Strong Ethereum Price Action: Bulls Eyeing Further Gains

Table of Contents

Recent Catalysts Driving Ethereum's Price Surge

Several factors have converged to propel Ethereum's price upward, creating this strong Ethereum price action.

Ethereum's Growing DeFi Ecosystem

Ethereum's dominance in the Decentralized Finance (DeFi) space is a significant driver of its price appreciation. The thriving DeFi ecosystem boasts numerous protocols offering innovative financial services, attracting substantial user engagement and capital.

- Key DeFi Protocols: Aave, Compound, Uniswap, MakerDAO, Curve Finance all contribute significantly to Ethereum's Total Value Locked (TVL). These protocols facilitate lending, borrowing, trading, and other DeFi activities, generating substantial transaction fees and demand for ETH.

- Growing User Base: The increasing number of users interacting with these DeFi applications fuels network effects, enhancing the platform's value and driving up demand for ETH. This increased usage translates directly into higher transaction fees, further supporting the price.

- Positive Network Effects: The success of these DeFi protocols attracts more developers and users, creating a positive feedback loop that reinforces Ethereum's position as a leading DeFi platform, contributing to strong Ethereum price action.

The Shanghai Upgrade and its Impact

The successful completion of the Shanghai upgrade marked a pivotal moment for Ethereum, allowing the unlocking of staked ETH. This event had significant implications for market liquidity and price stability.

- Unlocking Schedule: The phased unlocking of staked ETH didn't trigger the anticipated massive sell-off, indicating a high level of confidence amongst stakers. This controlled release minimized negative pressure on the ETH price.

- Reduced Selling Pressure: The fears of a large influx of selling pressure post-upgrade proved unfounded, suggesting a bullish sentiment among long-term ETH holders. This contributes to the ongoing strength of the Ethereum price.

- Increased Market Liquidity: The increased liquidity resulting from the Shanghai upgrade can facilitate smoother price movements and potentially reduce volatility in the short term, creating a more stable environment for bullish price action.

Overall Positive Market Sentiment

The prevailing bullish sentiment in the broader cryptocurrency market has undoubtedly played a role in Ethereum's price surge. Positive macroeconomic factors, although unpredictable, can significantly influence investor confidence.

- Macroeconomic Influences: While macroeconomic factors can be volatile, periods of relative stability or positive economic indicators often correlate with increased risk appetite, boosting investments in cryptocurrencies like Ethereum.

- Market Capitalization: Overall increases in the cryptocurrency market capitalization often lead to gains across the board, with Ethereum benefiting from the positive sentiment and spillover effects.

- Bitcoin's Influence: Bitcoin's price movements often influence altcoins like Ethereum. Periods of Bitcoin strength often see positive correlation, while Bitcoin downturns can sometimes lead to temporary corrections in Ethereum's price.

Technical Analysis: Chart Patterns Suggesting Further Gains

Technical analysis provides further evidence supporting the bullish outlook for Ethereum's price. Examining key chart patterns and indicators paints a promising picture.

Key Support and Resistance Levels

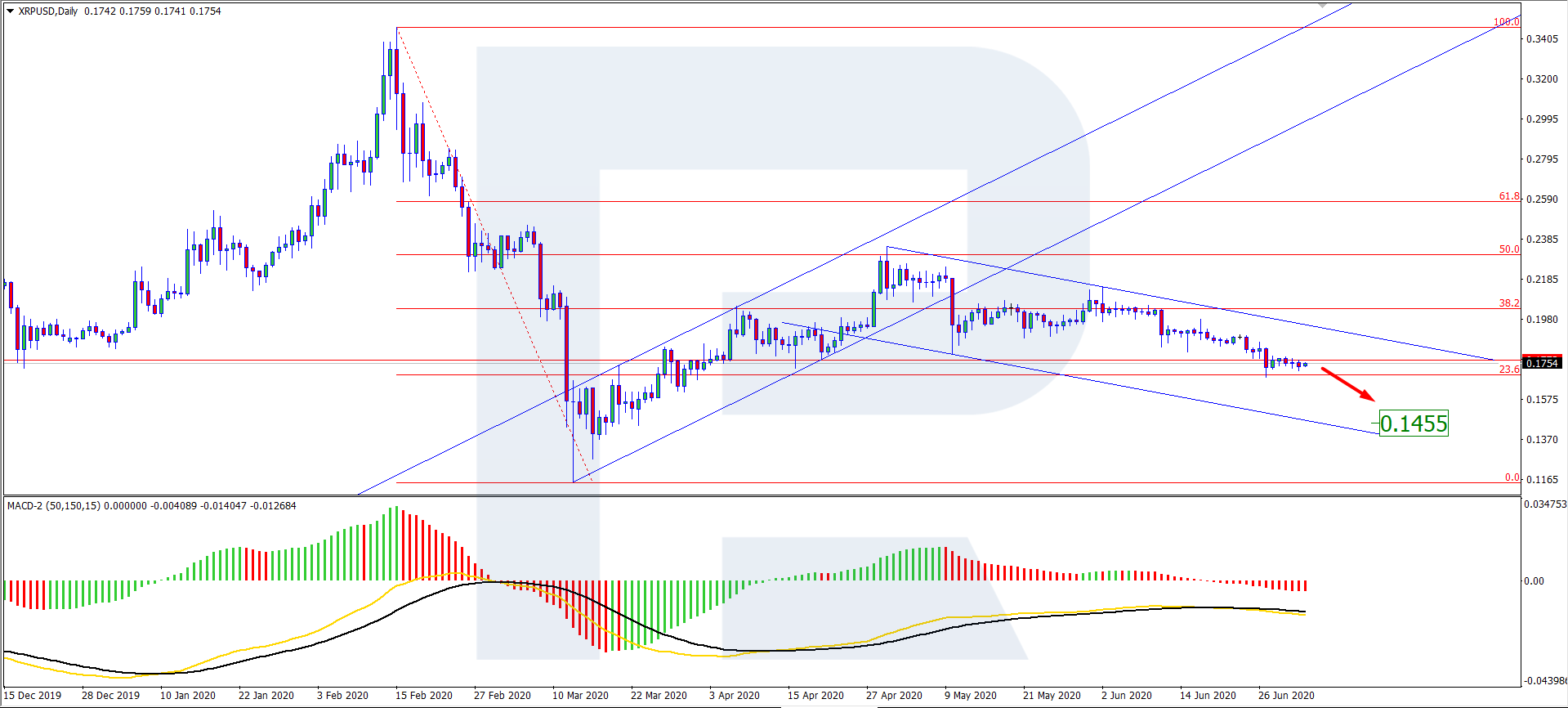

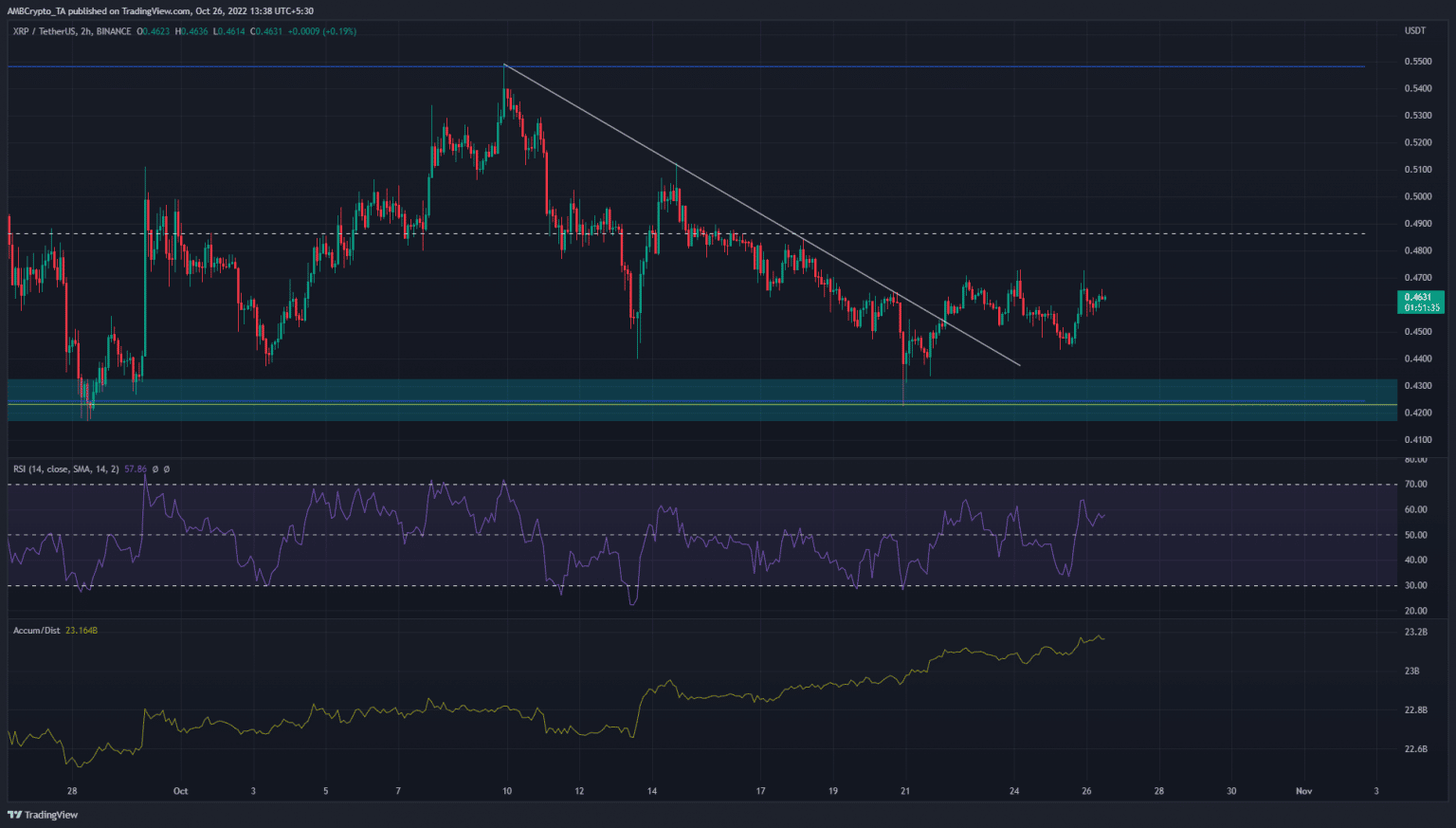

Analyzing the Ethereum price chart reveals key support and resistance levels that have proven significant in recent price movements.

- Support Levels: These levels represent price points where buying pressure is expected to be stronger, potentially preventing further declines. Breaks below these levels could signal a bearish correction.

- Resistance Levels: These represent price points where selling pressure is typically stronger, potentially capping further price increases. Breakouts above these levels often signal significant bullish momentum. (Insert chart illustrating support and resistance levels here)

- Breakouts: Successful breakouts above significant resistance levels often trigger further upward price movements, signifying strong buying pressure and investor confidence.

Identifying Bullish Indicators

Several technical indicators suggest a bullish trend for Ethereum.

- Relative Strength Index (RSI): An RSI above 50 generally indicates bullish momentum. A reading above 70 could suggest overbought conditions, potentially indicating a short-term correction. (Insert chart illustrating RSI here)

- Moving Averages (MA): A bullish crossover of short-term MAs (e.g., 50-day MA) above long-term MAs (e.g., 200-day MA) is often considered a bullish signal, indicating a shift in momentum. (Insert chart illustrating moving averages here)

- MACD (Moving Average Convergence Divergence): A bullish MACD crossover, where the MACD line crosses above the signal line, can indicate growing bullish momentum. (Insert chart illustrating MACD here)

The convergence of these bullish indicators reinforces the positive outlook for Ethereum's price.

Potential Risks and Challenges for Ethereum's Price

Despite the bullish outlook, several risks and challenges could impact Ethereum's price.

Regulatory Uncertainty

Regulatory uncertainty remains a significant risk for the entire cryptocurrency market, including Ethereum.

- Varying Regulations: Different jurisdictions are adopting varying approaches to regulating cryptocurrencies, creating uncertainty and potential hurdles for market participants.

- Impact on Adoption: Stringent regulations could hinder the adoption of Ethereum and other cryptocurrencies, negatively affecting price.

Competition from Other Layer-1 Blockchains

Ethereum faces increasing competition from other Layer-1 blockchain networks, each offering unique features and advantages.

- Strengths and Weaknesses: Ethereum's strengths lie in its established ecosystem and network effects. However, scalability limitations and high transaction fees remain challenges compared to some competitors.

- Market Share: Increased competition could impact Ethereum's market share and, consequently, its price.

Macroeconomic Factors

Negative macroeconomic events, such as inflation, recessionary fears, or geopolitical instability, can negatively impact investor sentiment and cryptocurrency prices, including ETH.

Conclusion

The strong Ethereum price action is a result of a confluence of positive factors, including a flourishing DeFi ecosystem, the successful Shanghai upgrade, and positive market sentiment. Technical analysis suggests further upward potential. However, regulatory uncertainty, competition, and macroeconomic factors pose risks. Staying informed about these factors is crucial. While this analysis suggests potential for further gains, always conduct thorough research and consider your risk tolerance before making any investment decisions. Capitalize on the potential for strong Ethereum price action by staying informed through reputable sources and keeping abreast of the latest market developments. Remember to consult financial advisors before making investment decisions.

Featured Posts

-

Cantina Canalla Malaga El Restaurante Mexicano De Moda

May 08, 2025

Cantina Canalla Malaga El Restaurante Mexicano De Moda

May 08, 2025 -

The Closure Of Anchor Brewing Company A Look Back At Its History

May 08, 2025

The Closure Of Anchor Brewing Company A Look Back At Its History

May 08, 2025 -

X Men Rogue Channels Cyclops Powers

May 08, 2025

X Men Rogue Channels Cyclops Powers

May 08, 2025 -

San Franciscos Anchor Brewing Company Shuts Down A Historic Brewery Closes Its Doors

May 08, 2025

San Franciscos Anchor Brewing Company Shuts Down A Historic Brewery Closes Its Doors

May 08, 2025 -

Andors Showrunner Hints At Rogue Ones Recut Version

May 08, 2025

Andors Showrunner Hints At Rogue Ones Recut Version

May 08, 2025

Latest Posts

-

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025 -

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025 -

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025 -

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025 -

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025