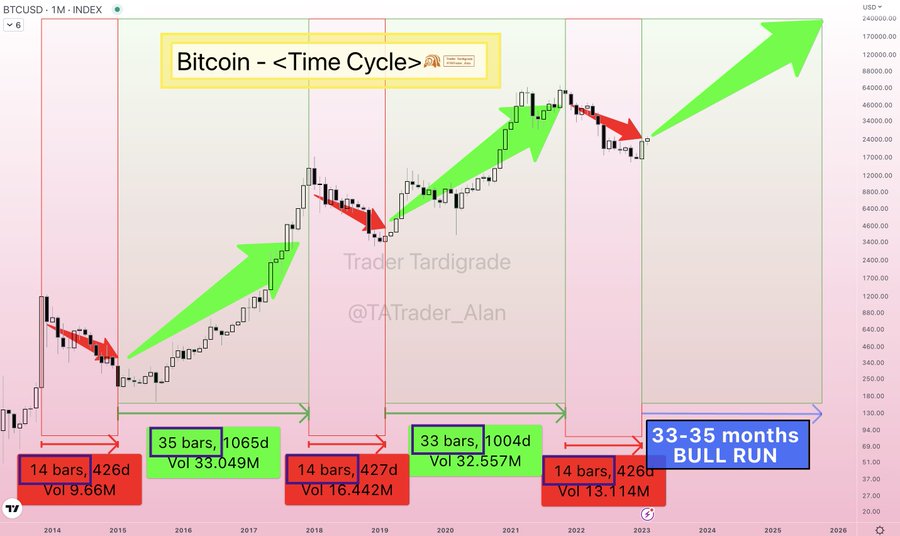

Recent Bitcoin (BTC) Gains: A Deeper Look At Market Drivers

Table of Contents

Macroeconomic Factors Influencing Bitcoin's Price

Inflation and Safe-Haven Assets

High inflation rates often push investors towards alternative assets perceived as hedges against inflation. Bitcoin, with its limited supply of 21 million coins, is increasingly viewed as a safe haven, similar to gold.

- Correlation between inflation and Bitcoin price: Historically, periods of high inflation have been correlated with increases in Bitcoin's price. For example, the surge in inflation during 2021 saw a corresponding rise in the BTC price.

- Fiat currency devaluation: As the purchasing power of fiat currencies diminishes due to inflation, investors seek assets that retain or increase their value, driving demand for Bitcoin.

- [Insert chart showing correlation between inflation rate (CPI) and Bitcoin price over the past 5 years]

Interest Rate Hikes and Their Impact

Central bank interest rate hikes influence Bitcoin's value indirectly. Higher interest rates generally reduce risk appetite in financial markets, potentially leading to capital outflows from riskier assets like cryptocurrencies.

- Interest rate changes and risk appetite: Increased interest rates make traditional investments like bonds more attractive, potentially drawing investment away from Bitcoin.

- Impact on traditional markets: Downturns in traditional markets can sometimes trigger a flight to safety, potentially benefiting Bitcoin as a less correlated asset.

- [Link to a relevant financial news article discussing the impact of interest rate hikes on crypto markets]

Regulatory Developments and Their Influence

Positive Regulatory Signals

Positive regulatory developments or statements from governments and regulatory bodies can significantly boost investor confidence and attract institutional investment.

- Supportive regulations: Clear regulatory frameworks that define Bitcoin's legal status and reduce uncertainty can encourage wider adoption. Examples include certain jurisdictions granting Bitcoin exchange-traded fund (ETF) approvals.

- Statements from key regions: Positive statements from influential regulatory bodies can signal a shift towards a more accepting regulatory environment.

- Attracting institutional investors: Reduced regulatory uncertainty makes it easier for institutional investors to allocate capital to Bitcoin, driving up demand.

Negative Regulatory Actions and Their Effects

Conversely, negative regulatory actions or announcements can trigger significant price drops due to increased uncertainty and potential restrictions.

- Examples of negative regulatory actions: Bans on cryptocurrency trading or stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations can negatively impact market sentiment.

- Market sentiment and regulatory uncertainty: Negative regulatory news often creates market volatility and uncertainty, leading to sell-offs.

- [Link to an article discussing the impact of a specific regulatory action on Bitcoin's price]

Technological Advancements and Network Activity

Bitcoin Network Upgrades

Upgrades and improvements to the Bitcoin network enhance its efficiency, scalability, and security, attracting more users and investors.

- Impact on transaction costs, speed, and network health: Upgrades like the SegWit implementation have improved transaction speeds and reduced fees, making Bitcoin more user-friendly.

- Attracting users and investors: A more efficient and secure network fosters greater trust and confidence, attracting both individual and institutional investors.

- [Link to Bitcoin's whitepaper or a relevant technical article about recent upgrades]

Growing Institutional Adoption

The increasing adoption of Bitcoin by institutional investors (e.g., corporations, hedge funds) significantly impacts its price stability and growth.

- Examples of large-scale Bitcoin acquisitions: Many prominent companies have added Bitcoin to their treasury reserves, signaling a growing acceptance of Bitcoin as an asset class.

- Implications for price stability and growth: Large institutional investments tend to stabilize prices and reduce volatility, potentially leading to sustained long-term growth.

- [Include statistics illustrating the growth of institutional investment in Bitcoin]

Market Sentiment and Psychological Factors

FOMO (Fear of Missing Out)

The fear of missing out (FOMO) plays a significant role in driving price increases, particularly during periods of rapid growth.

- Psychological drivers of FOMO: FOMO compels investors to buy Bitcoin, even at higher prices, driven by the fear of losing potential profits.

- Impact on market behavior: FOMO can create a self-fulfilling prophecy, pushing prices higher as more investors jump in.

Media Coverage and Public Perception

Media coverage and public perception significantly influence investor sentiment and Bitcoin's price.

- Positive and negative media coverage: Positive news stories about Bitcoin tend to boost investor confidence, while negative news can lead to sell-offs.

- Influence of social media sentiment: Social media platforms play a crucial role in shaping public opinion and driving short-term price fluctuations.

Conclusion

Recent Bitcoin (BTC) gains are driven by a complex interplay of macroeconomic factors, regulatory developments, technological advancements, and market psychology. Understanding the interconnectedness of these elements is crucial for navigating the cryptocurrency market effectively. High inflation, positive regulatory signals, network upgrades, institutional adoption, and FOMO all contribute to price increases. Conversely, interest rate hikes, negative regulations, and negative media coverage can exert downward pressure.

Key Takeaways: To make sound investment decisions, it is vital to stay informed about macroeconomic trends, regulatory changes, technological developments, and market sentiment.

Call to Action: Stay informed about future Recent Bitcoin (BTC) Gains by following reputable sources and conducting thorough research before making any investment decisions. Understand the factors driving Recent Bitcoin (BTC) Gains to navigate the market effectively.

Featured Posts

-

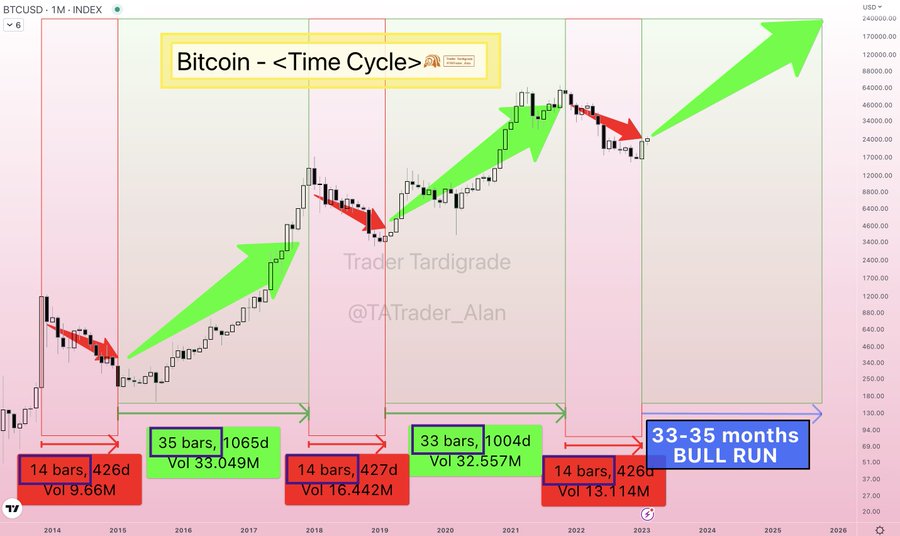

Is Sk Hynix The New Dram Leader Ais Role In The Market Shift

Apr 24, 2025

Is Sk Hynix The New Dram Leader Ais Role In The Market Shift

Apr 24, 2025 -

Tzin Xakman O Tzon Travolta Apoxaireta Ton Thryliko Ithopoio

Apr 24, 2025

Tzin Xakman O Tzon Travolta Apoxaireta Ton Thryliko Ithopoio

Apr 24, 2025 -

Us Stock Futures Rise Sharply Following Trumps Statement On Powell

Apr 24, 2025

Us Stock Futures Rise Sharply Following Trumps Statement On Powell

Apr 24, 2025 -

Tesla Q1 Profits Plunge Amid Musks Political Backlash

Apr 24, 2025

Tesla Q1 Profits Plunge Amid Musks Political Backlash

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Wednesday April 23 Finns Vow To Liam

Apr 24, 2025

The Bold And The Beautiful Spoilers Wednesday April 23 Finns Vow To Liam

Apr 24, 2025