Is There A Canadian Warren Buffett? Examining Billionaire Successors

Table of Contents

Analyzing the Characteristics of a "Canadian Warren Buffett"

To identify a potential "Canadian Warren Buffett," we must first understand the key characteristics that define Warren Buffett's investment philosophy.

Defining the Buffett Model:

What are the hallmarks of Warren Buffett's investment style? His success stems from a combination of key principles:

- Long-term value investing: Buffett is renowned for his "buy and hold" strategy, focusing on long-term growth rather than short-term market fluctuations. He invests in companies he believes have strong fundamentals and enduring value.

- Focus on undervalued companies: Buffett actively seeks out companies trading below their intrinsic value, allowing him to capitalize on market inefficiencies. This requires thorough due diligence and a deep understanding of company financials.

- Strong emphasis on company fundamentals: Buffett meticulously analyzes a company's balance sheet, income statement, and cash flow statements before making any investment. He looks for companies with strong management teams, sustainable competitive advantages, and a clear path to future growth.

- Disciplined approach to risk management: Buffett avoids excessive risk-taking, preferring to invest in companies with proven track records and strong financial positions. He famously emphasizes protecting capital as a primary goal.

Identifying Potential Canadian Counterparts:

Several Canadian billionaires have achieved remarkable success in the investment world. While none perfectly mirrors Buffett's approach, some share key similarities:

- Example: Galen Weston Jr. - Known for his long-term, family-oriented approach to business, building a diverse portfolio of companies including Loblaw Companies Limited, a major Canadian grocery chain. His investment strategy focuses on building strong brands and sustainable businesses, aligning with some aspects of the Buffett model.

- Example: Barry Sherman (deceased) - A highly successful pharmaceutical entrepreneur, Sherman built Apotex Inc. into a global generic drug giant through aggressive business strategies and smart acquisitions. His entrepreneurial spirit and focus on growth are reminiscent of Buffett's ambition.

- Example: David Thomson - The Thomson family's influence on global media and information services through Thomson Reuters demonstrates a long-term, strategic approach to investment and building a business empire. This showcases a capacity for long-term vision and shrewd management similar to Buffett.

These examples showcase successful Canadian investors, although their specific strategies might differ from Buffett's exact approach. They highlight different facets of successful long-term investment and business building within the Canadian context.

Beyond Finance: Considering Other Sectors:

The qualities that define a successful investor like Warren Buffett extend beyond the finance sector. Successful Canadian entrepreneurs in other industries often display similar traits:

- Focus on long-term growth and sustainable business models: Companies prioritizing long-term value creation often outperform those focused solely on short-term profits.

- Strategic acquisitions and mergers: Strategic acquisitions, executed with careful planning and integration, can significantly enhance a company's market position and growth potential.

- Building strong brands and reputations: A strong brand acts as a significant competitive advantage, enhancing customer loyalty and increasing profitability.

Examining the Canadian Economic Landscape and its Impact on Investment Strategies

The Canadian economy possesses unique characteristics that influence investment strategies compared to the US market.

Unique Challenges and Opportunities:

- Focus on resource-based industries: Canada's economy is significantly reliant on natural resources, creating both opportunities and risks related to commodity price fluctuations and global demand. This impacts investment decisions in sectors like energy, mining, and forestry.

- Geopolitical factors influencing investment decisions: Canada's close ties with the US and its international relationships influence investment decisions, creating both opportunities and sensitivities related to global trade and political stability.

- Regulatory environment and its effects: Canada's regulatory framework impacts investment decisions, particularly in areas such as financial services and environmental regulations. Navigating regulatory complexities requires expertise and careful planning.

The Role of Canadian Venture Capital:

Canadian venture capital plays a crucial role in supporting innovation and entrepreneurship. Firms like [mention specific successful Canadian VC firms and their notable investments] provide vital funding and mentorship to promising startups, fostering growth within the Canadian economy.

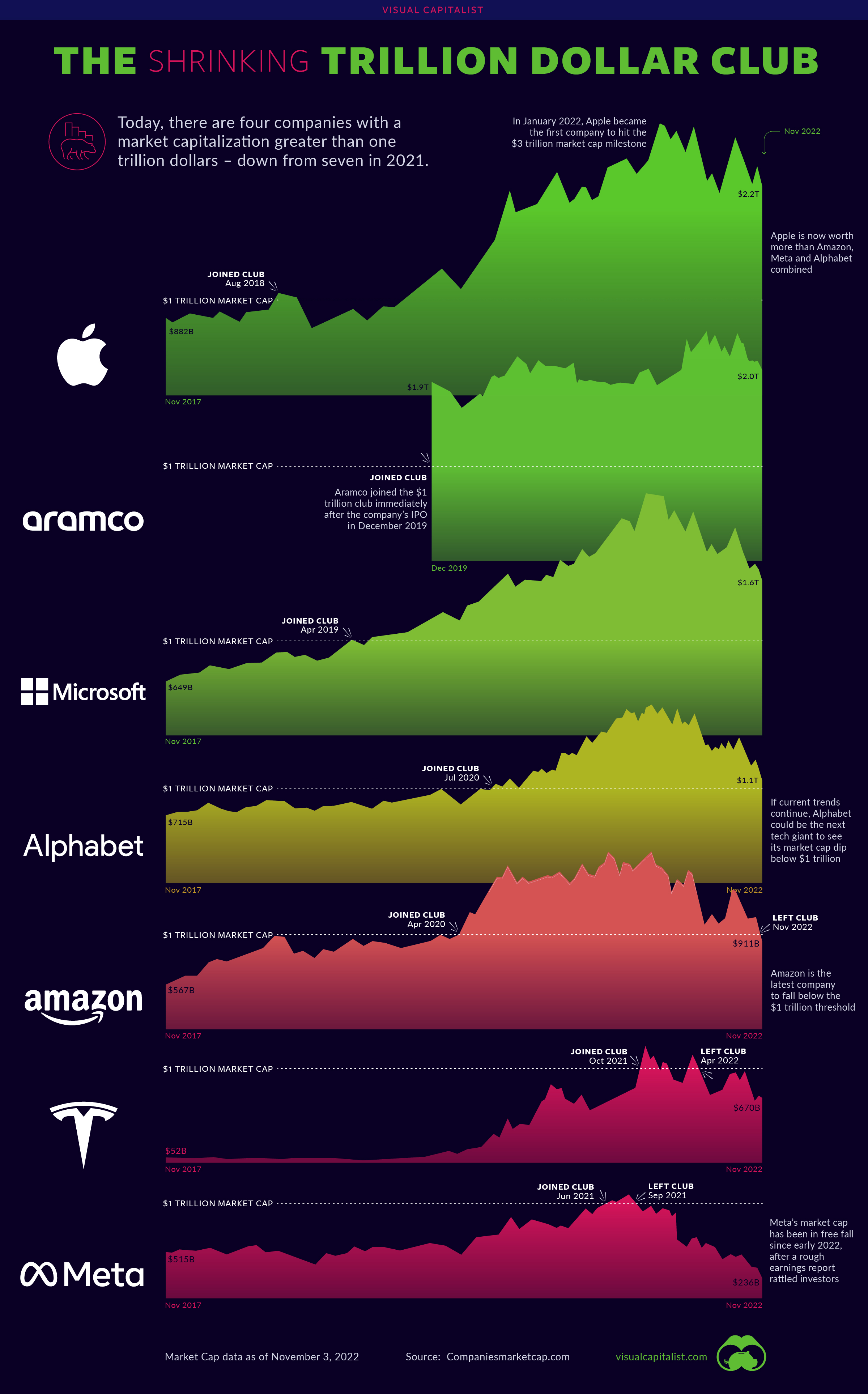

Canadian Stock Market Performance:

The Canadian stock market's performance relative to global markets has fluctuated. While offering opportunities for growth, it also presents unique challenges for investors, requiring careful diversification and strategic investment choices.

The Future of Canadian Investment and the Next Generation of Billionaires

The landscape of Canadian investment is constantly evolving, presenting both challenges and exciting opportunities.

Emerging Trends in Canadian Investment:

- ESG investing: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions, emphasizing sustainable and responsible business practices.

- Technological advancements: Technological innovations across various sectors are creating new investment opportunities and transforming existing industries.

- Shifting market dynamics: Global economic shifts and technological disruptions are creating both risks and opportunities for Canadian investors, requiring adaptability and foresight.

Identifying Potential "Future Buffetts":

Several younger entrepreneurs and investors are demonstrating remarkable success and possess the potential to become future Canadian investment moguls. These individuals often leverage technology, innovation, and a global perspective to build significant businesses.

The Importance of Mentorship and Education:

Mentorship programs and leading business schools, such as the Rotman School of Management at the University of Toronto and the Ivey Business School at Western University, play a pivotal role in shaping the next generation of Canadian investors and entrepreneurs. These institutions provide valuable knowledge, networking opportunities, and guidance.

Conclusion:

While a direct "Canadian Warren Buffett" may not currently exist, Canada boasts a number of extraordinarily successful billionaires and investors who exhibit comparable traits of shrewdness, long-term vision, and disciplined investment strategies. The Canadian economic landscape, with its unique challenges and opportunities, shapes the investment approaches of its most successful players. The future of Canadian investment promises exciting developments, with emerging trends and a new generation of entrepreneurs poised to make their mark. The potential for future "Canadian Buffetts" is significant, fueled by innovation, strong mentorship, and a dynamic economic environment.

Call to Action: Are you interested in learning more about the investment strategies of successful Canadian billionaires and the emerging trends shaping the Canadian financial landscape? Continue exploring the world of Canadian finance and discover the next generation of investment moguls – the potential "Canadian Warren Buffetts" of tomorrow!

Featured Posts

-

Melanie Griffith And Dakota Johnsons Siblings Attend Materialist Premiere

May 09, 2025

Melanie Griffith And Dakota Johnsons Siblings Attend Materialist Premiere

May 09, 2025 -

India Stock Market Today Sensex And Nifty 50 Close Flat Amidst Volatility

May 09, 2025

India Stock Market Today Sensex And Nifty 50 Close Flat Amidst Volatility

May 09, 2025 -

The Impact Of Daycare On Children Evidence Based Insights

May 09, 2025

The Impact Of Daycare On Children Evidence Based Insights

May 09, 2025 -

Recent Bitcoin Rebound Signs Of A Market Recovery

May 09, 2025

Recent Bitcoin Rebound Signs Of A Market Recovery

May 09, 2025 -

Gen Z And Smartphones Why Androids Redesign Might Not Be Enough

May 09, 2025

Gen Z And Smartphones Why Androids Redesign Might Not Be Enough

May 09, 2025

Latest Posts

-

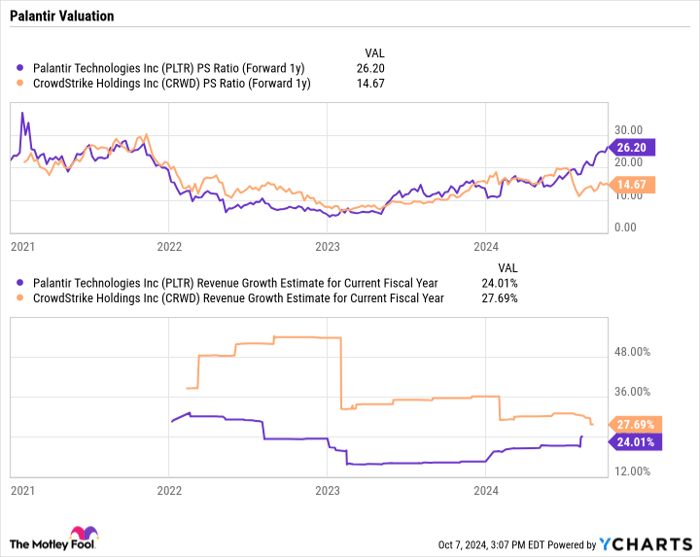

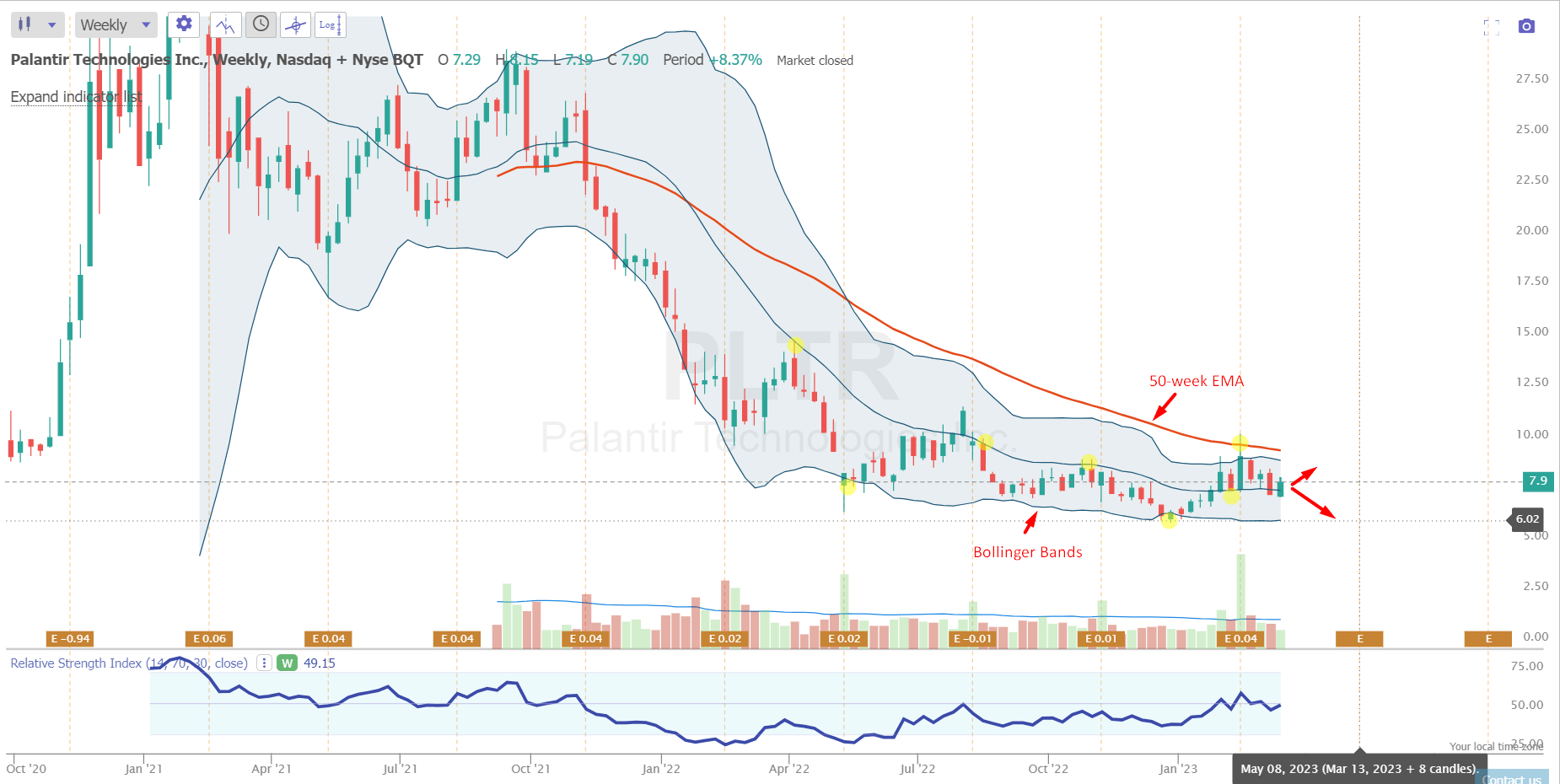

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025 -

Investing In Palantir A Practical Guide To Evaluating The Stock

May 09, 2025

Investing In Palantir A Practical Guide To Evaluating The Stock

May 09, 2025 -

Palantir Stock Buy Sell Or Hold A Detailed Investment Guide

May 09, 2025

Palantir Stock Buy Sell Or Hold A Detailed Investment Guide

May 09, 2025 -

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025 -

Palantirs Potential Can It Achieve A Trillion Dollar Market Cap By The End Of The Decade

May 09, 2025

Palantirs Potential Can It Achieve A Trillion Dollar Market Cap By The End Of The Decade

May 09, 2025