surrounding Vatican finances in previous decades: The lack of publicly accessible financial statements and the secretive nature of internal financial operations hindered accountability and fueled speculation about potential mismanagement.

- Significant past financial scandals: Several high-profile scandals, involving alleged embezzlement and misuse of funds, have further damaged the Vatican's reputation and complicated efforts to regain public trust. These scandals highlighted the urgent need for improved financial oversight and transparency.

Pope Francis's Efforts at Reform

Transparency Initiatives

Since his election, Pope Francis has prioritized transparency and accountability in Vatican finances, recognizing the importance of these factors in restoring public trust and improving the financial health of the Holy See. His efforts represent a significant departure from the previous era's opacity.

- Specific examples of reforms implemented: The creation of the Secretariat for the Economy, the appointment of independent auditors, and the establishment of stricter financial regulations are among the notable reforms undertaken to improve Vatican financial transparency.

- Challenges encountered in implementing these reforms: Resistance from within the Vatican bureaucracy, ingrained habits of secrecy, and the complexity of unwinding decades of opaque financial practices have presented significant obstacles to reform.

- Assessment of the success of these reforms so far: While the reforms represent a significant step forward, their long-term effectiveness remains to be seen. The Vatican still faces significant challenges in fully achieving financial transparency and accountability.

The Ongoing Challenges Facing Vatican Finances

Lack of Diversification

The Vatican's investment portfolio faces significant risks due to a lack of diversification. Over-reliance on specific investments exposes it to considerable vulnerability in volatile global markets.

- Analysis of the Vatican's current investment strategy: Details about the Vatican's current investment strategy remain limited, adding to the ongoing concerns about its financial vulnerability.

- Discussion of potential risks: The concentration of investments in certain sectors, along with potential exposure to currency fluctuations, presents significant risks to the Vatican's long-term financial stability.

- Suggestions for diversification strategies: Experts suggest that the Vatican should diversify its investments across a wider range of asset classes, reduce its exposure to high-risk investments, and seek professional financial advice to improve its risk management.

Operational Costs and Budget Deficits

The Vatican's operational costs, including staff salaries, maintenance of its vast property holdings, and the substantial expenses involved in running its various departments, consistently exceed its revenue.

- Breakdown of the Vatican's major expenses: Salaries, property maintenance, administrative costs, and the upkeep of the Vatican Museums are among the significant expenses that contribute to the budget deficit.

- Analysis of past and projected budget deficits: The Vatican has consistently reported budget deficits, raising concerns about its long-term financial sustainability.

- Discussion of potential cost-cutting measures: Implementing stricter cost controls, streamlining operations, and exploring alternative revenue streams are crucial steps towards addressing the budget deficit.

The Role of External Factors

Global Economic Conditions

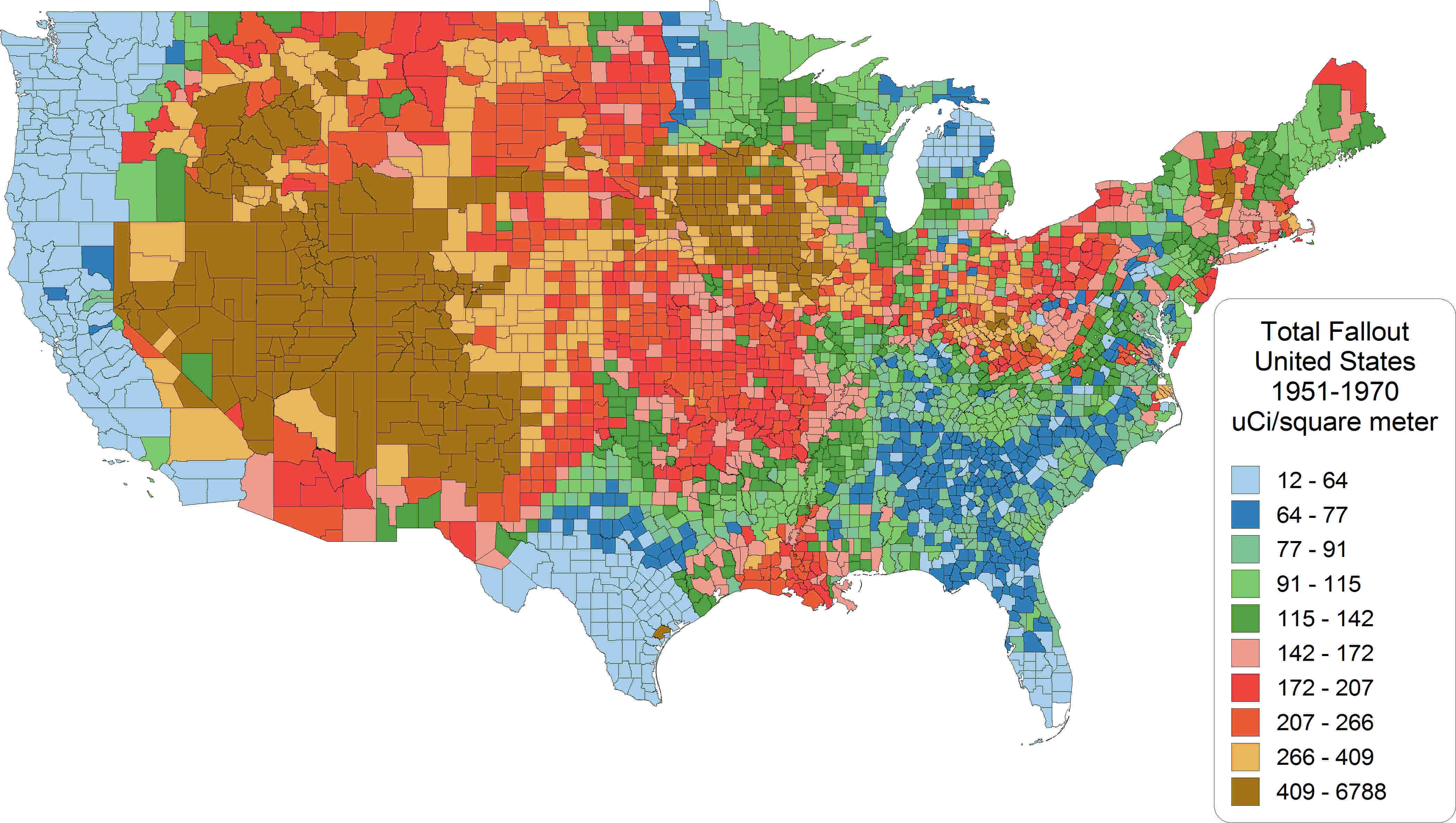

The global economy significantly impacts Vatican finances. Recessions, financial crises, and fluctuations in currency values directly affect the value of its investments and its operational costs.

- Impact of recessions and financial crises: The 2008 global financial crisis severely impacted the value of the Vatican's investments, highlighting its vulnerability to external economic shocks.

- Fluctuations in the value of the Euro and other currencies: Changes in currency exchange rates affect the value of Vatican assets denominated in foreign currencies.

- The effect of global inflation on operating costs: Inflationary pressures increase the cost of goods and services, exacerbating the Vatican's budget deficit.

Decreasing Donations

Declining charitable donations represent another significant challenge to Vatican finances. This trend is likely influenced by secularization and economic hardship among its donors.

- Trends in charitable donations to the Vatican: Data on donation trends suggest a decline in recent years, adding pressure on the Vatican's already strained budget.

- Potential causes for decreasing donations: Factors like increased secularization, economic uncertainty, and a shift in philanthropic priorities may contribute to the decline in donations.

- Strategies to attract new donations and maintain existing support: Improving transparency and communication, showcasing the impact of donations, and diversifying fundraising strategies are crucial to counter this decline.

Conclusion

Pope Francis's efforts to reform Vatican finances represent a significant attempt to address deeply rooted challenges. The Vatican's financial situation is undeniably complex, stemming from a legacy of opacity, significant operational costs, and vulnerability to external economic factors. While reforms toward greater transparency have been initiated, significant hurdles remain, including a lack of diversification in investments, persistent budget deficits, and declining donations. The long-term financial health of the Holy See requires continued commitment to reform, greater financial transparency, and a proactive approach to managing risks. Further research into the intricacies of Vatican finances is crucial to understanding the ongoing challenges and the progress of reform efforts. Understanding the Vatican's persistent financial challenges is essential to evaluating the long-term sustainability of one of the world’s most influential institutions.

Featured Posts

-

Buy Your Psl 10 Tickets Sale Starts Today

May 08, 2025

Buy Your Psl 10 Tickets Sale Starts Today

May 08, 2025 -

Duesen Kripto Paralar Yatirimci Tepkileri Ve Piyasa Analizi

May 08, 2025

Duesen Kripto Paralar Yatirimci Tepkileri Ve Piyasa Analizi

May 08, 2025 -

Mraksh Ke Sahl Pr Kshty Hadthh Awr Ansany Asmglng Ka Ankshaf 4 Grftaryan

May 08, 2025

Mraksh Ke Sahl Pr Kshty Hadthh Awr Ansany Asmglng Ka Ankshaf 4 Grftaryan

May 08, 2025 -

Im Convinced Star Wars Is Finally Showing Us That Planet After 48 Years

May 08, 2025

Im Convinced Star Wars Is Finally Showing Us That Planet After 48 Years

May 08, 2025 -

Dodgers Superaran El Record De Los Yankees Historico Inicio De Temporada

May 08, 2025

Dodgers Superaran El Record De Los Yankees Historico Inicio De Temporada

May 08, 2025

Latest Posts

-

One Crypto Winner Amidst The Trade War Chaos

May 09, 2025

One Crypto Winner Amidst The Trade War Chaos

May 09, 2025 -

Trade War Fallout Identifying Cryptocurrencies With Resilience

May 09, 2025

Trade War Fallout Identifying Cryptocurrencies With Resilience

May 09, 2025 -

Could This Cryptocurrency Thrive Despite The Trade War

May 09, 2025

Could This Cryptocurrency Thrive Despite The Trade War

May 09, 2025 -

Understanding The Bitcoin Rebound A Guide For Investors

May 09, 2025

Understanding The Bitcoin Rebound A Guide For Investors

May 09, 2025 -

Recent Bitcoin Rebound Signs Of A Market Recovery

May 09, 2025

Recent Bitcoin Rebound Signs Of A Market Recovery

May 09, 2025