110% Growth Potential? Why Billionaires Are Investing In This BlackRock ETF

Table of Contents

Unveiling the High-Growth BlackRock ETF

Identifying the Specific ETF

The ETF generating this significant attention is the iShares Global Clean Energy ETF (ICLN). This BlackRock ETF offers investors exposure to a diverse range of companies involved in the global clean energy sector.

Understanding its Investment Strategy

ICLN's investment strategy focuses on companies involved in various aspects of renewable energy. This includes solar power, wind energy, energy storage, biofuels, and other clean energy technologies. Its sector allocation is heavily weighted towards companies directly involved in the production and distribution of clean energy. Geographic diversification is a key component, with exposure to companies across various developed and emerging markets. The ETF primarily employs a growth investing strategy, focusing on companies with high growth potential in the burgeoning clean energy market.

- Focus on Renewable Energy: ICLN invests in companies producing solar, wind, and other renewable energy solutions.

- Exposure to Global Markets: The ETF provides exposure to both established and emerging markets in the clean energy sector.

- Emphasis on Innovation: ICLN targets companies at the forefront of clean energy innovation and technology development.

Why Billionaires Are Betting Big on This BlackRock ETF

The Appeal of Diversification

Billionaires often favor diversification to mitigate risk. ICLN offers portfolio diversification by providing exposure to a sector less correlated with traditional energy markets. This reduces overall portfolio volatility and helps to protect against market downturns in other sectors. Effective asset allocation is crucial for wealth preservation, and ICLN fits this strategy well.

Potential for High Returns

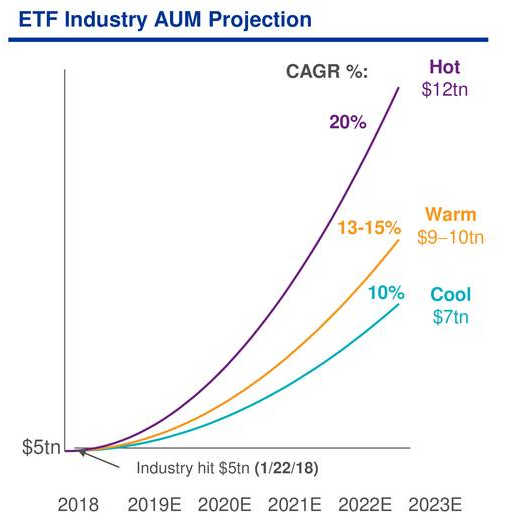

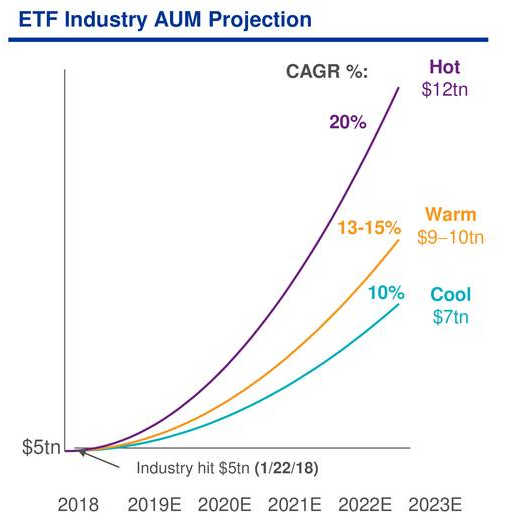

The clean energy sector is experiencing explosive growth, driven by increasing global demand for sustainable energy solutions and government support for renewable energy initiatives. While past performance is not indicative of future results, ICLN has shown strong historical performance, reflecting the growth of this sector. This potential for high returns, coupled with the growing importance of sustainability, makes it an attractive investment for those seeking significant growth opportunities.

- Market Trends: The increasing global focus on climate change and sustainability is driving significant investment in the clean energy sector.

- Technological Advancements: Continuous innovation in renewable energy technologies is boosting efficiency and lowering costs.

- Expert Opinions: Many analysts project continued strong growth for the clean energy sector, supporting the potential for high returns from ICLN.

Analyzing the 110% Growth Potential Claim

Fact-Checking the Claim

The 110% growth potential claim likely refers to a projected return over a specific investment horizon, possibly several years, under certain market conditions. Such projections are based on various assumptions, including continued strong growth in the clean energy sector, favorable regulatory environments, and technological advancements. It is crucial to remember that projected returns are not guaranteed and are subject to significant uncertainty.

Assessing the Risks Involved

While the potential returns are enticing, it's vital to acknowledge the inherent risks associated with ICLN. Investment risk includes market volatility, potential sector-specific downturns, and the inherent uncertainty associated with any long-term investment.

- Market Corrections: Broader market corrections can impact even high-growth sectors like clean energy.

- Sector-Specific Downturns: Negative developments in specific areas of the clean energy sector could negatively affect the ETF’s performance.

- Regulatory Changes: Changes in government policies and regulations could affect the growth of the clean energy sector.

To mitigate these risks, investors should consider diversifying their portfolio further and employing strategies like dollar-cost averaging. Understanding your individual investment goals and risk tolerance is paramount before investing in any asset, including ICLN.

How to Invest in This BlackRock ETF

Step-by-Step Guide

Investing in ICLN is relatively straightforward. You’ll need a brokerage account with a reputable firm. Most online brokerage platforms allow you to purchase ETFs like ICLN easily.

Important Considerations

Before investing, it’s crucial to consider several factors. Trading fees vary among brokerage platforms, so compare options. Tax implications depend on your individual circumstances, so consult a tax professional if needed. Consider your investment timeframe; ICLN is generally viewed as a long-term investment.

- Brokerage Accounts: Fidelity, Schwab, and TD Ameritrade are examples of brokerage accounts where you can buy ICLN.

- Purchase Process: The process generally involves searching for the ETF's ticker symbol (ICLN) and placing a buy order.

- Resource Links: Consult the websites of these brokerage firms for details on opening accounts and trading ETFs.

Conclusion

The iShares Global Clean Energy ETF (ICLN) presents a compelling investment opportunity, particularly given its focus on the rapidly growing clean energy sector and its appeal to sophisticated investors. While the claim of 110% growth potential requires careful consideration and depends heavily on various factors, the underlying growth potential of the clean energy sector is undeniable. Remember that all investments carry risk; thorough due diligence and a careful consideration of your personal risk tolerance are crucial. Explore this BlackRock ETF and consider investing in this high-growth opportunity, but only after conducting your own research and understanding the associated risks. Remember to always consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

The Strengthening Taiwan Dollar And The Path To Economic Restructuring

May 08, 2025

The Strengthening Taiwan Dollar And The Path To Economic Restructuring

May 08, 2025 -

0 4

May 08, 2025

0 4

May 08, 2025 -

Analyzing Play Station Podcast Episode 512 The True Blue Story

May 08, 2025

Analyzing Play Station Podcast Episode 512 The True Blue Story

May 08, 2025 -

Is Bitcoins Rebound Just The Beginning A Deep Dive Into Market Predictions

May 08, 2025

Is Bitcoins Rebound Just The Beginning A Deep Dive Into Market Predictions

May 08, 2025 -

Psg Opens Doha Labs A Global Innovation Expansion Begins

May 08, 2025

Psg Opens Doha Labs A Global Innovation Expansion Begins

May 08, 2025

Latest Posts

-

Analyzing Ripples Xrp Potential Can It Break Through To 3 40

May 08, 2025

Analyzing Ripples Xrp Potential Can It Break Through To 3 40

May 08, 2025 -

Ripples Xrp Assessing The Likelihood Of A Price Increase To 3 40

May 08, 2025

Ripples Xrp Assessing The Likelihood Of A Price Increase To 3 40

May 08, 2025 -

Is 3 40 A Realistic Price For Xrp Ripples Market Analysis

May 08, 2025

Is 3 40 A Realistic Price For Xrp Ripples Market Analysis

May 08, 2025 -

Xrp Ripple A High Risk High Reward Investment Opportunity

May 08, 2025

Xrp Ripple A High Risk High Reward Investment Opportunity

May 08, 2025 -

Analyzing The Challenges Why Xrp Etfs May Underperform Expectations

May 08, 2025

Analyzing The Challenges Why Xrp Etfs May Underperform Expectations

May 08, 2025