Tesla's Q1 Profit Fall: Examining The Impact Of Controversies

Table of Contents

The Price War and its Consequences

Tesla's aggressive price cuts, implemented to boost sales volume in a tightening EV market, significantly impacted its Q1 profits. This price war strategy, while aiming to increase market share and Tesla sales volume, dramatically reduced the Tesla profit margin per vehicle.

-

Aggressive Price Cuts: Tesla's decision to slash prices across its vehicle lineup sparked a price war within the electric vehicle market, forcing competitors to follow suit or risk losing market share. This strategy, while initially increasing sales figures, came at a substantial cost to profitability.

-

Impact on Profit Margins: The reduced pricing directly translated into a significantly lower profit margin per vehicle sold. This squeezed Tesla's overall profitability, despite increased sales volume. The impact on Tesla profit margin was immediate and substantial, raising concerns about long-term financial sustainability.

-

Competitive Landscape: The price war intensified competition within the EV sector, placing pressure on Tesla and other manufacturers to find ways to maintain profitability while remaining competitive. This heightened competition necessitates innovative strategies to maintain profit margins while increasing Tesla sales volume.

-

Long-Term Effects: The long-term implications of this price war strategy are still unfolding. While increased sales volume might be appealing in the short term, the reduced profit margins could negatively impact Tesla's ability to invest in research and development, hindering future innovation. The impact on Tesla stock price also reflects this concern.

-

Stock Price Impact: The market reacted negatively to the reduced profit margins, leading to a drop in Tesla's stock price. Investors are increasingly concerned about the sustainability of this price-driven growth strategy.

Elon Musk's Distractions and Their Ripple Effect

Elon Musk's involvement in other ventures, particularly the tumultuous acquisition of Twitter, has undeniably created distractions that impacted Tesla's performance. These distractions affected both Tesla leadership and brand reputation.

-

Twitter Acquisition and Beyond: The significant time and resources devoted to the Twitter acquisition diverted attention and resources from Tesla's core business operations. This created a leadership vacuum and decreased focus on critical aspects of the company's strategic direction.

-

Impact on Tesla Leadership: The CEO's preoccupation with other ventures negatively impacted Tesla’s leadership and management focus. The lack of dedicated attention to day-to-day operations could have contributed to inefficiencies and missed opportunities.

-

Investor Confidence: Musk's actions and public pronouncements have influenced investor confidence in Tesla. The uncertainty surrounding his leadership and priorities contributed to market volatility and a decline in the company's stock performance.

-

Reputational Damage: The controversies surrounding Musk's other ventures have cast a shadow on Tesla's brand image, potentially affecting consumer perception and purchasing decisions. Negative publicity often translates to decreased sales, especially in the luxury EV market.

-

Consumer Perception: Musk's actions directly influence consumer perceptions of Tesla. This impacts customer loyalty and future sales of Tesla vehicles, creating a ripple effect impacting Tesla’s bottom line.

Production and Supply Chain Challenges

Tesla continues to grapple with production challenges, including supply chain disruptions and rising raw material costs. These issues directly impact Tesla production capabilities and overall profitability.

-

Production Capacity: Meeting the increasing demand for Tesla vehicles while maintaining production efficiency remains a significant challenge. Production bottlenecks have impacted the company's ability to meet its sales targets.

-

Supply Chain Disruptions: Global supply chain issues, including shortages of key components and raw materials, hampered Tesla's production capabilities and increased costs. These disruptions severely affected Tesla production throughout the quarter.

-

Gigafactory Strategy: While Tesla's gigafactory strategy aims to improve production efficiency and reduce reliance on external suppliers, its effectiveness has been impacted by unforeseen challenges and delays.

-

Solutions and Mitigation: Tesla needs to implement robust strategies to improve production efficiency, diversify its supply chains, and mitigate future risks. This includes investing in further automation and establishing more reliable sourcing for raw materials.

-

Link to Reduced Profitability: The combination of production challenges and rising costs directly contributed to reduced profitability in Q1. Addressing these issues is crucial for restoring Tesla's financial health.

The Impact of Regulatory Scrutiny

Regulatory scrutiny and safety concerns surrounding Tesla's vehicles have created additional headwinds. Safety recalls and investigations have impacted Tesla’s reputation and financial performance.

-

Safety Recalls and Investigations: Recent safety recalls and ongoing investigations by regulatory bodies like the NHTSA (National Highway Traffic Safety Administration) have attracted negative publicity and created potential liabilities.

-

Negative Publicity and Legal Liabilities: The negative publicity surrounding safety issues can deter potential buyers and lead to substantial financial penalties if violations are found. These legal and financial liabilities directly impact Tesla’s profitability.

-

Autonomous Driving Technology: Controversies surrounding Tesla's Autopilot and Full Self-Driving features have intensified regulatory scrutiny and raised concerns about the safety of autonomous driving technology.

-

Long-Term Implications: The long-term implications of regulatory scrutiny could involve stricter safety standards, increased legal costs, and potential limitations on the development and deployment of autonomous driving technologies.

Conclusion

Tesla's Q1 profit fall is a multifaceted problem stemming from a confluence of factors. The price war strategy, while boosting sales volume, severely impacted Tesla profit margins. Elon Musk's distractions, persistent production challenges, and increasing regulatory scrutiny all played significant roles in the company's reduced profitability. Understanding these interconnected issues is crucial for investors and consumers. To stay informed about the future of Tesla and the electric vehicle industry, continue to monitor news and analysis on Tesla's Q1 profits and the ongoing challenges facing the company. Staying updated on Tesla Q1 profits and related developments is key to navigating the evolving landscape of the electric vehicle market.

Featured Posts

-

Three Years Of Data Breaches Cost T Mobile A 16 Million Fine

Apr 24, 2025

Three Years Of Data Breaches Cost T Mobile A 16 Million Fine

Apr 24, 2025 -

Months Long Lingering Of Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 24, 2025

Months Long Lingering Of Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 24, 2025 -

Understanding High Stock Market Valuations Insights From Bof A

Apr 24, 2025

Understanding High Stock Market Valuations Insights From Bof A

Apr 24, 2025 -

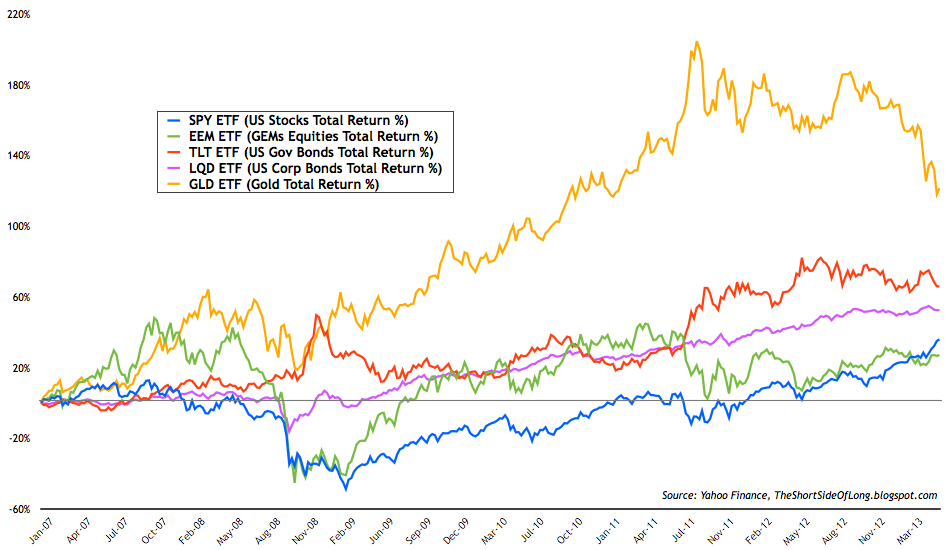

Strong Performance Of Emerging Market Equities Overcoming Us Downturn

Apr 24, 2025

Strong Performance Of Emerging Market Equities Overcoming Us Downturn

Apr 24, 2025 -

Addressing Investor Anxiety Bof As View On High Stock Market Valuations

Apr 24, 2025

Addressing Investor Anxiety Bof As View On High Stock Market Valuations

Apr 24, 2025