Disney's Profit Outlook Rises: Parks And Streaming Drive Growth

Table of Contents

Theme Park Revenue Surge: A Key Driver of Disney's Profitability

Increased Attendance and Spending at Disney Parks Worldwide

Disney Parks revenue is booming, fueled by increased attendance and higher guest spending across its global portfolio. This positive trend is evident in several key areas:

- Disneyland Resort (California): Experienced a significant rebound in attendance post-pandemic, with robust spending on merchandise and dining.

- Walt Disney World Resort (Florida): Continues to be a major revenue driver, benefiting from new attractions and increased hotel occupancy.

- Disneyland Paris: Saw strong growth in international tourism, contributing significantly to overall park revenue.

- Shanghai Disneyland: Maintained consistent popularity, demonstrating the enduring appeal of the Disney brand in Asia.

The average spending per guest has also increased significantly. This is partly due to higher ticket prices but also reflects increased spending on premium experiences, such as Genie+, expedited ride access, and higher-priced dining options. The successful implementation of Genie+ demonstrates Disney's ability to effectively monetize the guest experience, boosting Disney Parks revenue and contributing directly to a positive Disney's profit outlook.

Strategic Investments Paying Off: New Attractions and Enhancements

Disney's strategic investments in new attractions and park enhancements are paying significant dividends. These improvements are attracting more visitors and encouraging higher spending per guest:

- Star Wars: Galaxy's Edge (Disneyland & Disney World): This immersive land continues to draw large crowds and generate substantial revenue.

- Avengers Campus (Disneyland & Disney World): The Marvel-themed land provides further opportunities for guest spending on immersive experiences.

- TRON Lightcycle / Run (Magic Kingdom): This highly anticipated new ride is expected to further boost attendance and revenue at Magic Kingdom.

- Ongoing renovations and expansions: Continuous improvements to existing attractions and infrastructure further enhance the guest experience and justify higher ticket prices.

These investments directly impact park expansion and contribute to higher occupancy rates in Disney resorts, resulting in a substantial positive effect on the overall Disney's profit outlook.

Disney+ and Streaming Success: A Powerful Growth Engine

Subscriber Growth and Engagement Metrics

Disney+ has emerged as a major growth engine, significantly impacting Disney's profit outlook. Key metrics illustrate this success:

- Impressive subscriber growth: Disney+ has exceeded subscriber growth targets, adding millions of subscribers globally.

- Rising ARPU (Average Revenue Per User): The company has successfully increased ARPU through price increases and the introduction of bundled services.

- High engagement rates: Popular content, including Marvel and Star Wars series, keeps viewers engaged, leading to higher retention rates.

The success of Disney+ is also heavily influenced by the release of blockbuster content and the expansion into new international markets, increasing global reach and revenue.

Content Strategy and Investment: Fueling Future Growth

Disney's strategic content investments are crucial to maintaining its competitive edge in the crowded streaming landscape:

- Focus on original programming: The company continues to invest heavily in high-quality original programming across various genres.

- Leveraging existing franchises: Disney is effectively leveraging its existing intellectual property (IP) to create compelling new content for its streaming platform.

- Strategic acquisitions: Acquisitions of studios and production companies enhance the company's content library and production capabilities.

This robust content strategy, combined with effective marketing and distribution, is essential for continued subscriber growth and, consequently, a stronger Disney's profit outlook.

Synergies Between Parks and Streaming: A Powerful Combination

Leveraging Intellectual Property Across Platforms

Disney masterfully leverages its intellectual property (IP) across its parks and streaming services, creating a powerful synergy:

- Cross-promotion: Streaming content promotes park visits, and park experiences generate interest in streaming content.

- Franchise expansion: New characters and storylines introduced in streaming shows often find their way into the parks, extending the franchise's lifespan and appeal.

- Merchandise sales: Successful streaming shows drive sales of related merchandise in the parks and online.

This integrated approach maximizes the value of Disney's IP, driving revenue across multiple platforms and significantly contributing to the overall Disney's profit outlook.

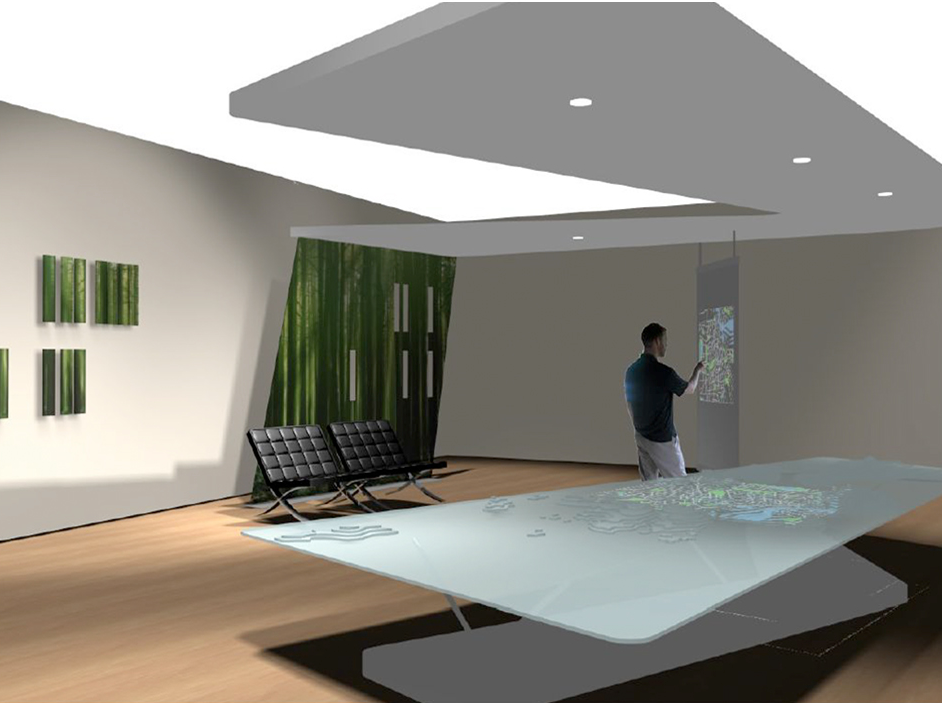

Enhanced Guest Experience Through Technology and Integration

Technology plays a vital role in enhancing the guest experience and strengthening the synergy between parks and streaming:

- Mobile app integration: The My Disney Experience app streamlines park planning and enhances on-site experiences.

- Wearable technology: Wearable devices provide guests with real-time information and enhance the interactive elements of park experiences.

- Personalized experiences: Data-driven personalization tailors guest experiences both in the parks and on the streaming platform.

These technological advancements improve guest satisfaction and encourage repeat visits and increased spending, contributing positively to Disney's profit outlook.

Conclusion

Disney's improved profit outlook is a direct result of the strong performance of its theme parks and the resounding success of its streaming services, Disney+. The synergistic relationship between these two core businesses, coupled with strategic investments and innovative technological integration, positions Disney for continued growth in the entertainment industry. Keep an eye on Disney's continued growth and its impact on the entertainment industry. Stay tuned for updates on Disney's profit outlook and the ongoing evolution of its business model.

Featured Posts

-

Elon Musks Brother Kimbal Musk Philanthropy Restaurants And Political Activism

May 09, 2025

Elon Musks Brother Kimbal Musk Philanthropy Restaurants And Political Activism

May 09, 2025 -

Daycare Vs Stay At Home Parenting Making The Right Choice

May 09, 2025

Daycare Vs Stay At Home Parenting Making The Right Choice

May 09, 2025 -

6

May 09, 2025

6

May 09, 2025 -

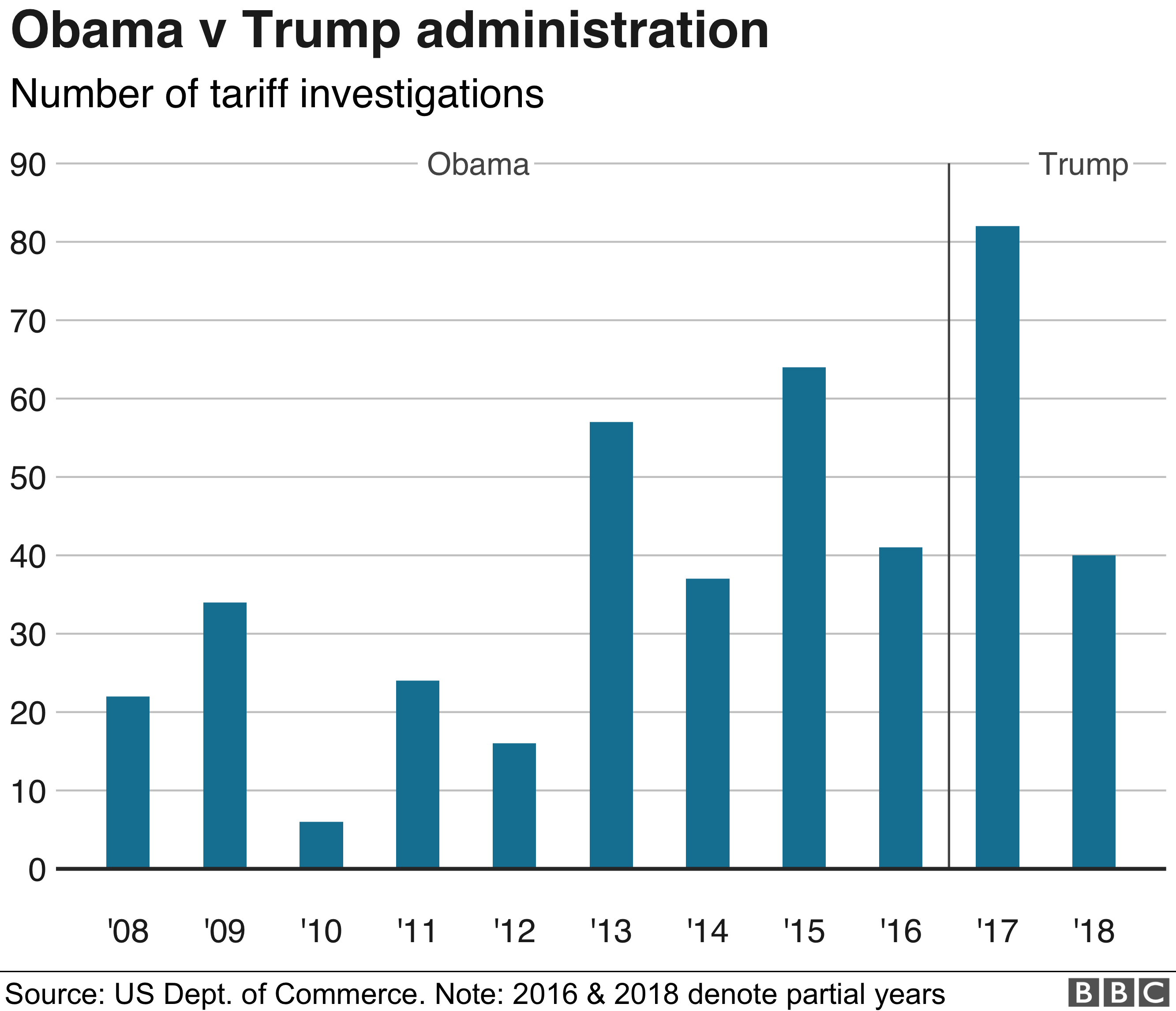

Persistent Tariffs Senator Warner On Trumps Trade Strategy

May 09, 2025

Persistent Tariffs Senator Warner On Trumps Trade Strategy

May 09, 2025 -

Farages Reform Will It Succeed Where Others Have Failed

May 09, 2025

Farages Reform Will It Succeed Where Others Have Failed

May 09, 2025

Latest Posts

-

Palantir Stock Before May 5th Is Now The Time To Buy Wall Streets Verdict

May 09, 2025

Palantir Stock Before May 5th Is Now The Time To Buy Wall Streets Verdict

May 09, 2025 -

Palantir Stock A Current Market Assessment And Investment Recommendation

May 09, 2025

Palantir Stock A Current Market Assessment And Investment Recommendation

May 09, 2025 -

Is Palantir Stock A Good Investment Evaluating The Risks And Rewards

May 09, 2025

Is Palantir Stock A Good Investment Evaluating The Risks And Rewards

May 09, 2025 -

Palantir Technology Stock Should You Invest Before May 5th

May 09, 2025

Palantir Technology Stock Should You Invest Before May 5th

May 09, 2025 -

Is Palantir Stock A Buy Right Now A Comprehensive Analysis

May 09, 2025

Is Palantir Stock A Buy Right Now A Comprehensive Analysis

May 09, 2025