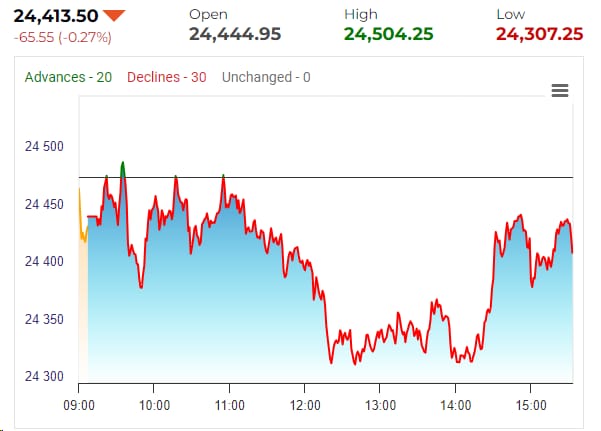

Why Current Stock Market Valuations Are Not A Cause For Alarm: BofA

Table of Contents

BofA's Rationale: Considering the Broader Economic Picture

BofA's overall assessment of the market is cautiously optimistic. While acknowledging the elevated valuation metrics, they emphasize the need to consider the broader economic context. Their analysis suggests that several factors mitigate the risks associated with high stock market valuations.

-

Strong Corporate Earnings Growth Despite Inflation: Despite persistent inflation, many companies have demonstrated resilience, reporting strong earnings growth. This suggests that businesses are effectively managing rising costs and maintaining profitability, a key factor supporting current stock prices.

-

Resilient Consumer Spending and Job Market: The consumer remains relatively strong, with robust spending despite inflationary pressures. A healthy job market further bolsters this positive outlook, indicating continued economic activity and supporting consumer confidence—crucial indicators for sustained market growth.

-

Long-Term Growth Potential of the Global Economy: BofA's long-term forecasts remain positive, pointing to the continued growth potential of the global economy. Emerging markets and technological advancements are expected to drive future growth, offsetting some of the concerns regarding current valuations.

-

Impact of Interest Rate Hikes on Valuations: While interest rate hikes by central banks aim to curb inflation, their impact on stock market valuations is complex. BofA's analyses suggest that while rate hikes can temporarily depress valuations, the long-term impact depends on factors such as the pace of rate increases and the overall health of the economy. They highlight that this is a factor that needs continued monitoring but isn't necessarily a cause for immediate alarm.

-

To support their claims, BofA regularly publishes detailed market reports and analyses. [Link to a relevant BofA report, if available].

Understanding Current Valuation Metrics: Beyond the Headlines

Understanding stock market valuations requires looking beyond simple headline figures. Common valuation metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales ratio are helpful, but they must be interpreted within their context.

-

Historical Context: Comparing current valuations to historical averages and past market cycles provides valuable perspective. While current P/E ratios might appear high compared to historical averages, they might be entirely reasonable considering factors like low interest rates and strong earnings growth in certain periods.

-

Sector-Specific Analysis: Not all sectors are created equal. A blanket assessment of "high valuations" overlooks the significant differences between sectors. Some sectors might be genuinely overvalued, while others may present compelling opportunities due to undervaluation. A granular analysis is crucial.

-

Addressing Concerns about Potential Market Bubbles: The term "market bubble" is often thrown around loosely. A true bubble involves unsustainable speculation that eventually bursts. BofA's assessment considers whether current valuations are driven by fundamental strength or speculative exuberance. Their analysis, which often involves detailed assessment of individual company financials, aims to distinguish between justified valuations and bubble-like conditions.

-

Misleading Metrics: It's crucial to understand that valuation metrics can be misleading without proper context. For example, a high P/E ratio might reflect strong future earnings growth potential, not necessarily overvaluation. A thorough analysis, considering a multitude of factors, is necessary to avoid misinterpretations.

The Impact of Inflation and Interest Rates on Stock Market Valuations

Inflation and interest rates significantly influence stock prices. Understanding this relationship is key to navigating the current market environment.

-

Inflation's Effect: High inflation erodes purchasing power and can negatively affect company earnings. However, companies that successfully manage pricing and maintain profit margins can weather inflationary pressures. BofA's analysis often evaluates companies' ability to navigate inflation, a crucial factor in assessing valuations.

-

Interest Rates and Discounted Cash Flow: Interest rates directly impact discounted cash flow valuations, a common method used to assess the intrinsic value of a company. Higher interest rates decrease the present value of future earnings, leading to lower valuations. This interaction is a crucial part of BofA's valuation models.

-

Mitigating Inflation's Impact: Investors can mitigate the impact of inflation by diversifying their portfolios, including inflation-hedging assets like commodities and real estate. BofA often provides guidance on portfolio strategies designed to address inflationary risks.

-

Long-Term vs. Short-Term Effects: The effects of interest rate changes are not instantaneous. Short-term market fluctuations are common, but the long-term impact depends on various factors including the overall economic environment and the actions of central banks. BofA’s analysis considers both the short-term volatility and the potential long-term implications.

Opportunities Within the Current Market Environment

Despite seemingly high stock market valuations, opportunities exist for discerning investors.

-

Identifying Undervalued Sectors or Companies: Through rigorous fundamental analysis, investors can identify undervalued sectors or companies that are not accurately reflecting their intrinsic value, potentially offering attractive entry points.

-

Risk Mitigation Strategies: In a volatile market, risk mitigation is paramount. Diversification across different asset classes, focusing on defensive stocks, and employing appropriate risk management strategies are all crucial elements in navigating market uncertainty.

-

Long-Term Investment Strategies: A long-term investment horizon is vital in mitigating the impact of short-term market fluctuations. Focusing on long-term growth potential minimizes the influence of short-term volatility on overall investment returns.

Conclusion

BofA's perspective on current stock market valuations suggests a more cautious, rather than alarmist, approach is warranted. While valuation metrics may appear elevated compared to historical averages, a nuanced analysis reveals several mitigating factors. Strong corporate earnings, resilient consumer spending, the long-term growth potential of the global economy, and a thorough understanding of the interplay between inflation and interest rates offer a more balanced view. Don't let fear drive your investment decisions. Conduct thorough research, consider your own risk tolerance, and develop a well-diversified investment strategy to navigate the current market landscape. Learn more about managing your investment portfolio in the face of fluctuating stock market valuations.

Featured Posts

-

Bayern Munich Vs Eintracht Frankfurt A Comprehensive Match Preview

May 09, 2025

Bayern Munich Vs Eintracht Frankfurt A Comprehensive Match Preview

May 09, 2025 -

So Very Fragile A Parenting Expert Explains The Risks Of Early Daycare

May 09, 2025

So Very Fragile A Parenting Expert Explains The Risks Of Early Daycare

May 09, 2025 -

De Indiase Strategie Van Brekelmans Doelen En Methoden

May 09, 2025

De Indiase Strategie Van Brekelmans Doelen En Methoden

May 09, 2025 -

Pam Bondi Accused Of Concealing Epstein Records Senate Democrats Speak Out

May 09, 2025

Pam Bondi Accused Of Concealing Epstein Records Senate Democrats Speak Out

May 09, 2025 -

Argumenti Zoshto Bekam E Nepobiten Bro 1 Vo Fudbalot

May 09, 2025

Argumenti Zoshto Bekam E Nepobiten Bro 1 Vo Fudbalot

May 09, 2025

Latest Posts

-

Bajaj Twins Drag Geopolitical Uncertainty Sensex Nifty 50 Daily Close

May 09, 2025

Bajaj Twins Drag Geopolitical Uncertainty Sensex Nifty 50 Daily Close

May 09, 2025 -

Whats The Real Safe Bet A Comparative Analysis Of Investment Vehicles

May 09, 2025

Whats The Real Safe Bet A Comparative Analysis Of Investment Vehicles

May 09, 2025 -

Stock Market Update Choppy Trading Bajaj Impact And Geopolitical Concerns

May 09, 2025

Stock Market Update Choppy Trading Bajaj Impact And Geopolitical Concerns

May 09, 2025 -

The Real Safe Bet Minimizing Risk And Maximizing Returns In Todays Market

May 09, 2025

The Real Safe Bet Minimizing Risk And Maximizing Returns In Todays Market

May 09, 2025 -

India Stock Market Today Sensex And Nifty 50 Close Flat Amidst Volatility

May 09, 2025

India Stock Market Today Sensex And Nifty 50 Close Flat Amidst Volatility

May 09, 2025