Ripple Settlement Talks: SEC May Classify XRP As A Commodity

Table of Contents

The SEC's Argument Against Ripple and XRP

The SEC's core argument centers on the claim that Ripple's sales of XRP constituted unregistered securities offerings. They allege that Ripple conducted numerous unregistered sales of XRP, violating federal securities laws. This contention rests heavily on the application of the Howey Test, a legal framework used to determine whether an investment constitutes a security.

-

Key Evidence Presented by the SEC: The SEC points to evidence suggesting Ripple actively promoted XRP sales to generate profits, including marketing materials and internal communications. They also highlight the centralized nature of XRP's initial distribution.

-

The Howey Test and its Relevance: The Howey Test considers four key factors: an investment of money, in a common enterprise, with an expectation of profits, solely from the efforts of others. The SEC argues that XRP satisfies all four prongs of this test, classifying it as a security.

-

Potential Penalties for Ripple: If found guilty, Ripple faces substantial penalties, including significant fines and potential restrictions on future operations. This outcome could set a precedent for other cryptocurrency projects, potentially chilling innovation within the industry.

Ripple's Defense and Counterarguments

Ripple vehemently denies the SEC's accusations, arguing that XRP is a decentralized digital asset, functioning as a currency or a commodity, not a security. Their defense strategy hinges on highlighting the differences between XRP and traditional securities.

-

XRP as a Currency or Commodity: Ripple emphasizes XRP's use in decentralized exchanges and its widespread adoption for payments and remittances, arguing that its functionality aligns more closely with established financial instruments like commodities.

-

Decentralized Nature of XRP: They stress the decentralized nature of XRP's network and its operation outside of Ripple's direct control. This contrasts sharply with the SEC's assertion that Ripple exerted significant control over XRP's distribution and value.

-

Expert Testimony and Legal Precedents: Ripple's legal team has presented expert witness testimony and cited legal precedents to support their claims, aiming to demonstrate that XRP doesn't meet the criteria for classification as a security.

The Potential Implications of Classifying XRP as a Commodity

Classifying XRP as a commodity would have significant repercussions, altering its regulatory framework and potentially impacting its market value.

-

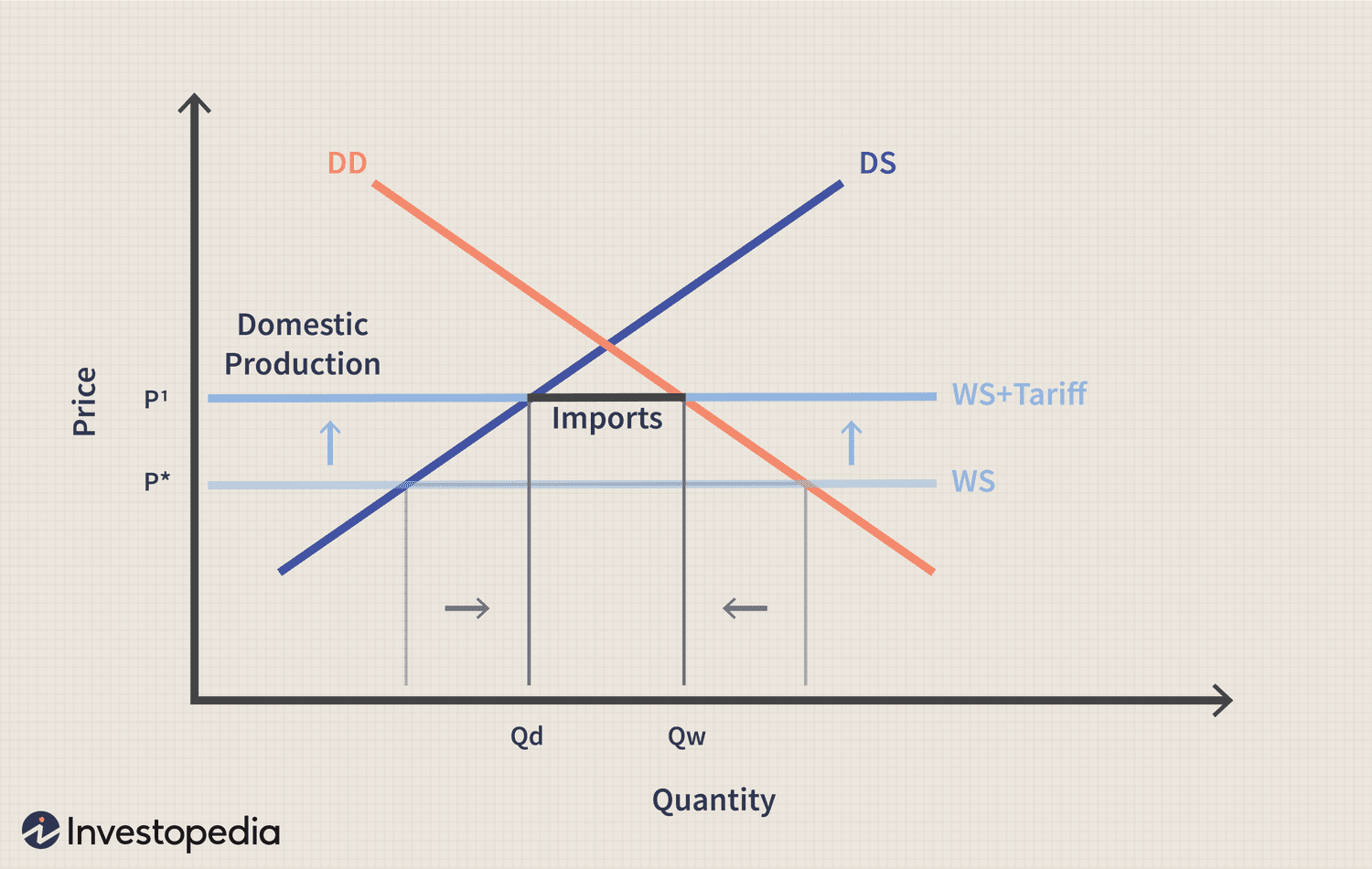

Regulatory Differences: Commodities are subject to different regulations than securities. A commodity classification would likely place XRP under the purview of the Commodity Futures Trading Commission (CFTC), rather than the SEC, leading to a potentially less stringent regulatory environment.

-

Impact on XRP's Price and Trading Volume: The outcome of the Ripple settlement talks will undoubtedly affect XRP's price. A commodity classification could lead to increased price stability or volatility depending on market reactions and regulatory clarity. Trading volume might also increase due to reduced regulatory uncertainty.

-

Broader Implications for the Cryptocurrency Market: The decision in the Ripple case will establish a crucial legal precedent, providing much-needed regulatory clarity for the cryptocurrency market and potentially influencing how other digital assets are categorized.

The Ripple Settlement Talks and Potential Outcomes

The ongoing Ripple settlement talks offer a pathway to resolve this protracted legal dispute. Both parties are reportedly engaged in negotiations to reach an agreement outside of a full trial.

-

Potential Settlement Terms: Potential settlement terms could include financial penalties for Ripple, commitments to enhance regulatory compliance, or a combination thereof. The details remain confidential, fueling speculation within the crypto community.

-

Likelihood of a Settlement vs. a Trial: While a settlement is often seen as the most likely outcome, the possibility of a full trial remains. The outcome of a trial is unpredictable and carries higher stakes for both sides.

-

Impact of a Settlement on the Future of XRP: A settlement, particularly one involving a commodity classification of XRP, would provide significant clarity for XRP investors and the broader crypto industry, potentially boosting confidence and driving future growth.

Expert Opinions and Market Reactions

The cryptocurrency community and legal experts closely monitor the Ripple settlement talks, offering diverse opinions on potential outcomes.

-

Expert Quotes and Analysis: Legal experts and crypto analysts provide varying perspectives on the likelihood of a settlement and the potential classification of XRP as a commodity, offering insights based on their understanding of the case and market dynamics.

-

Market Reactions to Recent Developments: News and rumors surrounding the Ripple case consistently impact XRP's price. Positive developments often lead to price increases, while negative news can trigger price drops, highlighting the market's sensitivity to the ongoing legal battle.

-

Impact of News and Rumors on XRP's Price Volatility: The inherent volatility of the cryptocurrency market is amplified during periods of uncertainty surrounding the Ripple case, making price fluctuations significant.

Conclusion: Understanding the Ripple Settlement Talks and the Future of XRP

The Ripple settlement talks represent a pivotal moment for the cryptocurrency industry. The potential classification of XRP as a commodity holds significant implications for Ripple, XRP investors, and the overall regulatory landscape. Understanding the various arguments, potential outcomes, and market reactions is crucial for navigating this evolving situation. Stay informed about future developments in the Ripple settlement talks and the potential XRP classification by subscribing to relevant news sources and engaging in further research on the SEC vs. Ripple case. The implications of a commodity classification for XRP are substantial and warrant your continued attention.

Featured Posts

-

Dragons Den A Guide To Success

May 01, 2025

Dragons Den A Guide To Success

May 01, 2025 -

Xrp Etf Latest News And Analysis Following Ripples Legal Victory

May 01, 2025

Xrp Etf Latest News And Analysis Following Ripples Legal Victory

May 01, 2025 -

Lady Raiders Fall Short Against Cincinnati In 59 56 Defeat

May 01, 2025

Lady Raiders Fall Short Against Cincinnati In 59 56 Defeat

May 01, 2025 -

Xrp News Today Ripple Lawsuit Update And Us Etf Prospects

May 01, 2025

Xrp News Today Ripple Lawsuit Update And Us Etf Prospects

May 01, 2025 -

Kshmyrywn Ka Msylh Elaqayy Amn Ke Lye Sng Myl

May 01, 2025

Kshmyrywn Ka Msylh Elaqayy Amn Ke Lye Sng Myl

May 01, 2025

Latest Posts

-

Nvidia Faces Broader Political Headwinds Than Just China

May 01, 2025

Nvidia Faces Broader Political Headwinds Than Just China

May 01, 2025 -

Mark Carneys Liberal Victory Implications For Canada Us Relations

May 01, 2025

Mark Carneys Liberal Victory Implications For Canada Us Relations

May 01, 2025 -

Jalen Hurts White House Absence Trumps Tush Push Comment Explained

May 01, 2025

Jalen Hurts White House Absence Trumps Tush Push Comment Explained

May 01, 2025 -

Trumps Tariff Revenue A Realistic Replacement For Income Tax

May 01, 2025

Trumps Tariff Revenue A Realistic Replacement For Income Tax

May 01, 2025 -

Exclusive The Complete Sale Of Elon Musks X Corp Debt Is Finalized

May 01, 2025

Exclusive The Complete Sale Of Elon Musks X Corp Debt Is Finalized

May 01, 2025