Bitcoin's 10x Multiplier: Could It Take Wall Street By Storm?

Table of Contents

Bitcoin's Technological Advantages & Growing Adoption

Bitcoin's inherent strengths are driving its increasing adoption and fueling speculation about a potential 10x price increase.

Decentralization and Security

Bitcoin's decentralized nature is a key differentiator. Unlike traditional financial systems controlled by central authorities, Bitcoin operates on a peer-to-peer network secured by blockchain technology. This makes it resistant to censorship and manipulation.

- Blockchain Technology: A distributed, immutable ledger recording all Bitcoin transactions, ensuring transparency and security.

- Mining Process: The process of validating transactions and adding new blocks to the blockchain, secured by cryptographic hashing algorithms.

- Cryptographic Security: Advanced encryption techniques protect Bitcoin transactions and prevent unauthorized access.

This robust security, combined with the decentralized finance (DeFi) movement's increasing reliance on blockchain technology, contributes significantly to Bitcoin's appeal as a secure and reliable store of value. The cryptographic hashing algorithms ensure the integrity of each transaction, making it virtually impossible to alter or counterfeit.

Increased Institutional Investment

Institutional investors are increasingly embracing Bitcoin, viewing it as a potential diversification tool and a hedge against inflation. This growing acceptance significantly impacts Bitcoin's market capitalization and price.

- Grayscale Bitcoin Trust (GBTC): A publicly traded investment vehicle providing exposure to Bitcoin.

- MicroStrategy's Bitcoin Holdings: A prominent example of a publicly traded company holding a substantial amount of Bitcoin as a treasury asset.

- Other Large Companies: Many other large corporations are exploring Bitcoin investments, adding legitimacy and increasing market demand.

The growing interest from institutional investors, including hedge funds and asset management firms, suggests a shift in perception of Bitcoin from a speculative asset to a more mainstream investment option. The potential for a Bitcoin ETF (Exchange Traded Fund) further fuels this trend and could significantly impact price.

Growing Global Adoption & Use Cases

Bitcoin's use cases are expanding beyond simple speculation, driving its global adoption.

- El Salvador adopting Bitcoin as legal tender: A landmark event demonstrating the potential for Bitcoin to become a widely accepted form of currency.

- International Remittances: Bitcoin facilitates faster and cheaper cross-border payments, benefiting millions of people globally.

- Growth of Bitcoin ATMs: Increasing access to Bitcoin through ATMs further enhances its accessibility and convenience.

Bitcoin's growing acceptance as a store of value, a medium of exchange, and its potential in various sectors, including international remittance and payment gateways, underpins its potential for sustained growth. The classification of Bitcoin as "digital gold" reflects its growing appeal as a hedge against inflation and a store of value.

Challenges Facing Bitcoin's Ascent to a 10x Multiplier

Despite its potential, several challenges could hinder Bitcoin's path to a 10x multiplier.

Volatility and Price Fluctuations

Bitcoin's price is notoriously volatile, presenting significant risks for investors.

- Historical Price Swings: Bitcoin has experienced dramatic price increases and decreases throughout its history.

- Regulatory Uncertainty: Varying regulatory approaches across different countries create uncertainty and potential risks.

- Market Manipulation Concerns: The relatively smaller market capitalization compared to traditional assets makes it potentially susceptible to manipulation.

Effective risk management strategies are crucial for navigating Bitcoin's volatility. Understanding the factors driving price fluctuations and the regulatory landscape is crucial for making informed investment decisions. Predicting Bitcoin's price with accuracy remains challenging due to its volatility.

Scalability Issues and Transaction Fees

Bitcoin's transaction processing speed is a limitation, potentially impacting widespread adoption.

- Transaction Speed: Compared to traditional payment systems, Bitcoin transactions can be slower.

- Transaction Fees: Fees can vary depending on network congestion, potentially discouraging wider usage.

- Lightning Network: A second-layer solution aiming to improve scalability and reduce transaction fees.

Solutions like the Lightning Network are actively being developed to address scalability issues. However, overcoming these challenges is crucial for Bitcoin to achieve mass adoption and compete effectively with existing payment systems.

Regulatory Hurdles and Government Intervention

Government regulations play a significant role in Bitcoin's future.

- Varying Regulatory Approaches: Different countries have different regulations, creating a complex landscape.

- Potential for Future Regulations: Governments worldwide are developing regulatory frameworks for cryptocurrencies, which could impact Bitcoin's growth.

- Impact of Taxation: Taxation policies on Bitcoin vary significantly across jurisdictions, impacting its investment attractiveness.

Navigating the complex regulatory landscape is crucial for the continued growth of Bitcoin. Clear and consistent regulations are needed to foster innovation and prevent market manipulation.

Predicting Bitcoin's Future: The Path to a 10x Multiplier

Predicting Bitcoin's future price is challenging, but analyzing market trends and various factors can shed light on potential scenarios.

Analyzing Market Trends and Predictions

Several factors could contribute to a 10x price increase:

- Bitcoin Price Prediction Models: Various models exist, using technical and fundamental analysis to forecast future prices.

- Macroeconomic Factors: Global economic conditions, inflation, and geopolitical events can significantly impact Bitcoin's price.

- Technological Advancements: Innovation within the Bitcoin ecosystem, such as improvements in scalability and user experience, could drive growth.

Combining technical analysis, fundamental analysis, and consideration of macroeconomic factors are crucial for building a robust Bitcoin price prediction model.

The Role of Inflation and Safe-Haven Assets

Bitcoin's potential as a hedge against inflation and a safe-haven asset is a major driver of its appeal.

- Inflation Hedge: Bitcoin's limited supply and decentralized nature make it potentially attractive as an inflation hedge.

- Comparison to Gold: Often compared to gold as a store of value, Bitcoin's potential to appreciate in value during inflationary periods is a key attraction for many investors.

The potential of Bitcoin to act as a safe-haven asset during periods of economic uncertainty could drive significant price increases. Its comparison to gold as a "digital gold" further strengthens its appeal.

Conclusion

Bitcoin's potential for a 10x multiplier is a compelling proposition, driven by its technological advantages and growing adoption. However, significant challenges remain, including volatility, scalability, and regulatory hurdles. Analyzing market trends and understanding the interplay of these factors are crucial for navigating this complex landscape. Whether Bitcoin conquers Wall Street remains to be seen, but its impact on the financial world is undeniable. Stay informed about Bitcoin developments, assess the inherent risks, and make informed decisions before investing in this volatile yet potentially revolutionary digital currency.

Featured Posts

-

Stephen Kings The Long Walk Official Movie Release Date Unveiled

May 08, 2025

Stephen Kings The Long Walk Official Movie Release Date Unveiled

May 08, 2025 -

Possible Canada Post Strike In Late October What To Expect

May 08, 2025

Possible Canada Post Strike In Late October What To Expect

May 08, 2025 -

Ev Mandate Opposition Car Dealers Double Down On Concerns

May 08, 2025

Ev Mandate Opposition Car Dealers Double Down On Concerns

May 08, 2025 -

Lyon Psg Maci Canli Izle Lig 1 I Nereden Ve Hangi Kanalda Izleyebilirsiniz

May 08, 2025

Lyon Psg Maci Canli Izle Lig 1 I Nereden Ve Hangi Kanalda Izleyebilirsiniz

May 08, 2025 -

Trump Media And Crypto Coms Etf Partnership Sends Cro Price Higher

May 08, 2025

Trump Media And Crypto Coms Etf Partnership Sends Cro Price Higher

May 08, 2025

Latest Posts

-

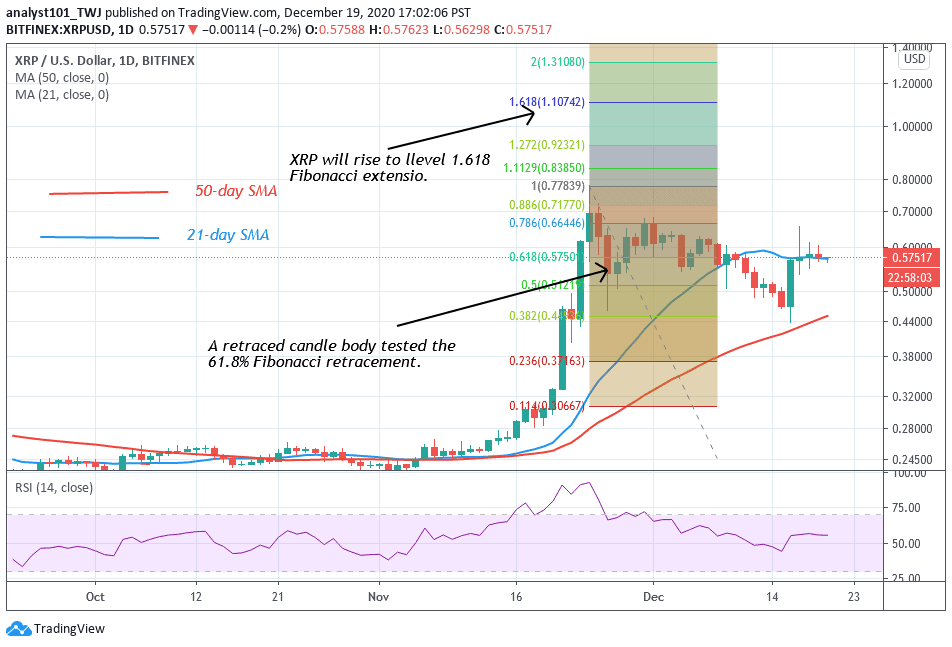

Analyzing The Challenges Why Xrp Etfs May Underperform Expectations

May 08, 2025

Analyzing The Challenges Why Xrp Etfs May Underperform Expectations

May 08, 2025 -

Ripple Xrp On The Rise A Look At Its Potential To Hit 3 40

May 08, 2025

Ripple Xrp On The Rise A Look At Its Potential To Hit 3 40

May 08, 2025 -

Ripples Xrp A Comprehensive Guide For Potential Investors

May 08, 2025

Ripples Xrp A Comprehensive Guide For Potential Investors

May 08, 2025 -

Xrp Etf Risks The Impact Of High Supply And Limited Institutional Adoption

May 08, 2025

Xrp Etf Risks The Impact Of High Supply And Limited Institutional Adoption

May 08, 2025 -

Can Xrp Hit 3 40 Analyzing Ripples Resistance Levels

May 08, 2025

Can Xrp Hit 3 40 Analyzing Ripples Resistance Levels

May 08, 2025