The Broadcom-VMware Deal: An Analysis Of The Extreme Price Increase

Table of Contents

The Staggering Acquisition Cost and its Implications

The Broadcom-VMware deal represents a significant premium paid for VMware. Understanding this premium is crucial to analyzing the deal's success.

Premium Paid vs. VMware's Market Value

Broadcom paid a substantial premium over VMware's pre-announcement market capitalization. While the exact figures fluctuate based on market conditions, the premium significantly exceeded typical acquisition premiums seen in recent major tech mergers and acquisitions.

- Specific numbers: At the time of the announcement, the deal valued VMware at approximately $61 billion, significantly above its pre-announcement market valuation. This represents a considerable premium, exceeding what many analysts anticipated.

- Comparison to similar acquisitions: Compared to other recent large tech acquisitions, such as Microsoft's acquisition of LinkedIn or Salesforce's acquisition of MuleSoft, the Broadcom-VMware premium stands out as exceptionally high. This difference warrants closer examination.

- Speculation on reasons for the high price: Several factors likely contributed to the high price tag. These include VMware's strong position in the virtualization market, the strategic value of its software portfolio for Broadcom's expansion into enterprise software, and potentially a bidding war (although none was publicly confirmed).

Synergies and Expected Returns

Broadcom's rationale for the acquisition centers on potential synergies and a strong return on investment (ROI). The company expects significant cost savings through economies of scale and increased market share. However, the feasibility of these claims remains to be seen.

- Expected cost savings: Broadcom anticipates streamlining operations and eliminating redundancies, leading to substantial cost savings. However, the actual cost savings realized may be less than projected.

- Potential market share expansion: The acquisition could help Broadcom expand its market share in the enterprise software sector, offering a broader portfolio of products and services to its customers. However, intense competition may limit this growth.

- Projected revenue growth: Broadcom projects significant revenue growth as a result of cross-selling opportunities and increased market penetration. The realization of this projection depends on successful integration and market acceptance.

Debt Financing and Financial Risk

Funding this massive acquisition required significant debt financing, introducing considerable financial risk for Broadcom.

- Level of debt incurred: The acquisition significantly increased Broadcom's debt load. This elevated debt level impacts its credit rating and financial flexibility.

- Impact on Broadcom's credit rating: Rating agencies are closely monitoring Broadcom's debt levels and financial performance following the acquisition. A downgrade could increase borrowing costs and limit future investment opportunities.

- Potential implications for future investments: The increased debt burden could constrain Broadcom's ability to pursue future acquisitions or investments in research and development.

Market Reactions and Investor Sentiment

The Broadcom-VMware deal triggered immediate and ongoing market reactions, affecting investor sentiment regarding both companies.

Immediate Impact on VMware Stock Price

The announcement of the acquisition resulted in immediate fluctuations in both Broadcom's and VMware's stock prices.

- Stock price changes before, during, and after the announcement: VMware's stock price saw a significant jump upon the announcement, reflecting investor reaction to the acquisition price. Broadcom's stock price also experienced volatility.

- Investor sentiment reflected in trading volume: The trading volume for both stocks increased significantly following the announcement, indicating heightened investor interest and engagement.

Long-Term Outlook for VMware Shareholders

VMware shareholders will receive a substantial payout, but the long-term prospects depend on the success of the combined entity.

- Analysis of potential dividend payouts: The acquisition structure likely involves a cash payout to VMware shareholders, but the ultimate return will depend on the post-acquisition performance of the combined entity.

- Projected long-term stock performance post-acquisition: The long-term performance of the combined Broadcom entity will heavily influence the return on investment for VMware shareholders.

Competitive Landscape and Market Consolidation

The acquisition has significant implications for the competitive landscape, leading to increased market consolidation and potential antitrust concerns.

- Key competitors affected: This acquisition shifts the competitive dynamics within the enterprise software market, potentially impacting competitors like Cisco, HPE, and others.

- Potential implications for innovation: The reduced number of major players could potentially stifle innovation within the sector, leading to less competition and potentially higher prices for consumers.

- Discussion of potential antitrust investigations: Regulatory bodies are likely to scrutinize the deal to prevent anti-competitive practices and ensure fair market competition.

Regulatory Scrutiny and Antitrust Concerns

The scale of the Broadcom-VMware deal has attracted significant regulatory scrutiny and raised serious antitrust concerns.

Antitrust Investigations and Potential Outcomes

Various regulatory bodies are likely to investigate the deal for potential antitrust violations.

- Jurisdictions involved in reviews: The deal will likely be reviewed by antitrust regulators in the US, Europe, and other key jurisdictions.

- Potential remedies (divestiture, etc.): Depending on the outcome of the investigations, regulators might require Broadcom to divest certain assets or implement other remedies to mitigate potential anti-competitive effects.

- Timeline for regulatory approvals: The regulatory review process is likely to be lengthy, potentially delaying the closing of the deal or even leading to its rejection.

Impact of Regulatory Delays on the Deal

Regulatory delays could significantly impact the deal's timeline, cost, and overall success.

- Potential for renegotiation: Prolonged regulatory scrutiny could lead to renegotiations of the deal's terms.

- Impact on Broadcom's financial projections: Delays could affect Broadcom's financial projections and increase uncertainty around the expected synergies and ROI.

Conclusion

The Broadcom-VMware deal represents a watershed moment in the enterprise software landscape. The shocking price increase raises questions about financial risk and potential anti-competitive outcomes. While synergies are projected, the high cost necessitates close monitoring of the integration process, regulatory approvals, and the long-term impact on the competitive landscape. Staying informed on future developments in the Broadcom-VMware deal is crucial for understanding its full implications. Continue following news and analysis of the Broadcom-VMware deal to make informed decisions.

Featured Posts

-

Brazil Bound Justin Herbert And The Chargers Open 2025 Season Overseas

Apr 27, 2025

Brazil Bound Justin Herbert And The Chargers Open 2025 Season Overseas

Apr 27, 2025 -

Movies And Shows To Watch On Kanopy A Free Streaming Guide

Apr 27, 2025

Movies And Shows To Watch On Kanopy A Free Streaming Guide

Apr 27, 2025 -

Wta Success Belinda Bencics Postpartum Triumph

Apr 27, 2025

Wta Success Belinda Bencics Postpartum Triumph

Apr 27, 2025 -

Considerable Us Growth Slowdown Predicted By Deloitte

Apr 27, 2025

Considerable Us Growth Slowdown Predicted By Deloitte

Apr 27, 2025 -

Thueringen Artenvielfalt Von Eidechsen Und Molchen Im Neuen Atlas

Apr 27, 2025

Thueringen Artenvielfalt Von Eidechsen Und Molchen Im Neuen Atlas

Apr 27, 2025

Latest Posts

-

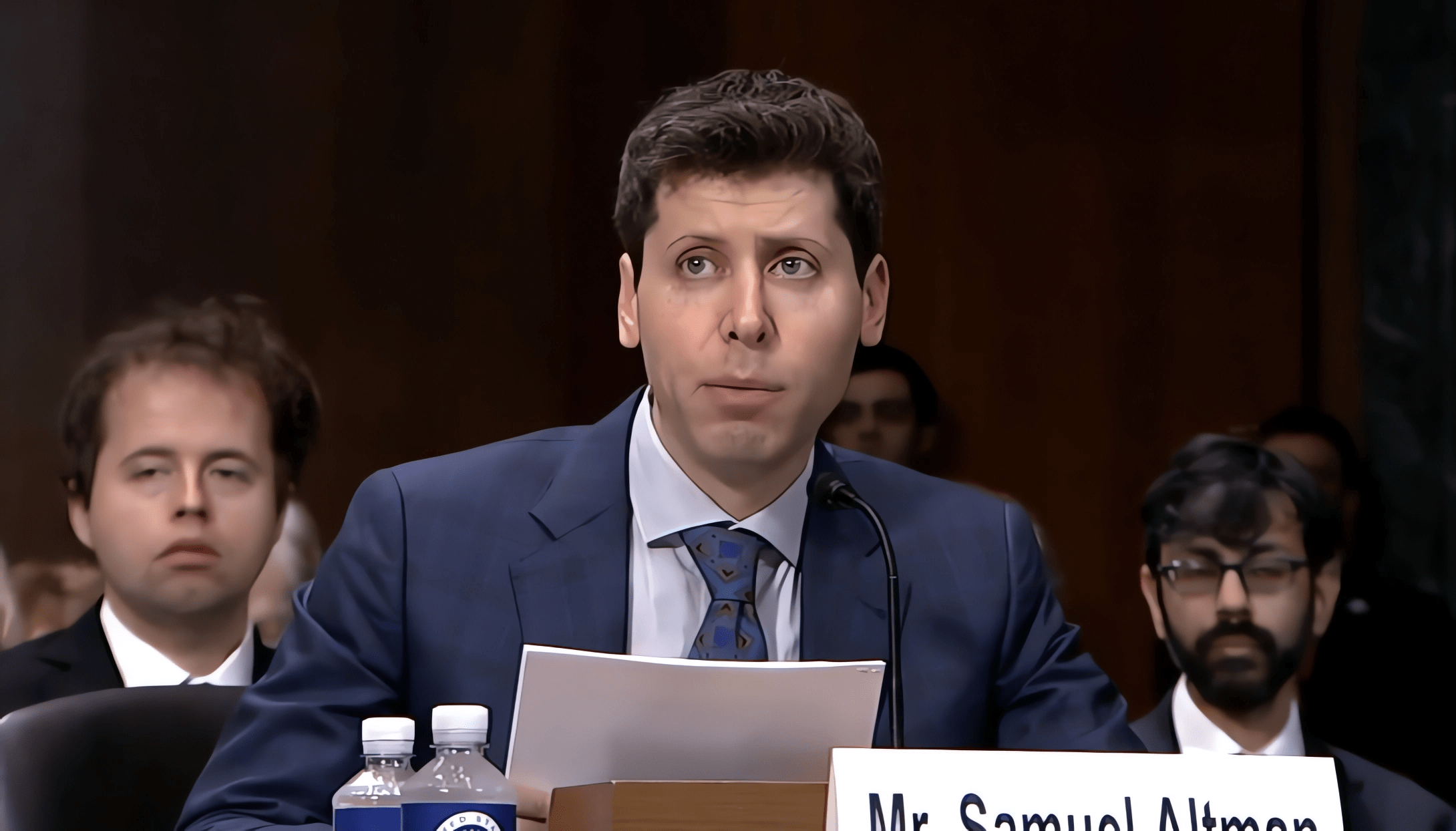

Open Ais Chat Gpt An Ftc Investigation And Its Potential Consequences

Apr 28, 2025

Open Ais Chat Gpt An Ftc Investigation And Its Potential Consequences

Apr 28, 2025 -

Chat Gpt Developer Open Ai Faces Ftc Investigation

Apr 28, 2025

Chat Gpt Developer Open Ai Faces Ftc Investigation

Apr 28, 2025 -

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Development

Apr 28, 2025

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Development

Apr 28, 2025 -

Jan 6 Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 28, 2025

Jan 6 Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 28, 2025 -

Cassidy Hutchinson Plans Memoir A Look Inside The January 6th Hearings

Apr 28, 2025

Cassidy Hutchinson Plans Memoir A Look Inside The January 6th Hearings

Apr 28, 2025