Widening Cracks In Private Credit: Credit Weekly Report

Table of Contents

Private credit, unlike public debt traded on exchanges, involves direct lending to companies outside the public markets. This includes various forms of financing, such as leveraged loans, direct lending, and mezzanine debt. It plays a vital role in financing businesses, particularly smaller and mid-sized companies that may not qualify for traditional bank loans or public bond offerings. However, the recent volatility highlights the inherent risks associated with this asset class.

Rising Default Rates in Private Credit

A worrying trend is emerging: default rates in the private credit market are climbing. Across various sectors, from real estate and technology to energy, borrowers are struggling to meet their obligations. Several high-profile defaults have recently shaken investor confidence, underscoring the growing fragility of this market segment. This increase is largely due to a confluence of factors, including:

- Rising Interest Rates: The significant increase in interest rates by central banks worldwide has dramatically increased borrowing costs for private credit borrowers, making it harder to service existing debt.

- Inflationary Pressures: Persistent inflation has eroded profit margins for many businesses, impacting their ability to repay loans.

- Economic Slowdown: A potential recession or economic slowdown further exacerbates the situation, reducing demand and revenue for many companies.

Several contributing factors to the increase in defaults include:

- Increased leverage in portfolio companies: Many companies took on significant debt during the low-interest-rate environment, leaving them highly vulnerable to rising rates.

- Reduced liquidity in the market: The decreased liquidity makes it challenging for companies to refinance or restructure their debt.

- Economic downturn impacting borrowers' ability to repay: The current economic climate is placing immense pressure on many businesses, increasing the likelihood of defaults.

- Impact on different sectors: The effects are not uniform; sectors like real estate and technology are particularly susceptible due to their high debt levels and sensitivity to interest rate changes.

Decreased Liquidity and Increased Volatility in the Private Credit Market

The reduced liquidity in the private credit market presents significant challenges for investors. Exiting investments has become increasingly difficult, leading to wider bid-ask spreads and depressed valuations. This illiquidity is further amplified by:

- Shrinking secondary market activity: Fewer trades are taking place, making it harder to determine accurate market prices.

- Wider bid-ask spreads: The difference between the buying and selling prices has widened significantly, reflecting the uncertainty in the market.

- Increased difficulty in fundraisings: Raising capital for new investments has become more challenging due to investor hesitation.

- Potential for fire sales impacting valuations: Investors needing to liquidate assets quickly may be forced to sell at significantly lower prices.

This decreased liquidity contributes to increased volatility in valuations, particularly for illiquid assets. The uncertainty surrounding valuations is causing many investors to adopt a more cautious approach, impacting new lending and pricing.

Impact of Rising Interest Rates on Private Credit

The surge in interest rates has dramatically altered the landscape of private credit. Borrowers now face substantially higher costs of borrowing, impacting their debt servicing capabilities and potentially leading to covenant breaches.

- Increased interest rate expense for borrowers: This directly reduces profitability and cash flow available for debt repayment.

- Higher borrowing costs for future deals: New deals will be significantly more expensive, impacting the feasibility of many projects.

- Potential for covenant breaches: Higher interest expenses can easily push borrowers beyond pre-agreed covenants, triggering default.

- Increased pressure on borrowers’ cash flow: This reduces their ability to withstand economic shocks and repay debt.

This increased risk profile necessitates a more cautious approach to private credit investments. Thorough due diligence and robust risk management strategies are crucial for navigating this environment.

Regulatory Scrutiny and Increased Compliance Costs

The private credit industry is facing increased regulatory scrutiny, resulting in significant compliance costs for fund managers. New reporting requirements, stricter due diligence processes, and enhanced oversight are all adding to operational expenses.

- New reporting requirements: Fund managers need to dedicate more resources to complying with evolving reporting standards.

- Increased due diligence and compliance procedures: The increased complexity adds to the cost and time required for evaluating potential investments.

- Higher legal and consulting fees: Navigating complex regulations requires specialized legal and consulting expertise.

- Potential for regulatory fines and penalties: Non-compliance can result in significant financial penalties.

These increased compliance costs directly impact the profitability and operational efficiency of private credit firms, necessitating adjustments to their investment strategies and fee structures.

Navigating the Widening Cracks in Private Credit

The private credit market is facing considerable headwinds. Rising default rates, decreased liquidity, higher interest rates, and increased regulatory scrutiny all present significant challenges for investors. However, this challenging environment also presents opportunities for experienced investors with robust risk management strategies. Careful due diligence, diversified portfolios, and a focus on distressed debt strategies can help mitigate some of the risks. For example, focusing on assets with strong underlying cash flows and stable businesses can help to offset increased interest rate pressure.

Stay informed about the evolving landscape of private credit by subscribing to our weekly reports and gaining insights into mitigating risks within the market. Understanding private credit market analysis and implementing effective private credit investment strategies are crucial for success in this dynamic environment.

Featured Posts

-

Federal Government Appoints Anti Vaxxer To Lead Autism Study

Apr 27, 2025

Federal Government Appoints Anti Vaxxer To Lead Autism Study

Apr 27, 2025 -

Wta Tennis Austria And Singapore To Decide 2023 Champions

Apr 27, 2025

Wta Tennis Austria And Singapore To Decide 2023 Champions

Apr 27, 2025 -

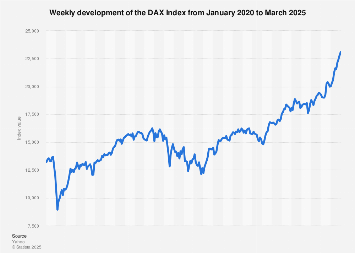

Dax Performance The Impact Of German Politics And Business Sentiment

Apr 27, 2025

Dax Performance The Impact Of German Politics And Business Sentiment

Apr 27, 2025 -

Ackman On The Us China Trade War Time As A Decisive Factor

Apr 27, 2025

Ackman On The Us China Trade War Time As A Decisive Factor

Apr 27, 2025 -

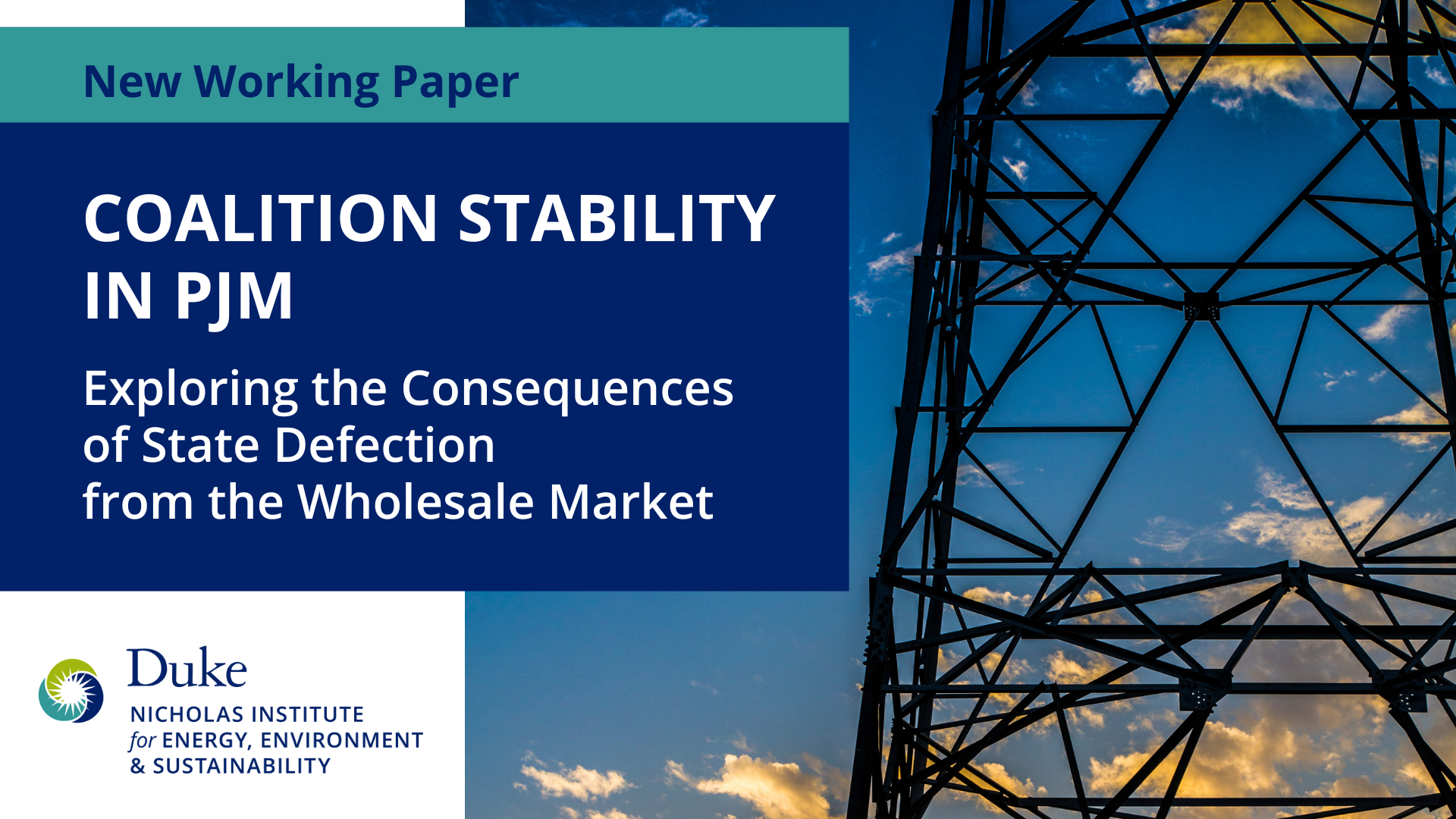

Coalition Stability Amidst Bsw Leadership Transition Crumbachs Departure

Apr 27, 2025

Coalition Stability Amidst Bsw Leadership Transition Crumbachs Departure

Apr 27, 2025

Latest Posts

-

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025

The U S Dollars First 100 Days A Historical Comparison

Apr 28, 2025 -

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025 -

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025

Nixons Shadow A Look At The Current U S Dollars Performance

Apr 28, 2025 -

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025

U S Dollar Weak Start To Presidency Mirrors Nixon Era

Apr 28, 2025 -

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025

Yukon Legislature Mine Managers Testimony Sparks Contempt Threat

Apr 28, 2025