Will Ethereum Hit $2,700? Wyckoff Accumulation Analysis Suggests Yes

Table of Contents

Introduction: Ethereum's price action has captivated investors worldwide. A burning question on many minds is whether the second-largest cryptocurrency will reach the coveted $2700 mark. This article employs Wyckoff accumulation analysis to dissect current market conditions and assess the probability of ETH hitting this target price. We'll analyze key indicators and price patterns to arrive at a data-driven conclusion.

Understanding Wyckoff Accumulation

The Wyckoff method is a sophisticated technical analysis technique used to identify accumulation and distribution phases in the market. It focuses on understanding the behavior of large market participants ("whales") and how their actions influence price movements. Unlike simpler methods that rely solely on price charts, Wyckoff analysis incorporates volume, price, and time to predict potential future price trends. Its core principles revolve around identifying specific phases within the accumulation process, which precede significant price advances.

The key phases of accumulation often include:

- Spring: A relatively small price decline designed to shake out weak holders before the price starts to rise. This is often characterized by increased volume.

- Markup: A period of price increases where smart money starts accumulating. This phase might not be a steady increase but will involve pullbacks to gather more buyers.

- Secondary Test: A subsequent price drop or consolidation phase to once again test the commitment of weak holders and attract more buyers at a lower price level.

The Wyckoff method, traditionally applied to stocks, has proven valuable in analyzing the cyclical nature of cryptocurrency markets like Ethereum, offering insightful Ethereum price predictions. This analysis provides crucial insights into potential buying opportunities, especially for identifying when a significant price increase may be underway.

Analyzing Ethereum's Price Chart Through the Wyckoff Lens

Identifying the "Spring" in Ethereum's Chart:

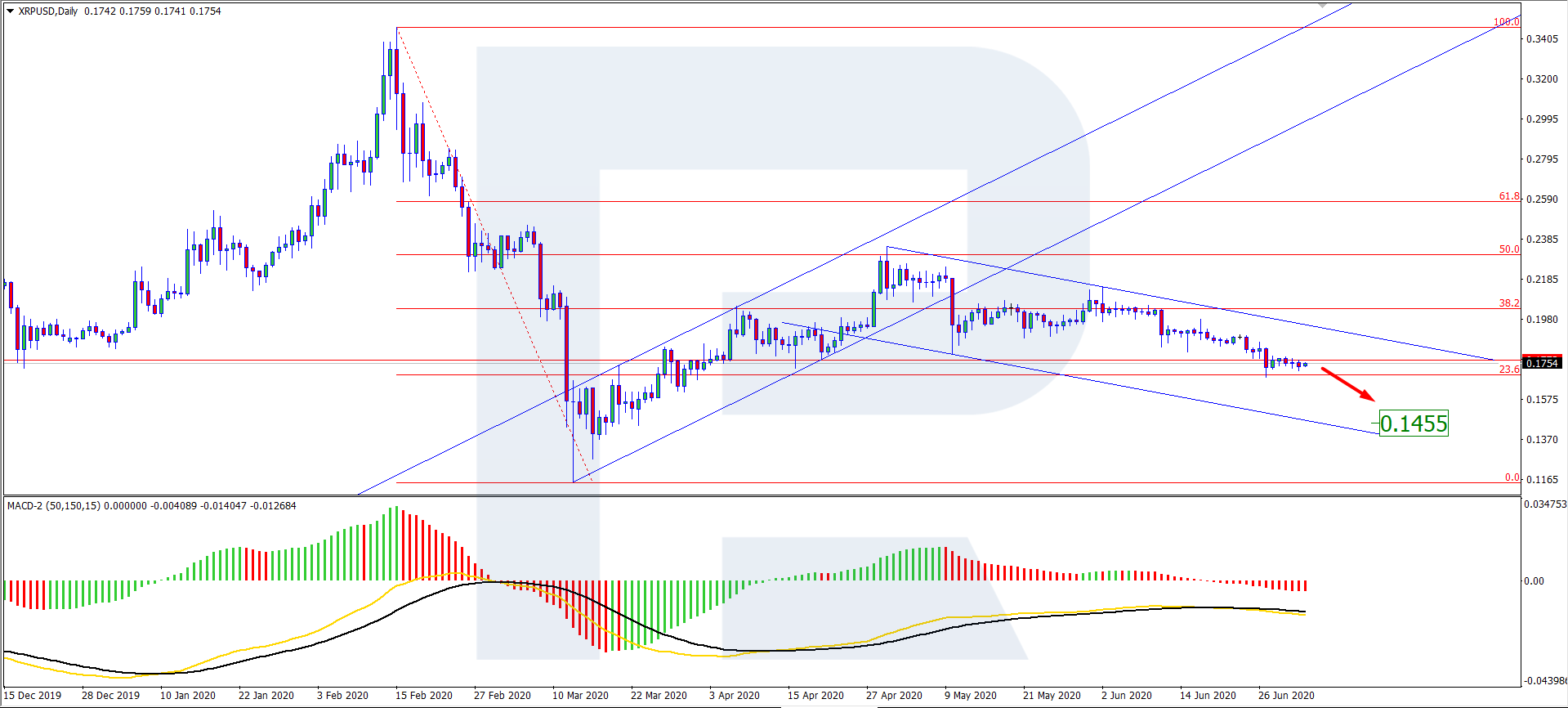

Recent Ethereum price charts show evidence suggestive of a Wyckoff Spring. (Insert chart here showing a recent price dip with increased volume). Observe the sharp decline followed by a relatively quick rebound. This swift reversal, accompanied by increased trading volume, points towards the possibility of a shakeout, characteristic of a Wyckoff Spring. The subsequent price consolidation after the drop further strengthens this analysis.

Evidence of Accumulation:

Analysis of Ethereum trading volume during recent periods of price consolidation reveals a key indicator of accumulation. (Insert chart here showing volume during consolidation). Despite the price remaining relatively stable, we observe consistent, above-average volume. This sustained volume indicates potential buying pressure from large investors. The presence of significant support levels around [insert price level] also bolsters the case for accumulation. This support level has repeatedly held, preventing further price declines – a further sign of substantial buyer interest and potential whale activity.

Assessing the Significance of the Secondary Test:

The recent [insert percentage]% correction in Ethereum’s price (Insert chart here) can be interpreted as a Wyckoff Secondary Test. This correction allowed the price to retest a key support level before buyers stepped in again. The market's reaction to this test—a relatively quick recovery—demonstrates strong buyer support, further strengthening the likelihood that we are in an accumulation phase. The relative lack of panic selling during the correction suggests that larger players are accumulating ETH.

Market Sentiment and External Factors

Positive Ethereum market sentiment plays a crucial role in driving its price. Recent news about [mention significant partnerships or developments related to Ethereum, e.g., Ethereum scaling solutions, DeFi growth, enterprise adoption] has significantly boosted investor confidence. These developments, coupled with a generally bullish sentiment in the broader cryptocurrency market, provide a tailwind for ETH price growth. However, regulatory uncertainties in certain jurisdictions remain a potential headwind.

Potential Risks and Challenges

While our Wyckoff accumulation analysis suggests a positive outlook for Ethereum, it's crucial to acknowledge potential risks. Unexpected market corrections, driven by broader macroeconomic factors or unforeseen negative news, could disrupt the accumulation pattern. Furthermore, the inherent volatility of the cryptocurrency market makes price predictions uncertain. It's vital to consider alternative scenarios where the accumulation phase might fail to lead to a substantial price increase. Increased regulatory scrutiny or a significant technological setback could also negatively impact ETH's price.

Conclusion:

Our Wyckoff accumulation analysis of Ethereum's price trajectory indicates potential for a move towards $2700. The presence of a clear Spring, evidence of sustained accumulation through volume analysis, and the significance of the Secondary Test all point towards this possibility. However, remember that the cryptocurrency market is volatile. While the analysis suggests a bullish outlook, it's not a guaranteed prediction.

Call to Action: While this Wyckoff accumulation analysis suggests a potential for Ethereum to hit $2700, remember that cryptocurrency markets are inherently volatile. Continue researching and monitoring Ethereum price and Wyckoff analysis to make informed decisions. Stay updated on the latest developments in the crypto space to refine your Ethereum investment strategy. Do your own research before making any investment decisions.

Featured Posts

-

Analyzing The Challenges Why Xrp Etfs May Underperform Expectations

May 08, 2025

Analyzing The Challenges Why Xrp Etfs May Underperform Expectations

May 08, 2025 -

Psg Vs Arsenal Gary Nevilles Prediction And Analysis

May 08, 2025

Psg Vs Arsenal Gary Nevilles Prediction And Analysis

May 08, 2025 -

Xrp Price Rally Outperforming Bitcoin And Other Cryptos Post Sec Grayscale Etf News

May 08, 2025

Xrp Price Rally Outperforming Bitcoin And Other Cryptos Post Sec Grayscale Etf News

May 08, 2025 -

Kripto Para Piyasalari Spk Nin Yeni Duezenlemeleri Ve Etkileri

May 08, 2025

Kripto Para Piyasalari Spk Nin Yeni Duezenlemeleri Ve Etkileri

May 08, 2025 -

Izjava Pavla Grbovica Komentar O Predlozima Za Prelaznu Vladu

May 08, 2025

Izjava Pavla Grbovica Komentar O Predlozima Za Prelaznu Vladu

May 08, 2025

Latest Posts

-

3 Key Factors Suggesting A Possible Parabolic Xrp Move

May 08, 2025

3 Key Factors Suggesting A Possible Parabolic Xrp Move

May 08, 2025 -

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025 -

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025

Investing In Xrp After Its 400 Increase A Prudent Approach

May 08, 2025 -

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025 -

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025

After A 400 Rise Where Does Xrp Go From Here A Market Analysis

May 08, 2025