Uber Stock Rebound Hinges On Autonomous Vehicle Success

Table of Contents

The Current State of Uber's Autonomous Vehicle Program

Uber's ambition to revolutionize transportation with self-driving cars is well-documented, but the path has been fraught with challenges. Their autonomous driving program is a complex undertaking, requiring significant technological advancements and overcoming substantial hurdles.

Technological Challenges

Developing fully autonomous vehicles is incredibly difficult. Uber, like other players in the autonomous vehicle market, faces a multitude of technological obstacles:

- Software Glitches: Software errors can lead to unpredictable vehicle behavior, necessitating constant refinement and testing. Recent incidents have highlighted the need for robust, fail-safe systems.

- Safety Concerns: Ensuring the safety of autonomous vehicles is paramount. Accidents involving self-driving cars, even those involving human error, can severely damage public trust and regulatory acceptance.

- Mapping and Navigation: Accurately mapping and navigating diverse environments – from busy city streets to rural areas – presents a complex challenge for self-driving technology. Unforeseen obstacles and changing conditions require sophisticated sensor and AI systems.

- High Development Costs: The research, development, and testing involved in autonomous robotaxi development are incredibly expensive, demanding significant ongoing investment.

Competitive Landscape

Uber is not alone in the race to develop self-driving technology. It faces stiff competition from well-funded and technologically advanced companies such as:

- Waymo: Alphabet's Waymo boasts a significant head start in terms of testing miles and technological maturity.

- Cruise: General Motors' Cruise is another major player, focusing heavily on large-scale deployment in specific cities.

- Tesla: Tesla's Autopilot system, while not fully autonomous, is pushing the boundaries of driver-assistance technology and represents a considerable competitor in the broader autonomous vehicle market.

This intense autonomous vehicle competition means Uber must consistently innovate to maintain a competitive edge and secure a substantial robotaxi market share.

The Potential Impact of Successful Autonomous Vehicles on Uber's Revenue and Profitability

If Uber successfully deploys a profitable autonomous vehicle fleet, the potential impact on its financial performance could be transformative.

Reduced Operational Costs

Autonomous vehicles could dramatically reduce Uber's operational expenses. This includes:

- Driver Salaries: Eliminating the need for human drivers would represent a massive cost saving.

- Insurance Premiums: Insurance costs for autonomous vehicles could be significantly lower than for human-driven vehicles, especially once a robust safety record is established.

- Increased Operational Efficiency: Optimized routing and scheduling algorithms could enhance efficiency and reduce fuel consumption.

These cost reduction strategies could significantly boost Uber's profitability and potentially reshape the autonomous vehicle profitability model.

Increased Market Share and Revenue Streams

The successful implementation of autonomous vehicles could open up new avenues for revenue generation and market expansion:

- Increased Ridership: Lower fares and increased availability could attract new customers and boost ridership.

- New Service Offerings: Autonomous vehicles could facilitate new services, including on-demand delivery, autonomous trucking, and subscription-based mobility solutions.

- Expansion into New Markets: Autonomous vehicles could allow Uber to expand into underserved areas or regions where driver availability is limited.

These factors could significantly increase revenue generation, creating a powerful autonomous vehicle business model.

Risks and Uncertainties Associated with Uber's Autonomous Vehicle Investment

Despite the potential benefits, significant risks and uncertainties are associated with Uber's autonomous vehicle investment.

Regulatory Hurdles

Navigating the regulatory landscape for autonomous vehicles is a complex and time-consuming process. Challenges include:

- Varying Regulations: Regulations governing autonomous vehicles differ widely across jurisdictions, creating complexities for deployment and scalability.

- Legal Liabilities: Determining liability in the event of an accident involving an autonomous vehicle presents a significant legal challenge.

- Safety Standards: Meeting stringent safety standards and gaining regulatory approval will be crucial for the widespread adoption of self-driving cars.

Public Perception and Acceptance

Public trust and acceptance are essential for the success of Uber's autonomous vehicle program.

- Negative Media Coverage: Accidents involving autonomous vehicles often receive extensive media coverage, which can negatively impact public perception.

- Safety Concerns: Many people harbor concerns about the safety and reliability of self-driving technology, requiring effective public education campaigns.

- Ethical Dilemmas: The ethical implications of autonomous vehicle decision-making in unavoidable accident scenarios need careful consideration and public discussion.

Conclusion: The Future of Uber Stock and Autonomous Driving

Uber's stock price is intrinsically linked to the success of its autonomous vehicle program. While the potential rewards of a successful autonomous vehicle fleet are substantial—including reduced operational costs, increased market share, and new revenue streams— significant challenges remain, encompassing technological hurdles, intense competition, regulatory obstacles, and public perception. The successful navigation of these challenges is critical for Uber to achieve its ambitious goals and ultimately see a substantial Uber stock rebound. To better understand the future of Uber, follow Uber's autonomous vehicle progress to better understand the potential for Uber stock rebound. Understanding the factors influencing Uber stock and its reliance on autonomous vehicle success is crucial for investors.

Featured Posts

-

New Commercial Hints At Jayson Tatum And Ella Mais Baby

May 08, 2025

New Commercial Hints At Jayson Tatum And Ella Mais Baby

May 08, 2025 -

A Different Story How Andor Season 2 Will Impact The Star Wars Universe

May 08, 2025

A Different Story How Andor Season 2 Will Impact The Star Wars Universe

May 08, 2025 -

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025 -

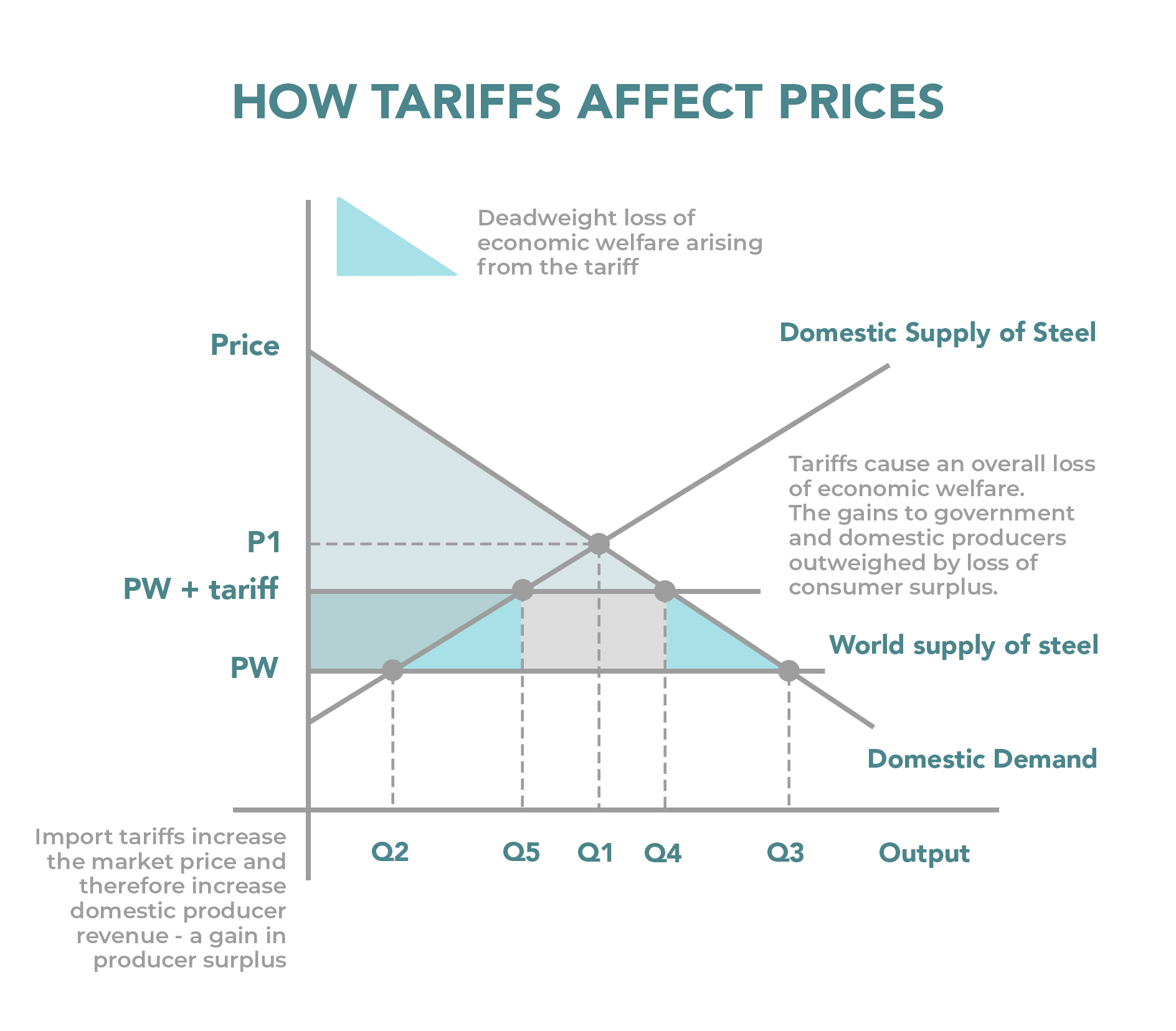

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025 -

Oklahoma City Thunder Vs Memphis Grizzlies A Crucial Matchup

May 08, 2025

Oklahoma City Thunder Vs Memphis Grizzlies A Crucial Matchup

May 08, 2025

Latest Posts

-

Surviving The Trade War A Cryptocurrencys Path To Success

May 09, 2025

Surviving The Trade War A Cryptocurrencys Path To Success

May 09, 2025 -

One Crypto Winner Amidst The Trade War Chaos

May 09, 2025

One Crypto Winner Amidst The Trade War Chaos

May 09, 2025 -

Trade War Fallout Identifying Cryptocurrencies With Resilience

May 09, 2025

Trade War Fallout Identifying Cryptocurrencies With Resilience

May 09, 2025 -

Could This Cryptocurrency Thrive Despite The Trade War

May 09, 2025

Could This Cryptocurrency Thrive Despite The Trade War

May 09, 2025 -

Understanding The Bitcoin Rebound A Guide For Investors

May 09, 2025

Understanding The Bitcoin Rebound A Guide For Investors

May 09, 2025