Ethereum Price Remains Firm: Upside Potential Explored

Table of Contents

Ethereum's Recent Price Performance and Market Sentiment

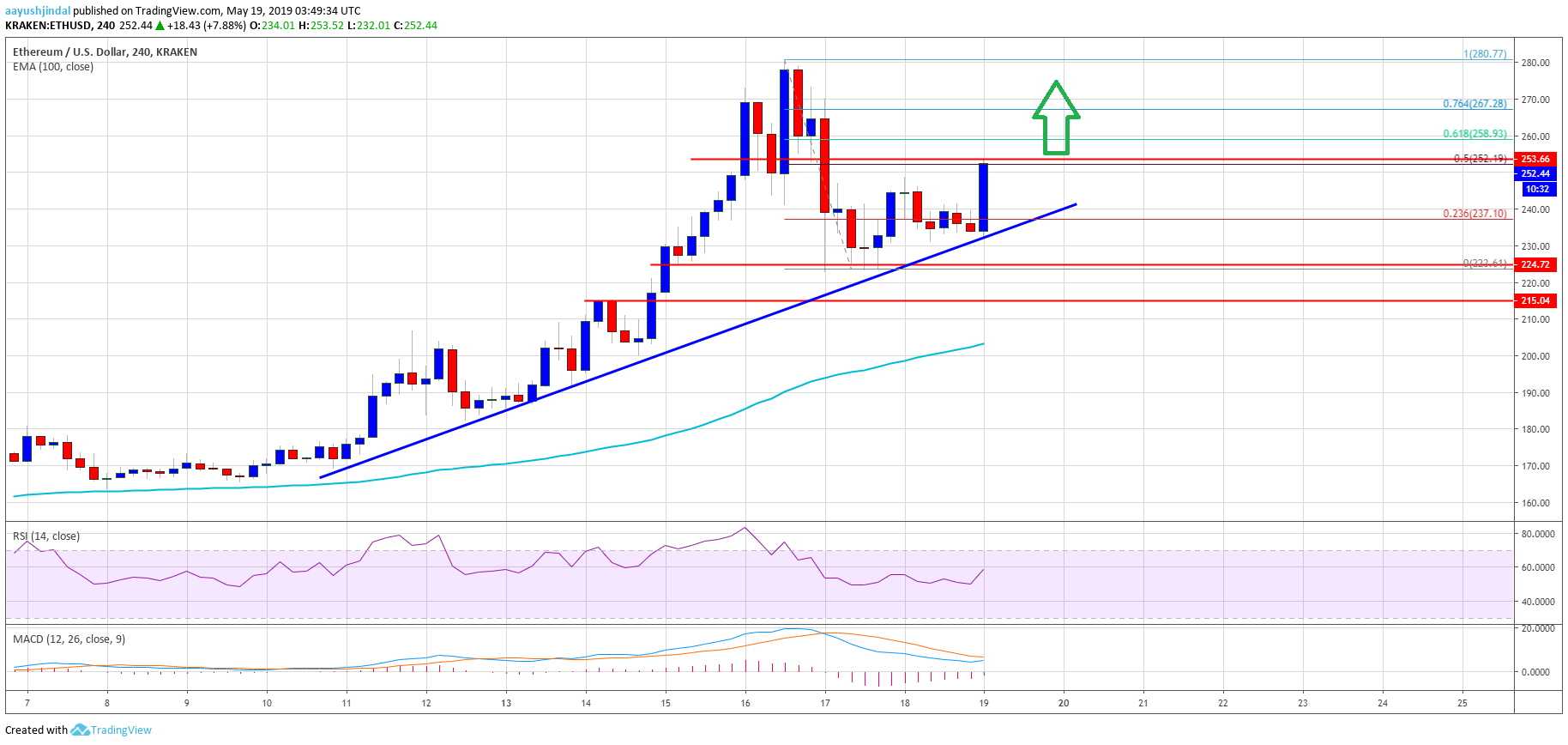

The Ethereum price has demonstrated resilience amidst market volatility. While Bitcoin, the leading cryptocurrency, has experienced fluctuations, Ethereum has shown relatively consistent performance. Analyzing charts from reputable sources like CoinMarketCap reveals a period of consolidation, indicating a potential accumulation phase. This suggests positive market sentiment, although not unequivocally bullish.

- Price points and percentage changes: Over the last month, Ethereum has shown a [Insert actual data and percentage change here] fluctuation, showcasing relative stability compared to other cryptocurrencies.

- Trading volume: Increased trading volume during this period suggests heightened market interest and active participation, bolstering the Ethereum price’s stability.

- Bitcoin correlation: While Ethereum price often correlates with Bitcoin’s price, recent data shows a degree of decoupling, signifying growing independent value.

Recent news, including [insert relevant news, e.g., regulatory developments or partnerships], has further influenced market sentiment towards Ethereum. While specific events can cause short-term price swings, the overall sentiment appears cautiously optimistic about the long-term potential of the Ethereum price.

Technological Advancements Driving Ethereum's Value

Ethereum's underlying technology is a significant driver of its value. The ongoing rollout of Ethereum 2.0, with its transition to a proof-of-stake consensus mechanism, is a game-changer. This upgrade dramatically improves scalability and reduces transaction fees.

- Sharding: The implementation of sharding significantly enhances network efficiency by distributing transaction processing across multiple chains, boosting throughput and reducing latency.

- Improved security features: Upgrades have enhanced the security and resilience of the Ethereum network, increasing investor confidence and contributing to a more stable Ethereum price.

- Upcoming upgrades: Future developments, such as [mention specific upcoming upgrades], promise further improvements in scalability, speed, and security, fueling future price appreciation. These enhancements are directly impacting the Ethereum price positively.

These advancements are not just theoretical; they are actively improving the user experience and laying the foundation for broader adoption, thus underpinning the Ethereum price.

The Growing DeFi Ecosystem and its Influence on Ethereum Price

The Decentralized Finance (DeFi) ecosystem flourishing on the Ethereum network is a crucial factor influencing the Ethereum price. The increasing number of DeFi applications and the total value locked (TVL) in these protocols directly impact demand for ETH.

- Popular DeFi applications: Projects like Uniswap, Aave, and Compound, built on Ethereum, have attracted billions of dollars in locked value, fostering strong demand for ETH.

- Demand for ETH: DeFi activities require ETH for gas fees and transactions, creating consistent demand and supporting the Ethereum price.

- Future DeFi growth: The ongoing development and innovation within the DeFi space are expected to further drive the growth of the Ethereum network, positively affecting the Ethereum price.

The strong correlation between DeFi growth and the Ethereum price highlights the vital role of this ecosystem in driving value.

Institutional Investment and Adoption of Ethereum

The growing interest from institutional investors is significantly impacting the Ethereum price. Large firms and funds are increasingly recognizing the long-term potential of Ethereum and its underlying technology.

- Examples of institutional adoption: [Insert examples of companies or funds investing in or using Ethereum]. These high-profile investments lend credibility and stability to the Ethereum price.

- Impact of large-scale investment: Significant institutional investment brings substantial capital into the market, increasing demand and supporting the Ethereum price.

- Future institutional investment: As regulatory clarity improves and institutional understanding of blockchain technology deepens, further investment is anticipated, potentially leading to a sustained upward trend in the Ethereum price.

This growing institutional support provides a strong foundation for the long-term stability and growth of the Ethereum price.

Conclusion: Ethereum Price Outlook and Call to Action

This analysis shows that the current firmness of the Ethereum price is underpinned by a combination of factors: technological advancements, DeFi growth, and increasing institutional adoption. While the cryptocurrency market remains inherently volatile, the positive trends discussed suggest a strong potential for upside in the Ethereum price. However, it’s crucial to approach any investment with caution.

We encourage you to conduct your own thorough research on Ethereum price analysis and consider exploring future Ethereum price predictions before making any investment decisions. Investigate various Ethereum investment strategies to find one that aligns with your risk tolerance. The future of the Ethereum price holds considerable potential, and by staying informed, you can navigate the market effectively. The potential for the Ethereum price to continue its upward trajectory is significant, making it an asset worth monitoring closely.

Featured Posts

-

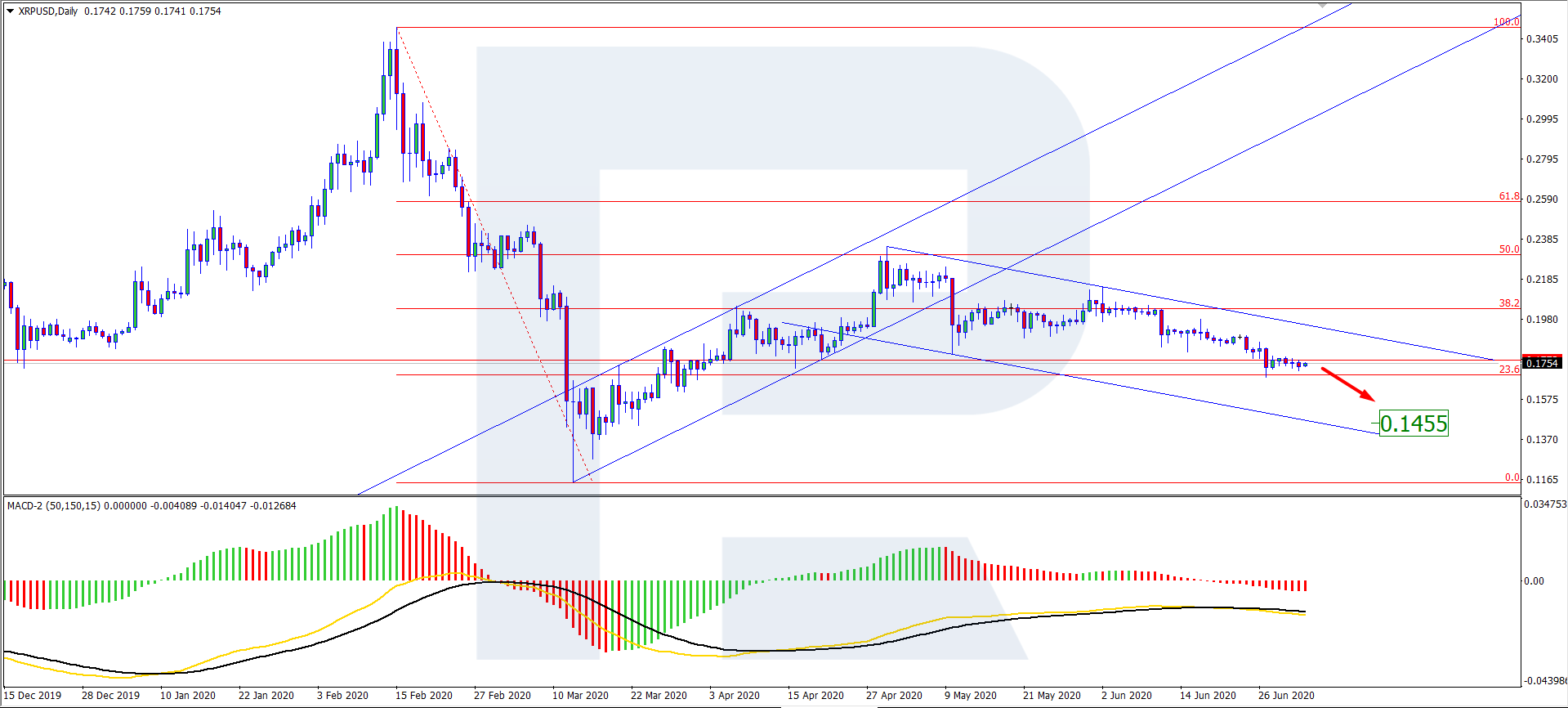

Xrp Price Rally Outperforming Bitcoin And Other Cryptos Post Sec Grayscale Etf News

May 08, 2025

Xrp Price Rally Outperforming Bitcoin And Other Cryptos Post Sec Grayscale Etf News

May 08, 2025 -

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025 -

Ethereum Price Strength Bulls In Control Upside Potential High

May 08, 2025

Ethereum Price Strength Bulls In Control Upside Potential High

May 08, 2025 -

Wednesday April 2nd 2025 Official Lotto And Lotto Plus Results

May 08, 2025

Wednesday April 2nd 2025 Official Lotto And Lotto Plus Results

May 08, 2025 -

Inter Milans Champions League Triumph A First Leg Masterclass Against Bayern

May 08, 2025

Inter Milans Champions League Triumph A First Leg Masterclass Against Bayern

May 08, 2025

Latest Posts

-

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025 -

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025 -

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025 -

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025

Understanding Xrps 400 Surge Future Price Prospects

May 08, 2025 -

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025

Can Xrp Continue Its Ascent After A 400 Increase

May 08, 2025