The Billionaire Without Berkshire Shares: A Potential Canadian Successor To Buffett?

Table of Contents

Identifying Potential Candidates

To find a potential Canadian Successor to Buffett, we must first define the characteristics of Buffett's renowned investment approach. This involves understanding his core tenets of long-term value investing, his meticulous focus on intrinsic value, and his unparalleled skill in stock picking.

Criteria for a "Buffett-like" Investor

Buffett's success hinges on several key elements:

- Proven track record of successful long-term investment: Consistent, substantial returns over many years, demonstrating resilience during market downturns.

- Strong understanding of fundamental analysis and business valuation: The ability to dissect a company's financials, understand its business model, and accurately assess its intrinsic worth. This includes proficiency in methods like discounted cash flow analysis and comparative company analysis.

- Reputation for integrity and ethical business practices: A commitment to transparency, responsible investing, and upholding the highest ethical standards.

- Patient and disciplined approach to investing: Avoiding impulsive decisions, sticking to a long-term strategy, and resisting the urge to chase short-term gains. This encompasses a deep understanding of value investing principles and the ability to weather market volatility.

Examining Canadian Billionaire Portfolios

Identifying a Canadian Successor to Buffett requires examining the investment strategies employed by successful Canadian billionaires. While specific portfolio details are often confidential, publicly available information and general investment strategies can offer valuable insights. By analyzing their approaches to value investing, their holdings in the Canadian stock market, and the overall composition of their investment portfolios, we can identify those who might embody a similar philosophy to Buffett, even without directly mirroring his Berkshire Hathaway investment strategy. A comparative portfolio analysis, focusing on long-term performance and investment philosophy, is crucial in this process.

Diverging from the Berkshire Hathaway Model

While Berkshire Hathaway's success serves as a benchmark, a Canadian Successor to Buffett might achieve comparable results through alternative strategies. The key isn't necessarily replicating Buffett's specific investments, but rather emulating his core principles of value investing and long-term vision.

Alternative Investment Strategies

Successful investing doesn't always involve mirroring Buffett's model. Consider these alternative approaches:

- Private Equity: Investing in privately held companies offers significant opportunities for long-term growth and value creation, providing a different pathway to significant wealth accumulation.

- Real Estate Investment: Strategic real estate investments, particularly in high-growth areas, can yield substantial returns and offer a tangible asset base.

- Hedge Funds: While riskier, well-managed hedge funds can provide diversified portfolios and access to unique investment opportunities often unavailable to individual investors.

The Importance of Market Context

The Canadian market differs significantly from the US market. Understanding these differences is crucial for any assessment of a potential "Canadian Successor to Buffett."

- Canadian Market: Characterized by a strong resource sector, a relatively smaller and more concentrated market compared to the US, and a different regulatory environment.

- US Market: A larger, more diversified market with greater liquidity and a wider range of investment opportunities. The differences in market dynamics and regulatory frameworks influence the types of investments considered profitable and the overall investment strategies employed.

The Canadian Business Landscape

The Canadian economy presents both unique opportunities and challenges for investors. Understanding these nuances is vital when searching for a Canadian Successor to Buffett.

Opportunities and Challenges for Canadian Investors

- High Growth Potential Sectors: The Canadian economy boasts strong potential in various sectors, including technology, renewable energy, and healthcare, presenting opportunities for significant investment returns.

- Regulatory Environments: Understanding the regulatory landscape is crucial for navigating potential legal and compliance challenges in different sectors.

- Influencing Factors: Macroeconomic factors like interest rates, inflation, and exchange rates significantly influence investment decisions and risk assessment in the Canadian market.

Conclusion

In conclusion, while a direct replication of Warren Buffett's investment strategy, including substantial investments in Berkshire Hathaway, might not be the sole path to success, the core principles of long-term value investing, fundamental analysis, and ethical business practices remain essential. By studying the investment portfolios of prominent Canadian billionaires, analyzing alternative investment strategies suited to the Canadian market, and acknowledging the unique opportunities and challenges within the Canadian business landscape, we can better identify potential future leaders in the world of finance – perhaps even the next Canadian Successor to Buffett. Further research into Canadian investment strategies and their diversification is encouraged to uncover the next generation of investment leaders. Finding the next Canadian Buffett requires a nuanced understanding of the Canadian market and the diverse strategies that can lead to extraordinary investment success.

Featured Posts

-

Top Nhl Storylines To Watch For The Rest Of 2024 25

May 09, 2025

Top Nhl Storylines To Watch For The Rest Of 2024 25

May 09, 2025 -

David In High Potential Episode 13 Casting And Character Analysis

May 09, 2025

David In High Potential Episode 13 Casting And Character Analysis

May 09, 2025 -

Reaktsiya Na Slova Kinga Mask Ta Tramp Zradniki Za Slovami Pismennika

May 09, 2025

Reaktsiya Na Slova Kinga Mask Ta Tramp Zradniki Za Slovami Pismennika

May 09, 2025 -

Pam Bondi And The Epstein Client List What We Know

May 09, 2025

Pam Bondi And The Epstein Client List What We Know

May 09, 2025 -

The Appeal Of Androids New Look A Gen Z Perspective

May 09, 2025

The Appeal Of Androids New Look A Gen Z Perspective

May 09, 2025

Latest Posts

-

Sensex Today 800 Point Surge Nifty Above 18 500 Live Updates

May 09, 2025

Sensex Today 800 Point Surge Nifty Above 18 500 Live Updates

May 09, 2025 -

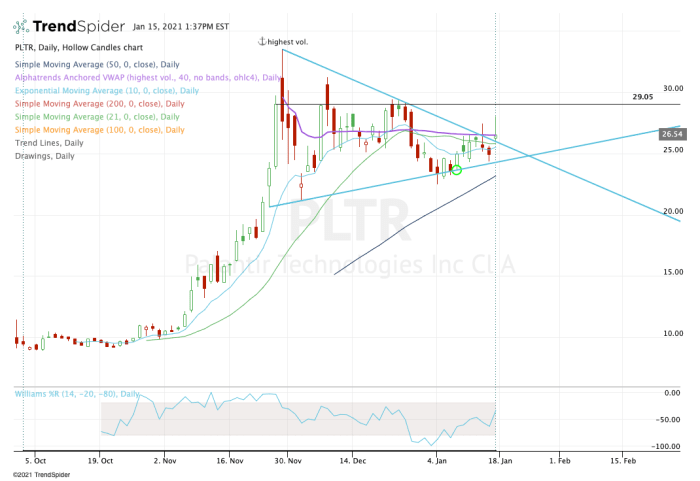

To Buy Or Not To Buy Palantir Stock Before May 5th A Comprehensive Review

May 09, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Comprehensive Review

May 09, 2025 -

Palantir Stock Down 30 Is It A Buying Opportunity

May 09, 2025

Palantir Stock Down 30 Is It A Buying Opportunity

May 09, 2025 -

Palantir Stock Should You Invest Before May 5th Analysis And Predictions

May 09, 2025

Palantir Stock Should You Invest Before May 5th Analysis And Predictions

May 09, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th A Wall Street Perspective

May 09, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Wall Street Perspective

May 09, 2025